Those of you familiar with Wise will know that it is usually the most affordable way to transfer money between countries. It helps you avoid bank fees and provides you with the real exchange rate (mid-market rate).

I have previously written about this service in another post, and it has been hugely beneficial to other expats who have used it.

One of Wise's other offerings is its account and debit card. This account enables you to send, receive, and spend money around the world with the real exchange rate, which can save you money.

I was fortunate enough to be one of the people selected to trial the account when it first came out, and I have continued to use it ever since.

In this post, I will walk you through how the Wise account works, help you determine whether or not you need one, and provide you with all the essential details on setup, fees, and how much you can save compared to traditional banking methods.

Contents

What is the Wise Account?

The Wise account provides you with bank account details for USD, GBP, EUR, and AUD currencies. You also have the option to add your local currency to your balance.

This means that even if you don't live in the US, UK, Australia, or Europe, you can effectively have a bank account in these regions, allowing you to send and receive money in these currencies.

The Wise account is like having local accounts all over the world: it's a multi-currency account that enables you to receive money in 10 currencies and hold money in 56 currencies, converting between them at the real exchange rate whenever you need to.

Holding multiple currencies is completely free, and Wise uses the real exchange rate for currency conversion

What Are the Benefits of a Wise Account?

The Wise debit card can be a useful tool for those who frequently travel abroad, send money internationally or need a more flexible and cost-effective way to manage their finances.

This account is beneficial for individuals who work in professions where they receive money from sources based in America, Australia, the UK, or Europe. These can include freelancers, expats, second home-owners, international students and overseas contractors.

You can receive the money into your Wise account and then spend it using the debit card, either electronically or through withdrawal. Alternatively, you can transfer the money to another bank account linked to your Wise account.

The key benefits of an account (and card) can be summarized as follows:

- Spend money abroad: The Wise debit card allows you to spend money in over 200 countries and territories at the real exchange rate, which can save you money compared to traditional bank debit cards that often charge high fees and markups on foreign transactions.

- Save on currency conversion fees: With the Wise debit card, you can hold and spend money in multiple currencies. This means you can avoid costly currency conversion fees that you would typically incur when using a traditional bank debit card.

- Track and manage spending: The Wise app provides real-time spending notifications, so you can keep track of your spending as it happens. You can also set spending limits, freeze and unfreeze your card, and block specific transactions, all from within the app.

- Enjoy enhanced security: The Wise debit card comes with EMV chip technology and two-factor authentication, which makes it more secure than traditional debit cards. Plus, if your card is lost or stolen, you can quickly freeze it from within the app.

Quick tip:

At times, when using ATMs, shopping, or making online purchases, you may be given the option to pay in your home currency. However, doing so may result in an inflated exchange rate and additional fees. To avoid these concealed charges, it's recommended to always select the local currency of the country you're in when making payments.

How I Use Wise

The Wise account will appeal to those who want to receive, hold and spend money in different currencies, and those who travel a fair bit.

I'll explain how it has been useful for me.

I regularly receive payments in US Dollars, and occasionally in Euros too. Historically, these payments were made to my PayPal account or my UK bank account.

With PayPal, I have to pay a receiving fee, and then another fee to transfer the money to my UK bank account. That final transfer to my bank account also means I am subject to PayPal's unfavorable exchange rate.

If the money is paid into my UK bank account I'm usually subject to a wire fee, and if not, I always have to deal with the poor exchange rate given by my bank.

But now, with Wise, I give my US account number to the person or company paying me, and they pay the US Dollars directly into my account. I can then spend in US Dollars using my Wise card or transfer the US Dollars to my UK bank account at the mid-market exchange rate

While I incur a small fee from Wise for withdrawing money to my bank account and converting the currency, I still save a significant amount compared to having the money paid into my PayPal account.

Furthermore, if I receive Euros or Australian Dollars, I can keep a balance of these currencies in my Wise account. This enables me to spend the balances of these currencies in any country I choose, even here in Thailand.

Can You Earn Interest on Your Wise Balance?

Yes. Wise Interest is a new opportunity to make your money work while maintaining an account balance.

When you open a Wise account, you are able to hold multiple currencies and activate Interest for three specific ones: Pounds, Dollars, and Euros. The current variable rates for each currency are as follows:

- GBP: 4.22%

- USD: 4.79%

- EUR: 2.83%

Your funds are invested in a managed fund that tracks central bank interest rates. Consequently, when those rates change, your rates will adjust accordingly. It's important to note that returns are not guaranteed.

To prioritize the safety of your funds while still providing a favorable return, Wise has partnered with BlackRock, the world's largest asset manager. By switching to Wise Interest, your money is allocated to a fund that holds government-backed assets. This fund is deemed low risk, thanks to the guarantee provided by the government for its assets.

While utilizing Wise Interest, there are annual fund fees of 0.29%, equivalent to £2.90 for every £1,000 held in Interest. It's worth noting that these fees are already factored into the rates offered.

With Wise Interest, you retain full access to your money while earning interest on your balance. Additionally, you can still send money and make purchases using your Wise card, all while enjoying a return on your funds.

In summary,

The Wise Debit Card (MasterCard)

The debit card is pretty cool, not least because it is a fluorescent green colour. When I whip it out in the supermarket, the cashier is always like, ” Oh, what bank is that?”

I don't actually use the debit card that much, though. My main use is having money paid into my Wise account and then transferring money to my bank account in the UK.

I do use it in Thailand when I'm short on funds in my Bangkok Bank account, which, incidentally, I often top up by using the Wise money transfer service to send money from my UK bank account to my Thai bank account.

My debit card arrived in this cool box

On a side note, Bangkok Bank is no longer issuing Visa debit cards. Those who have Visa cards will not be able to get a replacement if they lose the card or it expires. Instead, Bangkok Bank is issuing Union debit cards. However, these cards are not very useful as they can only be used to withdraw money, making the Wise debit card even more beneficial.

For the record, there is no significant difference between MasterCard and Visa. Both are widely accepted in over two hundred countries, and it is rare to find a location that accepts one but not the other.

Additionally, some who regularly visit Thailand but may struggle to get a bank account or simply do not want to go through the process. The Wise account is an excellent option for these visitors, as it provides a debit card with favorable exchange and withdrawal rates.

Inside the box is the ostentatious card > your key to stress-free spending.

It is really useful when visiting other countries, too.

I was recently on holiday in Bern, Switzerland. When I ran out of Swiss Francs, it made sense to use the Wise debit card because it gave me a favorable exchange rate. As I spent, it transferred the US Dollars in my Borderless account to Swiss Francs.

Wise Account Benefits Summary

- Lets you spend anywhere in the world at the real exchange rate. You'll pay low conversion fees, and zero transaction fees.

- Receive money in 10 currencies, including GBP, USD, CAD, EURO, AUD, NZD, RON, HUF, & SGD

- Hold money in 56 currencies.

- Free to pay with currencies in your account: convert money into your required currency and it will be free to spend or pay in your chosen local currency.

- Free first two ATM withdrawals (up to £200) a month. After that, there is a charge of 0.5 GBP per withdrawal. There’s a 1.75% fee on any amount you withdraw above 200 GBP. Check fees for your currency.

- Only pay a small conversion fee when you convert your money — typically between 0.35% and 1%.

- Pay in any currency, anywhere and it will automatically convert the currency in your account with the lowest conversion fee.

- Free same currency withdrawals for personal account users ( there are a couple of exceptions).

How Do I Set up a Wise Account?

To get set up, you'll need to:

- Create a free account ( you might need to wait a day or so to have your account verified)

- Select a currency. You can set up each currency with just a couple clicks. You can have more than one currency.

- Add money to your account. You can top up via debit card or bank transfer

Once your account is set up and you have access to it, you can do the following:

- Convert money between your currencies in seconds at the real exchange rate with low conversion fees

- Send money from any currency in your account to pay bills, send money to friends and family

- Spend money with your Wise MasterCard

- Receive money with account numbers and IBANs. Get paid to your account (zero fees)

+ Go here to set up your account now

Wise Account Fees

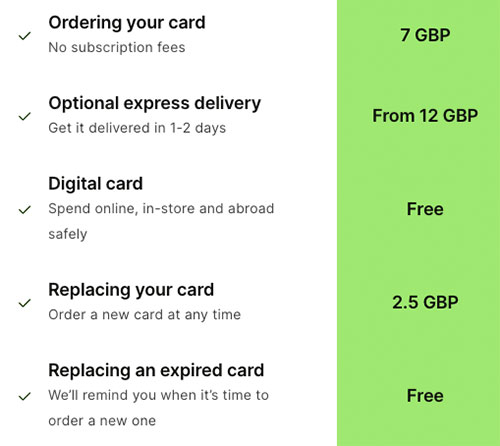

It's free to set up your account and get your international bank details, and free to receive money using those bank details.

You do have to pay for your first card, which in GBP is £7.

Wise does not charge any foreign transaction fees or ATM withdrawal fees. However, some ATM operators or merchants may charge their own fees for using their machines or services, which is outside of Wise's control.

Wise charges a small fee for currency conversion when you use your debit card to spend or withdraw money in a currency that is different from the currency you hold in your Wise account. This fee varies depending on the currencies involved and is typically around 0.35-2% of the transaction amount.

When you convert money in your account it's always with the real exchange rate, and Wise always shows you the full breakdown of fees and exchange rates before you confirm a transaction.

If you spend on your MasterCard in a currency you don't have in your account, Wise chooses to convert the balance with the lowest fee, so you never have to worry about getting the best rate.

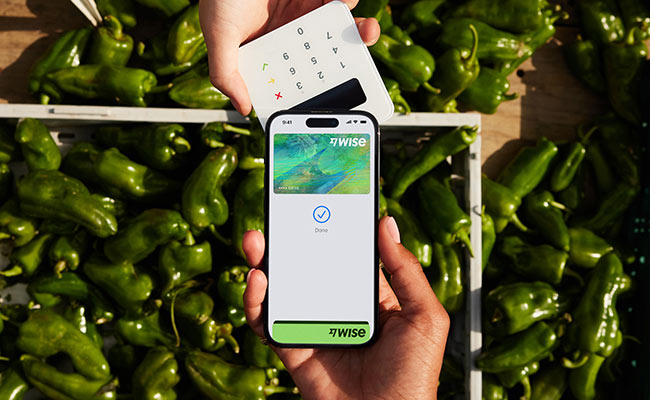

You can use Apple Pay with your Wise digital card.

Is Wise Cheaper Than My Bank?

In a nutshell, yes, much cheaper; at least for this type of banking where you're dealing with foreign currencies and spending abroad.

Consumer Intelligence conducted research comparing the Wise account to 21 current accounts offerings from banks in the UK, Europe, USA and Australia.

The research concluded that in comparison to the 21 current accounts included in the study Wise is cheaper, quicker and easier for consumers across all categories.

In the UK, the research found it’s up to 9x cheaper to use Wise instead of a bank to send money from GBP to AUD, EUR or USD for £200 and £1,000. And it's up to 7x cheaper to spend the same amounts abroad with the Wise debit MasterCard.

In Australia, the research found it’s up to 12x cheaper to use Wise instead of a bank to send money from AUD to EUR or USD for $250 and $1,000.

In Germany, the research found it’s up to 4x cheaper to use Wise instead of a bank to send money from EUR to AUD, USD for €250 and €1,000. And it's up to 2x cheaper to spend the same amounts abroad using the Wise debit card.

In Summary

The Wise account is the first platform to offer true multi-country banking to anyone who needs it, no matter where you live.

You can receive and send money all over the world, hold and convert money in 56 currencies, and get a contactless MasterCard for spending abroad.

If you are paid in a different currency than that of your home country, or perhaps even receive income in multiple currencies, the Wise account will save you money.

If you have been using PayPal to receive foreign currencies and then transferring them to your bank account, you can get those same companies or individuals to pay you into your Wise account and avoid those evil PayPal fees.

You can also conduct favorable currency conversions within your Wise account, but that's optional. With the Wise debit card, you can spend the money from any currency inside your Wise bank account in any country around the world.

This is a modern day banking revolution. It will save you money. I have saved thousands in fees already.

+ Click here to register your Wise account

Last Updated on

Garth says

Sep 02, 2023 at 9:39 am

sidney leonard says

Also, how complicated is the wiring process at the bank; I want to prepare my wife for what she can expect in the way of paperwork and documentation to initiate a wire transfer. Thank you.

Jun 09, 2023 at 4:44 am

James Ewing says

Alternatively, look into DeeMoney as a transfer option. They are a partner (of some kind) with Wise in Thailand and their primary business is funds transfer out of Thailand. Also Western Union (who works with Bangkok Bank) might be an option. But, as with most things financial in Thailand, you're most likely going to need a Thai phone number to set any of that up.

The wire transfer from the bank should be pretty easy as someone will be available to walk your wife through the process. I've never done one so don't have personal experience. BUT - and it's a big one - you're bringing into the US an over-the-minimum amount which will trigger all sorts of alarms and reports with your bank, the Feds, and all the anti-money laundering regulations. Get all your documents together - including your outbound transfer(s) from the US that funded your Bangkok Bank account - so you can prove the money's legitimacy.

Jun 09, 2023 at 9:45 pm

Chris Powell says

I currently have my police pension and my DWP (old age pension) paid into Barclays Bank and have direct debit with Moneycorp to transfer part of these pensions to my Thai bank account. Am l able to get both pensions paid into a Wise account in the UK and send a fixed monthly amount to my Thai bank.

Mar 31, 2023 at 2:06 pm

MA Scott says

Thanks!

Dec 06, 2022 at 1:21 pm

JamesE says

Dec 06, 2022 at 11:42 pm

Mike says

May 04, 2021 at 12:13 pm

TheThailandLife says

May 04, 2021 at 5:32 pm

PATPISAN says

It is the first step, apply for a wise Thailand account, your residence address in Thailand, then press Send money to allow the system to enter the verification process after After verifying your identity

step 2, edit your personal address to Australia

step 3, order wise card, edit delivery address to Thailand address, and wait for your wise card to be delivered to your home in Thailand

Big credit facebook group : Apple pay Thailand and wallet app

Jun 26, 2022 at 11:49 pm

Neil says

Is it therefore worth tourists getting one for their visit?

Thanks

Neil

Apr 19, 2021 at 12:50 am

TheThailandLife says

Apr 19, 2021 at 4:09 pm

SM says

Setting up the account wasn't free, for the business account it's 21GBP. I'm hoping next I'll get my account details and can withdraw from PayPal. Hopefully it'll be a borderless account and I've not wasted my time and money.

I don't know why these payment services can't have FAQs or somewhere for information. Like so many things these days you can only find out by trying which can cost time and money. No where on the site does it explain the procedure, it just keeps telling me there's more to do.

I've sent them an email two days ago, still no reply. Supplying little info, changing things without warning or explanation seems the norm for all these payment services.

Apr 08, 2021 at 5:29 pm

TheThailandLife says

Apr 08, 2021 at 6:23 pm

RS says

I'm really not sure if that's true or not, I was under the impression that you can't send money outside Thailand unless by bank to bank transfer using SWIFT, or other options like DeePay. WU, crypto, and in your pocket over a border (or I guess in some kind of secure courier service!).

You can't send GBP, and USD want an extra fee (I haven't looked at other currencies on the list in the app).

Mar 10, 2021 at 6:06 am

TheThailandLife says

Mar 10, 2021 at 5:22 pm

rinky stingpiece says

I was talking about sending money from a Thai bank account to a Wise balance, which necessarily involves a conversion, and as far as I can tell EUR (or maybe SGD) look like the viable options.

I haven't tried it, I opened a DeeMoney account. I'm not sure what the options are with buying crypto using a Thai account. I can see about a dozen options in the form of apps or websites for it, with one that is specifically Thai. Perhaps you can add a section to your article that you linked to?

Obviously, it's not for everyone and comes with caveats.

May 10, 2021 at 5:12 pm

TheThailandLife says

May 11, 2021 at 4:16 pm

Martin1 says

I don't want to be the smartass, but as far as I know it is possible to transfer money from Thai accounts in at least five ways:

1. Transfer from Thai bank a/c using SWIFT transfer to all countries in the world.

2. ... using Western Union ...

3. Cheque

4. DeeMoney

5. Withdraw using an ATM in target country and then deposit.

But I don't know if any of these meet rinky stingpiece's needs.

May 11, 2021 at 6:02 pm

TheThailandLife says

May 11, 2021 at 6:09 pm

Martin1 says

Having this information a transfer of funds (e. g. GBP or Euro) to my Wise accout should be possible from any other bank account on the world.

May 11, 2021 at 7:23 pm

TheThailandLife says

May 11, 2021 at 7:37 pm

rinky stingpiece says

I have transferred money via the usual bank ways from a Thai bank abroad, and I have got DeeMoney. It seems that Thailand is locking out competition like Wise with unattractive conditions. At least cryptocurrency is an option, and can suit some who want to do transfers quickly, and in some cases (but not all), cheaply.

May 11, 2021 at 9:46 pm

TheThailandLife says

May 12, 2021 at 4:57 pm

Max says

Feb 04, 2022 at 10:48 am

TheThailandLife says

Feb 04, 2022 at 4:58 pm

PATPISAN says

Jun 26, 2022 at 11:10 pm