If you're working, retiring, or frequenting Thailand then it makes sense to have a bank account.

Why?

Because using foreign credit and debit cards involves high fees, on top of local ATM charges. And then there's the frustration of cards being rejected by ATMs.

Opening a Thai bank account isn't the same process at every bank. There are different requirements for each. I tried at least five different branches of different bank brands before I had success in opening an account.

What struck me was that quite often the bank staff cited different requirements to that on the bank's website.

When I did cite the requirements stated on the website, I was told that “things had changed”, or “the manager said…”

So I figured others must be struggling too and decided to write this article to help other foreign nationals, like you.

My Current Banking Arrangements

My Thai Bank Account

Since writing the first version of this post, hundreds of people have reported their experiences of opening bank accounts in Thailand, making this post a solid resource for others wanting to do the same.

I still bank with Bangkok Bank, with a debit card, with access to Bualang online banking.

The online banking was set up for me at the ATM of the branch where I opened the account.

The ATM card was issued on the spot, for a 300 Baht fee, and I've had to replace it once due to wear and tear.

Transferring Money

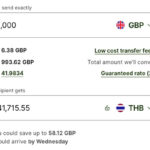

I now regularly transfer money to my Thai bank account via Wise. This is an international money transfer service, and usually the cheapest option.

Using this means I can avoid the sending and receiving bank charges and inflated currency conversion fees involved in money transfer.

It feels so good to beat the banks!

Multi-Currency Account

I also have a Wise account, which, by the way, is a great option if you don't want to open a Thai bank account, or need a pre-move banking solution until you are able to set one up.

This account lets me hold money in different currencies (GBP, USD, Euros, whatever) and then convert the money to THB whenever I like. I can do this at a time when the exchange rate is favorable.

Or, I can allow the currency conversion to take place in real time as I spend money in Thailand on the debit card (MasterCard), which is issued with the account.

If you are someone who has a regular income paid in a one or more currencies, this is a good solution for getting paid into an account that you can readily access in Thailand.

+ More on this type of account here

So I have my Bangkok Bank card, my TW Borderless card, and my home bank cards – which I never really use.

How to Open a Thai Bank Account

Things are a hell of a lot easier in Thailand when you have a Thai ATM card and an account to transfer money into.

But despite the permission to stay you have, be it a retirement visa, work permit, or Non Immigrant O Visa based on marriage, opening a bank account can be frustrating.

Indeed, I've heard from people on tourist visas who've had less hassle opening an account than someone on a long-stay visa who is married to a Thai national.

So before you trudge around town and get frustrated as hell, read this post and see which bank is most likely to work best for your situation.

What you'll find below is the requirements for each bank, and a summary of reader experiences reported in the comments section.

Since starting this post many moons ago, it seems that the overwhelming consensus is that Bangkok Bank is the most friendly bank when it comes to opening accounts for foreigners.

The easiest, however, may very well be K-Bank, depending on the branch.

There's a bit of a gap in 2019/20, where, because of COVID-19 not many foreign nationals were opening bank accounts, but you'll see some recent experiences starting in late 2021 and some new ones for 2022.

1. Bangkok Bank

Requirements:

- Passport and one other official identification document: for example, a reference letter from your embassy, your home bank or a person acceptable to the bank.

- You will also need to provide evidence of your address in Thailand as well as your regular address in your home country.

- UPDATE: In some cases Bangkok Bank is now asking for a certified letter from your Embassy. This letter must state that you have presented your passport to the Embassy, and that it is indeed your passport. Depending on the Embassy cost will be between 1150-1750 Baht)

If you have a work permit, are a permanent resident, or hold a long-stay visa, you can apply for a wider range of services such as a cheque account, internet banking and online international funds transfer services.

I opened my account with my passport, Non Immigrant O visa and my driver's license. This got me internet banking too. This was done at the Exchange Tower branch in Asoke, Bangkok. The rule regarding a letter from the embassy was not in place when I opened my account.

Reader Experiences:

- (2020) Alex opened an account in Khon Kaen with a Dutch marriage statement, his identity papers, Thai wife's ID card, and a written guarantee from his wife.

- (2020) At the second branch he tried in Isaan, John opened an account with passport, original marriage certificate, Thai wife's Tabien Baan, and drivers license (Thai and Australian).

- (2021) Sebastian was able to open an account at Bangkok Bank (Central Embassy Branch) with the following documents:- Passport

– ED Visa

– Acceptance letter from Thammasat University

– 500 THB opening deposit - (2021) John managed to open a Bangkok Bank account at Lotus’s Branch Thalang (Phuket) with a Tourist Visa, UK Passport and a letter from immigration (300 Baht.)

- (2022) Nishan opened an account on a Tourist Visa in Phuket (Patong) with a passport and letter from immigration. He got an ATM card, mobile banking, but had to take out a life insurance policy for 7,900 Baht.

2. Kasikorn Bank (K-Bank)

Requirements:

Individuals who have base in foreign countries:

- Passport

- Work permit or education-based visa (seems these are not required at every branch)

Reader Experiences:

- (2019) Anthonin opened an account at Pantip Plaza Pratunam with his passport, an address in Thailand, and a confirmation letter of internship.

- (2021) Phil opened a bank account with his passport and UK driving license. He was set up with telephone banking, mobile banking.

- (2021) Reetus opened an account at Kasikorn Bank Central Festival Pattaya with his passport (ED visa) and a letter from his language school. The ATM card was issued on the spot.

- (2021) Justin was able to open an account with Kasikorn at the Thanon Sri Nakharin branch, across the street from Paradise Park in Bangkok, using his education visa (technically an education guardian visa). He also showed them his townhome lease.

3. UOB Bank

Requirements:

Individual Non-Resident Account:

- A copy of passport

- A copy of work permit (seems this is not always required, depends on the branch)

- 50,000 Baht deposit

- Phone number

Reader Experiences:

- Danny opened a UOB account with a passport, phone number, proof of address and 50 000 baht. He got a bank card on the spot.

- (2021) Sebastian also opened an account with UOB Thailand to have an alternative. They required the following:

- Passport

– ED Visa

– Acceptance letter from Thammasat University

– A 50,000 THB opening deposit, which can be immediately withdraw after opening the account.

4. SCB

Requirements:

- A work permit and passport are required to open an account.

Non-Resident accounts are for:

- Branches or representative offices of Thai corporations established in countries outside Thailand.

- Tourists and other overseas visitors.

- Foreigners temporarily working in Thailand.

- Foreign government agencies, including embassies, consulates, or specialized UN agencies such as ESCAP, FAO, UNICEF, etc.

- International organizations or institutions located in Thailand, but established by the government of the country to which such organizations belong.

Note: The implication is that any non-resident can open an account.

Reader Experiences:

- Scott opened a SCB savings account at the Tesco Lotus Fortune Town branch, with nothing but a passport and money to open the account. He had previously tried at the Central Rama 9 branch and failed.

5. Bank of Ayudhya (Krungsri)

Requirements:

At least one or more of the following:

- Work permit

- Condominium Lease Agreement (at least 1 year)

- Thai Driver’s License

- House Registration Documents (proving you live in a particular house)

- A Thai wife’s ID card and Marriage Certificate

Reader Experiences:

- Joe opened a bank account (with a debit card) with just his passport on Sukhumvit Road (near Robinsons, between Nana and Asoke BTS stations). He showed his Non-Immigrant O-A visa (retirement visa). He used his girlfriend's address, but they did not require evidence of this. The visa card cost him 350 Baht.

- (2019) Tim opened a savings account with Krungsri (Onnut branch) with a 1-year lease contract for his condo and his passport.

- (2019) ASDF opened an account at Central Festival in Phuket. only a work permit was required.

6. CIMB

Requirements:

- Citizen ID card or passport (for foreigner)

- Savings account book or Current account number

Applicant Qualification:

- The applicant must be aged 15 or over.

- The applicant must own an individual savings and/or current account or a joint account that authorizes either owner to withdraw cash or a merchant account with single account owner.

- Other terms and conditions are as specified by the Bank.

Reader Experiences:

- Theo opened a CIMB Thai bank account using his friend as guarantor. Only his passport was needed and his friend's contact details, address, etc.

7. KrungThai

Requirements:

- For foreigners: Passport, alien certificate, work permit issued or endorsed by any credible organization or visa which is valid for at least 3 months.

- For international students: Passport and student certificate issued by school/college.

Reader Experiences:

- John was able to open a KrungThai savings passbook account in Chumphon. He used his passport and Non-Immigrant O visa.

- JP opened a savings account at Krung Thai on his Non O marriage visa, and also one at the SCB branch in Kalasin, which only required his passport and a deposit.

- (2018) Robert opened an account at Kuung Thai in Sattahip, with passport and address information.

How to Transfer Money to Your Thai Bank Account & Avoid Fees

Once you have opened your Thai bank account, you'll want to start transferring money into it from your bank in your home country.

Unfortunately, this can be a costly process, especially if you are transferring money every few months, or even more frequently.

Your home bank (the sending bank) will change you a fee of between $10-20, and the receiving bank will charge you around $10.

In addition, you will be charged a currency conversion fee – because the banks don't give you the mid-market rate, but instead a rate they decide on.

So, on $1,000 or £1,000, you could be looking at saving $50 or more in fees.

The good news is that you can avoid these fees using a great service that I've used for many years now.

Transferring Money Out of Thailand

So that's the best way to transfer money in, but what about transferring out?

if you want to know the best way to send money from your Thai bank account to an account overseas, check out this post for a run-down of all the options.

——

Share Your Experience & Help Others

It would be great if you can let me know what bank account you have and on what terms you acquired it.

This will save other readers time and hassle, and help them find the most “farang-friendly” branches, so to speak. I will then add the information to the list below.

——

More Tips for a Better Life in Thailand

Improve Your Thai Skills:

Learning Thai makes life here easier and more fun. I use Thaipod101. It is free to get started & easy to use.

Get Good Health Insurance:

Start with a quick quote from Cigna. Then compare my other recommendations here.

Protect Your Online Privacy:

A VPN protects you against hackers and government snooping. I always use one. You should too. Read why here.

Last Updated on

Lily Yeung says

2) Is there bank transfer fee if you open account in Bangkok and pay someone in Phuket, local currency?

3) How long does it take to open a new bank account in Phuket?

Aug 10, 2022 at 11:02 pm

Max says

It's actually a small scam but not expensive. It's just the annual fee for the Siriraj debit card,599 baht. Just change debit card year two,then the fee is 2-300 baht.

2)

Transfers online when using for example mobile banking is free,even to other banks. Local currency? Phuket is a part of Thailand,so we're talking baht.

3)

The time depends on customer service and if your required documents are in order. But normally about about 30-45 minutes.

Aug 10, 2022 at 11:31 pm

Martin1 says

To my eyes Max answered all your questions excellently, didn't he?

But please let me add something important (despite you hadn't asked): There will be fees if you withdraw cash on ATMs of other banks (one or two times you may without being charged).

And there will be fees if you withdraw cash (even on Bangkok Bank's ATMs !) in other provinces!

As far as I know the only card which one can use w/o fees is the ttb ALL FREE.

So opening up bank accounts in other provinces you plan to be regularely would be not a bad idea.

P.S.: To Max's #2: It is free now, yes. But in the past you had to pay fees as well (10, 20, 30 Baht)

Aug 11, 2022 at 1:57 pm

Max says

Aug 11, 2022 at 5:59 pm

Adam says

Opened a bank account with Bangkok Bank today, only had to bring a legalised/certified copy of my passport issued by the Dutch embassy (970 baht) and my passport.

500 baht to open the account (gets deposited in account), and had to take a debit card for 599 baht which includes a year of personal accident insurance. This was at the Fortune Town 2 branch in Bangkok. Left the bank with a new bank book and debit card and mobile banking.

I’m on a visa exemption by the way.

Aug 05, 2022 at 11:04 pm

Max says

Aug 05, 2022 at 11:42 pm

Niall says

Chiang Mai to Pai?

Jul 21, 2022 at 5:24 pm

TheThailandLife says

Jul 21, 2022 at 5:27 pm

Max says

Jul 21, 2022 at 5:47 pm

JamesE says

Jul 21, 2022 at 10:10 pm

TheThailandLife says

Jul 22, 2022 at 7:30 pm

Max says

Jul 22, 2022 at 8:10 pm

Tom Young says

Jul 20, 2022 at 11:53 pm

TheThailandLife says

Jul 21, 2022 at 4:33 pm

Tom says

Jul 21, 2022 at 4:44 pm

TheThailandLife says

Jul 21, 2022 at 4:52 pm

Max says

Check out this link how to register at Wise. A bit down you can see the green button saying "Get started".

Then just follow the instructions. It's dead easy.Doing it online is the only way, there's no way around it.

https://wise.com/

Jul 21, 2022 at 4:55 pm

TheThailandLife says

Jul 21, 2022 at 5:00 pm

Tom says

Jul 21, 2022 at 5:40 pm

Max says

Jul 21, 2022 at 6:21 pm

Tom says

Jul 22, 2022 at 3:49 pm

Tevin Ricketts says

Ca you also do a guide to Renting and Buying a Condo in Thailand

Thanks have a great day

Jul 09, 2022 at 10:44 am

TheThailandLife says

Jul 10, 2022 at 3:21 am

Andy Harrison says

I eventually got accepted by the Bangkok bank in Central Rama 2 with a passport and a stamped copy of my passport verified at the British embassy. It’s important to mention that you need to book an appointment online for the embassy.

I deposited 1000 baht to open it and then transferred the 400,000 needed to obtain a marriage visa. It’s also important to note that the amount has to be in the account for a minimum of two months before you apply for the visa so opening a bank account is the first thing anybody in a similar position to me should do.

Many thanks for all your help and advice by the way Peter……..very useful.

May 25, 2022 at 2:32 pm

Michael says

Does the THB400,000 need to be transferred from my UK bank account? Can I just use cash? Did you need to prove the source of funds?

Any other tips you could give or any other documents I should bring from the UK?

Did you use a lawyer to help with work permit? Any recommendation? I will be doing freelance work and it seems that I would need to set up a Thai company and hire myself to get a work permit.

Many thanks!

Nov 10, 2022 at 10:52 pm

Max says

Nov 10, 2022 at 11:42 pm

Michael Bird says

Although my wife and I will be leaving the UK together to Thailand, I believe the visa that I need to apply from here is Non-Immigrant O - Visiting friends and family: Family of a Thai national including spouse.

If you know any good agencies in Bangkok, please recommend. Thanks.

Nov 13, 2022 at 3:28 am

Max says

Nov 13, 2022 at 3:28 pm

N says

We want to set up a joint account. Will we need all of the documents again?

Or can we just walk in with our ATM card and passport?

May 23, 2022 at 10:46 am

TheThailandLife says

May 23, 2022 at 4:04 pm

Max says

May 23, 2022 at 5:51 pm

Chloe says

May 15, 2022 at 2:04 pm

Max says

May 15, 2022 at 2:18 pm

Martyn says

May 15, 2022 at 2:42 pm

TheThailandLife says

May 15, 2022 at 3:49 pm

riki says

Feb 12, 2022 at 9:31 am

Max says

Feb 14, 2022 at 8:38 am

Martin says

Having a work permit that is a no brainer. All of them want new customers, and saving accounts are for free.

Once a work permit is expired the accounts stay open (unlike in countries like Malaysia where you are at some banks required to show both your work permit and visa every time it expires).

Feb 14, 2022 at 11:34 pm

Max says

Feb 15, 2022 at 8:45 am

Martin says

Thanks for your reply.

Kindly, not everything is correct what you wrote.

Firstly, I will explain you my situation: indeed I invest money at Thai banks. For risk diversion I use several. And for each of those asset management departments an account (e.g. savings' account) is required.

Opening IS the difficult task! Closing I could do at any time.

There is NO cost for any savings account! Neither for opening one nor for a yearly fee.

Bangkok Bank offers MasterCard and UnionPay debit cards (credit cards, and I have one from Bangkok Bank, is different).

But even BBK's debit card I could use at many places and also for ordering in the Internet.

Where did you experience problems?

I described my way. I do understand that is not a model for every one. :-)

Feb 15, 2022 at 11:17 pm

Max says

Please don't mention Union Pay, I would never use a card connected to China. Do you know what a TPN-connected debit card is? I'll give you the short version:

When using a TPN-connected debit card online (or in a store), the store, company or airline must have their servers physically in Thailand. If not, then you can't use that card. TPN stands for Thai Payment Network and the idea came from BoT = Bank of Thailand. Some banks didn't buy the TPN-crap, like for example Kasikorn Bank and refused to use TPN connected Visa debit cards. I was one of the first in Pattaya to get the TPN connected MasterCard in November 2019 at Bangkok Bank when they stopped issuing Visa debit cards. Bangkok Banks excuse was Visas fees were too high, that was just BS, they were just greedy and bought BoT's explanation.

Suddenly the new MasterCard was totally useless if you wanted to buy stuff online from stores, companies or again, airlines with their servers outside Thailand which is normal for companies abroad. There were loads of posts and comments online from people living in Thailand with major problems when Bangkok Bank switched from Visa to the Be1st TPN MasterCard.

I'm never wrong about bank accounts and debit/credit cards and how they work in Thailand.

Mar 16, 2022 at 6:07 pm

Martin says

Quite frankly: that was rude! :-(

Does it make you feel better when you talk like this to other people?

Mar 16, 2022 at 8:59 pm

Max says

May 25, 2022 at 5:17 pm

TheThailandLife says

Mar 16, 2022 at 9:08 pm

Marcus says

May 25, 2022 at 1:58 pm

Max says

May 25, 2022 at 5:27 pm

Anthony Lavell says

Feb 05, 2022 at 12:00 am

TheThailandLife says

Feb 05, 2022 at 1:09 am

Max says

Feb 05, 2022 at 10:55 am

TheThailandLife says

Feb 06, 2022 at 4:17 am

Max says

Feb 06, 2022 at 12:23 pm