The options for transferring money out of Thailand are fairly limited, but with modern banking technology slowly catching up in Thailand, it's becoming much easier.

Once you understand the fees involved and the time it takes for each method, you can make a decision on what's best for you.

In this post, I'll give you an overview of the options – their lead times, fees and sending limits – plus a a few exchange comparisons to help you decide on the most practical, cost-effective option.

What's the Best Way to Transfer Money Out of Thailand?

The three main options for moving your cash out of Thailand and to your home country or anywhere else in the world are:

- Direct Bank Transfer

- Western Union

- DeeMoney

There is a fourth, and that is to use cryptocurrency, but since hardly anyone is going to want to get involved in that I won't be covering that option.

1. International Bank Transfer (SWIFT)

SWIFT international bank transfer is a great if you have a Thai bank account with one of the following banks:

Fees:

Fees will vary from bank to bank, the country you are sending to, and in some instances the type of account you have, be that personal or business banking.

Bangkok Bank (using the app), for example, charges 0.25% of the transfer value, with a minimum 200 Baht and maximum 500 Baht per transaction.

You can also send via Western Union through the Bangkok Bank app and at branches, if you have an account. It costs 1,200 Baht for a 70,000 Baht transfer, and 300 Baht for every additional 30,000 thereafter.

Kasikorn Bank charges are the same as Bangkok Bank.

Documentation:

Please note that in an earlier version of this article I wrote here that banks in Thailand require you to state the source of funds when sending money abroad. I refer to the following rule:

The Bank of Thailand requires every commercial bank to obtain documents from customers outlining the reasons for sending the funds abroad before completing the transaction

For example, the Bangkok Bank website states that it requires you to fill out this application form.

However, I was recently informed by a reader that no such documentation was required when he transferred 200,000 Baht from his Bangkok Bank account to his account in Europe via the app.

Rather than being asked for documentation, he received a message stating:

The international funds transfers service complies with official regulations from the Bank of Thailand and the AMLO Office and the Bank may require additional information from you.

It may be that if you make multiple transfers in a short period of time, or you transfer very large amounts, the system will flag a transaction and request further details.

Lead Time:

A SWIFT transaction can take 1-5 days, depending on the bank, so if you want cash to arrive immediately, see the next option.

Sending Limit:

The maximum amount you can transfer out of Thailand is determined by the Bank of Thailand, depending on the source of funds and/or the purpose of payment, including supporting documents.

2. Western Union

Western Union is the most popular remittence service, trusted the world over.

They offer instant transfers by cash and bank transfers that take 2-5 days.

Fees:

Western Union is best priced for sending moderate amounts of money.

For example, you can send 40,000 Baht to the US or UK for a fee of 850 Baht. But on small amounts such as 2,500 Baht, you will pay 400 Baht. The fee reflects the instant nature of the transfer.

You can use WU online or on via their app, or through a bank provider or high street booth.

One thing to consider is the exchange rate fee.

WU makes money on the exchange rate and doesn't give you the mid-market rate as one might expect.

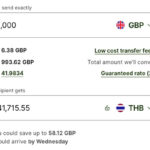

At today's rate, sending 50,000 THB from Thailand to the United Kingdom would result in a transfer of £1095.25.

This is £75 less than DeeMoney! See below.

Lead Time:

It depends on the type of payment you use. You can use the Money In Minutes service to send cash to an agent for pickup. Using a bank transfer will take 2-5 days.

Sending Limit:

You can send up to 250,000 THB per transaction and multiple transactions per day.

Western Union requires you to fill out a bank form stating the source of income, and certain money transfers may require you to provide proof of source of funds.

3. DeeMoney

DeeMoney is a remittance service that charges a flat fee to send money from Thailand to 35 different countries.

You can use the app to set up a transaction, or attend one of four branches in Bangkok to transfer cash.

Fees:

DeeMoney charges a 125 Baht flat fee to send money out of Thailand.

They also have a service called DeeNext that offers next day delivery. This costs 250 Baht. However, there is currently a special flat rate across the board offer of 125 Baht.

While the fee is cheap, the exchange rate isn't always favorable.

I compared the exchange rate of DeeMoney on 50,000 THB Vs the mid-market rate, which is the real exchange rate without any fees.

Those of you who use Wise to transfer money into Thailand will know that the mid-market rate is important in saving money on your transfer.

- DeeMoney = 1,165.10 GBP

- Mid Market Rate = 1,182.90 GBP

DeeMoney is nicking £17 on the transaction, which is a lot less than Western Union.

Looking at Wise fees for sending the equivalent in GBP to a Thai bank account from the UK, the fee is around £7. Sadly Wise don't do money transfers out of Thailand.

So while the DeeMoney transfer fee is cheap, the exchange rate is where they apply their markup.

Lead Time:

Transfers take 1-5 days.

Sending limit:

You can send a maximum of 800,000 Baht per day.

In Summary

Overall, the cheapest option for sending money out of Thailand is going to be a toss up between your banking provider and DeeMoney.

If you want to send cash for immediate collection and you don't live in Bangkok, Western Union is your friend. DeeMoney also offers a next day service (DeeNext).

On the face of it, DeeMoney is cheaper than your local bank. The fee is cheaper than say Bangkok Bank's SWIFT fee, but it all depends on the exchange rate you get from your bank in your home country.

Bangkok Bank and Kasikorn, for example, are currently only 75 Baht more expensive to send international bank transfer than DeeMoney, but you might get a cheaper exchange rate at the other end that easily makes up for this.

DeeMoney says they exchange rate at local currency rates, but I'm not entirely sure what this means. Which rate? They certainly don't use mid-market rates, so I'm left wondering.

In terms of daily limits, DeeMoney has a higher transaction limit at 800k, but you can't exceed this in one day. Western Union has a transaction limit of 250k, but you can make more than one transaction in a day.

In short, for convenience, if you have a banking app for your provider in Thailand it makes sense to use this option. The fee shouldn't be more than 500 Baht and will likely be 200 Baht.

If you can't be doing with apps and the potential of your bank asking for further documentation, use DeeMoney.

If you're prudent with financial decisions then check what exchange rate fee your home country bank adds to a transaction and do the math before making your choice.

——

Got a question, or an experience you want to share? Please leave it below.

More Money Tips for Thailand

Get the best exchange rates:

+ Avoid high currency conversion fees. Read more.

Need help with pension or investment planning?

+ Connect with my trusted personal IFA using this form

Got Medical Insurance?

+ You should have. Get a quote on international cover here.

Last Updated on

carole Montana says

Hope you are well.

Just to let you know Dee Money are having problems with money transfers particularly to the U.K.

I sent some money, and it was accepted however it sat in my account here with Dee money for 2 months, pending...

I called them and they said there was an issue in the U.K it would be sent in 7 days.

Ended up losing my temper not good i know however they immediately sent the money to the UK.

I've did not have a problem before however I've just looked on Trustpilot and there seems to be a lot of people in the same situation...

Just to let you know!

Oct 11, 2024 at 10:39 am

TheThailandLife says

Oct 12, 2024 at 6:15 pm

bratstvo says

Nice to be here.

I would appreciate to get some advice on the following banking question.

I am living here for almost 18 months. Like many here, I need to have 24 000 euros on a Bangkok Bank account in order to get my visa. Thus I have a Foreign currency account (said a saving account, but no interest).

It is a pity to keep this money sleeping on an account.

i a trying to open a fixed deposit account with interests... It appears so complicated.

May you share your experience on this, if any?

thank in advance.

Kind regards

Mar 14, 2023 at 4:49 pm