If you’re an American living abroad, be that in Asia, Africa, or Europe, you can't ignore your US tax filing requirement.

It doesn't matter whether you are a retiree, a digital nomad, or somewhere in between, you must ensure that you are complying with the law.

The US tax system is arguably the most complicated in the world, and living abroad as an expat can make it that much more difficult.

You can of course file your own taxes and submit them to the IRS, but, depending on your situation, it's easy to make a mistake or overlook something you need to declare.

Like me, you probably dread filing your accounts. It always seems like it's that time of year again – I literally just did my accounts! – but you just want to concentrate on your business, or live out your retirement in peace.

This is exactly why I pay someone else to do my return for me.

It gives me peace of mind, knowing that my taxes are filed correctly and that there won't be any comeback later down the line. I sleep better knowing a professional has my back.

Before we get into the Taxes For Expats company review, let's start with an overview of the tax liability for US citizens living and working abroad.

American Expats: What's Your Tax Liability?

If you’re a US citizen or US green card holder living abroad, you are required to file a tax return.

Don't worry, though. This doesn’t necessarily mean you’ll pay any tax.

For those working abroad, be that in Thailand, the UK, Australia, or Kenya, US citizens are subject to US taxation on worldwide income, even if you live overseas and pay taxes overseas.

Whether you end up paying anything depends on your situation.

For example, some US expats I know have assets earning them money back in the US. They may or may not be working abroad, but they still have a tax liability back home. Conversely, some don't have assets making an income back home, but they are working abroad. Either way, you still have to file a return.

What About Double Taxation?

Double taxation is a concern, but it's generally not an issue and actually the reason most US expats don't end up paying any tax after filing.

You see, the US has treaties with many countries that prevent double taxation.

Depending on the country in which you are expatriated, you may find that tax credits and tax exclusions offset, reduce or exclude some or all of your foreign earned income from your US tax liability.

There are a few that don't have a treaty with the US such as Vietnam, Mongolia, Kiribati, Liechtenstein, Brazil, and Algeria. You can see a full list here.

Taxes For Expats Review

About the Company

Taxes For Expats, also known as TFX, provides best in class tax advice, planning, and compliance services for individuals, partnerships, corporations, trusts, and estates, wherever you live in the world.

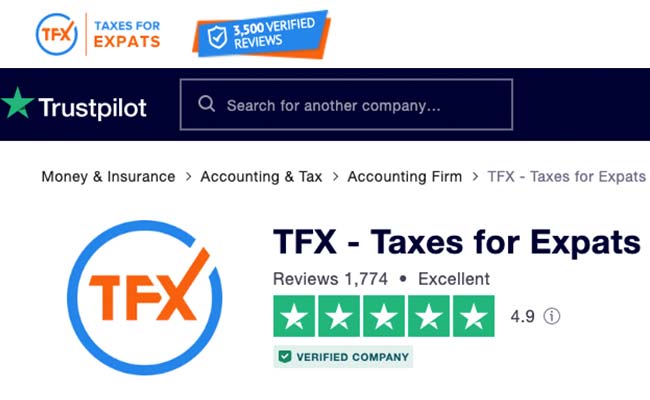

The company has a 5* rating on the Trust Pilot and Verified Reviews websites.

The company are solely focussed on US expats as their area of expertise. Whether you’re an expat, retiree, business owner, digital nomad with no fixed address, or crypto investor, you can file your US taxes through their experts, online.

One thing I really like about the service is this:

The average age of a Certified Public Accountant (CPA) or Enrolled Agent (EA) employed with TFX is 42. I'm not ageist, but this policy of only hiring seasoned professionals gives the service a lot of credibility. They don't hire junior staff and don't outsource work to middlemen.

Another standout aspect of the service is Quality Control. Every tax return is checked by a senior supervisor, who double-checks the work to ensure it's correct.

It's rare to find such attention to detail, which makes the service very attractive to expats like me who need reliability.

For the record, TFX is based out of New York. They have clients in 175 countries worldwide, and the founder, Ines Zemelman, has been filing taxes since 1991.

What Services Do They Offer?

Aside from the standard tax return service, Taxes For Expats offer the following:

- Tax planning affairs.

- Help with paying back taxes (if you haven’t been compliant and need to catch up).

- Help you file an amended tax return, if you made a mistake on a previous submission.

- Application for the IRS amnesty program (delinquent taxes), which includes 3 Tax returns + 6 FBARs (no penalties).

- They will also review your self-prepared tax return if you prefer to file yourself.

How TFX Works

The good news is that you won't need to send any paperwork in the post or run down to a local office with binders full of invoices and receipts.

Thanks to the Internet, everything is done remotely through a client dashboard.

You communicate with your assigned tax preparer online. All questions are handled via email and documents are uploaded to the secure client area.

Everything in the client dashboard is neatly organized, so you know which documents to upload at each step of the process.

All the information and documents uploaded to the dashboard are saved and accessible for future tax returns.

Quicken & Quickbooks Users

If you use either of these accounting software packages, you can upload reports into your client dashboard for your tax preparer to review.

You will have to manually input some data for your return, but this feature does streamline the process that little bit more.

How to Get Started with TFX – In 10 Easy Steps

The website is actually very easy to use. There's wealth of information on there that helps answer every question imaginable, both blog posts and an FAQ section. You can even call the company on the numbers provided in the top right-hand corner of the website.

Here's a step-by-step overview of how to get started with filing your return.

1. Sign Up & Register an Account

First up, you need to create an account on the website. This doesn't cost anything.

TFX will then send you an email with instructions on how to activate your account and access your secure dashboard.

This dashboard is where you enter your details and upload documents.

2. Schedule a 30-min Phone Consultation (optional)

You don't need to do this unless you think you need some pre-filing advice, but the option is there if you want to speak with a tax professional on the phone to discuss your situation before having them work on your case.

You will be charged a $50 retainer fee for the consultation, which is deducted from your total bill if you use TaxesForExpats afterwards for your return.

I personally wouldn't bother. Just skip this and move on to the tax questionnaire, because you can ask questions after this with your tax advisor.

3. Fill Out the Tax Questionnaire

Access the client dashboard to fill out the tax questionnaire.

The questionnaire works inside the browser window, so you don't have to download anything to your computer.

This information will be used to assign you a relevant tax preparer, and to determine what documents you need to upload.

If you have any questions at this point you can navigate to the FAQ section.

4. Meet Your Tax Preparer

You will be assigned a tax preparer, who will contact you about your filing. This is usually within a few hours of you submitting the questionnaire, depending on what country you are in (consider time zone differences).

At this point, if you have a question, you can email your tax preparer from within your client dashboard. It is secure and confidential.

5. Upload Your Tax Documents

Once you have finished filling out the questionnaire, you will be presented with a document checklist. These are the documents you need to upload to your client dashboard.

Once uploaded, your tax preparer will use the documents to complete your expat tax return.

6. Review & Sign Your Letter of Engagement

Your tax preparer will draft an engagement letter (EL) for you to review. This to legally confirm that you agree to have Taxes For Expats prepare your return for you. You will find this inside the client dashboard.

The letter will outline the work required and the fee. If you are happy with the letter, you will need to sign and submit it for work to begin.

7. Wait for Completion

The turnaround time is within 2 weeks. The quicker you complete your questionnaire and upload the required documents the sooner your preparer can start and get the return ready.

If you can't wait 2 weeks and need the filing done ASAP, you can pay for the expedited service.

8. Pay for the Service

You will be notified by email when your tax return is complete. The return will appear in your client dashboard. However, you must make payment first before you can see it in its entirety or download it to your computer or phone.

TFX accepts all major credit cards, PayPal, and wire transfers.

9. File Your Tax Returns

Once paid, you have a choice: You can download the return and mail it to the IRS, or you can instruct Taxes For Expats to electronically file your return on your behalf.

Having TFX do it for you is a no-brainer really. It saves you even more time.

10. Pay Your Taxes

Here's to hoping you don't owe the IRS a dime. But if you do, check the client dashboard for instructions on how to make a payment.

Whatever you do, if you write checks, don't send a check to TFX. It needs to be sent to the IRS!

How Much Does TaxesForExpats Cost?

When compared with similar services, TFX is very competitive – and in my experience, cheaper.

You may find a service that appears cheaper, but when you add VAT on it probably isn't. Taxes For Expat does not collect VAT.

Prices are quoted in USD, too, so if you do a comparison make sure you look at the currency conversion.

The pricing structure is simple and laid out in 3 tiers:

- Core: $350

- Premier: $450

- Streamlined procedure: $1 200. (If you haven't filed for a few years and want to be compliant)

Most people will fall under the Premier and Core plans.

Please note that there are additional fees for more complicated tax returns.

For example, if you have additional businesses or rental properties then you'll probably need to fill in extra forms outside of the structured pricing.

For example:

- FBAR form: Add $75.

- State tax return: Add $150 per state return.

- Schedule C: Add $100

Let's take a closer look at the packages.

1. Core ($350)

This is the cheapest package for those earning under 100k USD per year (gross).

Here's an example of what this includes:

- US and Foreign Wages

- Foreign Tax Credit Form 1116

- Qualified IRA or ROTH contributions

- Health Care Coverage Exemption

- Alternative Minimum Tax Calculations

- Estimated Payment Vouchers

- Gross Income Below $100K

- US Retirement and Social Security income

- Interest and Dividends (10 transactions included)

- Foreign Earned Income Exclusion Form 2555

- Child & Dependent Credits & Deductions

- Over 30 Tax Forms included

2. Premier ($450)

The Premier Package is for those who earn over 100k USD per year (gross).

This package includes all forms listed above in the Core Package, plus the following:

- Includes all forms in Core Package

- Investment Capital Gains (10 transactions included)

- 1 Rental Property

- Self-Employment Income (1 Schedule C)

- Other Non-Wage income

- 1 Schedule K-1

- Earned Income Credit

- Non-US Retirement Income

3. Streamlined ($1,200)

This is for the expat amnesty program, for so-called delinquent taxpayers.

This refers to anyone who hasn’t filed US taxes for 3 or more years while living abroad and wants to become compliant.

The IRS announced the amnesty in 2014. It offers amnesty from penalties and fees associated with undeclared taxes.

There are a number of pathways for the Streamlined Package. The one most suited to your circumstances will be determined after you fill out the questionnaire.

The standard pathway includes all the usual tax forms but also includes the following:

- 3 tax returns

- 6 years FBAR (Foreign bank accounts report)

- Special IRS program

* There is an optional personal affidavit letter add-on (300 USD), which you can actually write yourself.

In Summary

I definitely recommend Taxes For Expats. The ratings on Trust Pilot and Verified Reviews speak volumes about their professionalism.

Having spoken to the owner personally, I can honestly say they really value the expat community and are committed to providing a tailored, trustworthy service that meets our needs. I think it's good value too, certainly at the basic Core and Premier plans.

Many of my US expat readers are using TFX, some for a number of years already.

Yes, you can do your return yourself, and yes you will save money doing it. But as a business owner myself I always think about the cost of opportunity: What else could I be doing that would improve my life rather than spending more time on accounts! I could be working on a new business idea, or better still, spending time with my kids.

Taxes are complicated enough, but even more so if you’re a US resident living or working abroad. It's a source of anxiety for us all and something that can cause anguish. And for this reason it pays to pay a qualified professional to take the weight off your shoulders and get it right.

+ Get $25 off your return with this special link

Last Updated on

![Thailand's New Expat Income Tax Policy [Fact Checked by Experts] tax-expat-thailand](https://www.thethailandlife.com/wp-content/uploads/2023/10/tax-expat-thailand-150x150.jpg)

Leave a Reply