Travelers sometimes worry about insurance claims; that they will face excessive paperwork, prolonged processing times and obstructions that will make the process stressful.

And then there is the common belief that travel insurance companies are more interested in avoiding payouts than in helping their customers.

This perception is fueled by stories of denied claims based on technicalities or obscure policy details. Such experiences can lead to distrust and skepticism about the value of purchasing travel insurance.

One of the reasons I started using SafetyWing was their modern approach to coverage and inclusions. Notably, you don't need a return date or ticket to get a policy—something typically required by other insurers.

Additionally, you can obtain or extend insurance while on the go, rather than being limited to securing coverage before starting your trip.

I had actually been traveling with other policies without realizing that a return date was necessary for the policy to be valid!

However, I've received feedback from a few readers that their claims were taking longer than expected.

Of course, the duration of a claim can vary based on several factors, including the complexity of the claim and the evidence required. If the required documentation is not provided or procedures are not followed correctly, processing delays can occur.

Anyway, I always relay reader feedback to the companies of the services I recommend, and I did just that with SafetyWing. So I was pleased to learn that SafetyWing has recently revamped their claims process in response to user feedback, demonstrating that they are listening and making improvements!

Read on…

Redesigned SafetyWing Claims Experience

The company has taken mine and other customers' feedback into account and completely revamped the claims process to make it more user-friendly and efficient. The redesigned experience will ensure a smoother and quicker claims resolution process. Here are the key changes:

- Simple, streamlined claims form that can be filled out in 5 minutes, so you can spend less time on admin and more time enjoying your travels.

- Reduced claims turnaround time from 30-45 business days to 7-10 business days.

- Get reimbursed, on average, in 2.8 days.

Note: They still have the 24/7 customer care team to receive and answer queries in under a 60 seconds.

Additional Policy Changes

There are two new categories of optional add-ons that you can apply to your Nomad Insurance policy, as follows:

1. Adventure Sports Coverage: See the table below to see what is covered.

Please note that you are still not covered for professional, organised or rewarded sports or for expeditions, and you are still required to ensure your safety.

| American football | Karting |

| Aussie rules football | Kite-surfing |

| Aviation | Martial arts |

| Bobsleigh | Luge |

| Boxing | Motorbiking |

| Cave diving | Motorized dirt bikes |

| Free-style skiing | Mountaineering at elevations under 6000 meters altitude |

| Hang gliding | Parachuting |

| High diving | Parasailing |

| Ice hockey | Paragliding |

| Karting | Quad biking |

| Kite-surfing | Rugby |

| Martial arts | Ski / snowboard jumping |

| Luge | Ski-flying |

| Motorbiking | Skiing / snowboard acrobatics |

| Motorized dirt bikes | Skydiving |

| Mountaineering at elevations under 6000 meters altitude | Skeleton |

| Parachuting | Snow mobile |

| Parasailing | Spelunking |

| Paragliding | Scuba diving accompanied by an instructor certified by PADI/NAUI/SSI/BSAC |

| Quad biking | Tandem skydiving |

| Rugby | Tobogganing |

| Ski / snowboard jumping | Whitewater rafting |

| Ski-flying | Wrestling |

| Skiing / snowboard acrobatics |

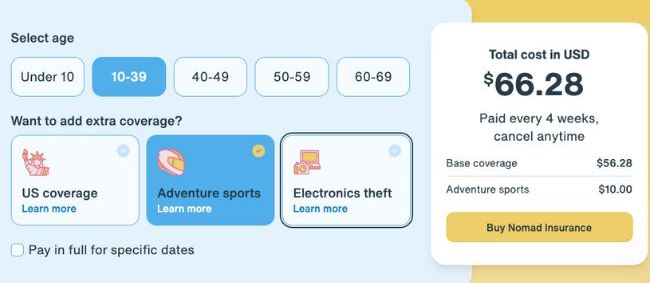

Policy cost with adventure sports add-on.

2. Electronics Theft Coverage: You can now get reimbursed if your laptop, phone, camera or other electronic items get stolen.

SafetyWing covers up to $3,000 per active insurance period, up to $1,000 per electronic. Up to $6,000 in your lifetime (lifetime max).

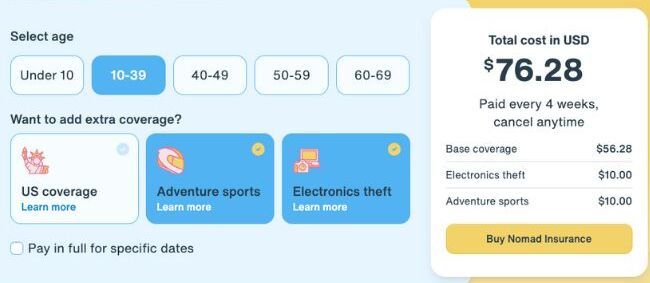

Policy cost with both add-ons.

——

I have an extensive review of SafetyWing and their products here, but let's do a recap of the Nomad travel medical insurance policy below.

Nomad Travel Medical Insurance Benefits Overview

Flexibility to Buy Insurance Anywhere

Whether you’ve already started your journey and realised you forgot to buy insurance, or you decided to extend your stay, SafetyWing allows you to sign up for or extend your coverage from anywhere in the world, even if your trip is already underway.

Pay-as-You-Go Subscription

SafetyWing offers a flexible 28-day billing cycle, allowing you to adapt your insurance to your travel plans. This pay-as-you-go model is ideal for open-ended trips or when your itinerary is as flexible as a yoga session.

Travel Without a Return Ticket

SafetyWing does not require a return date or ticket to start your coverage, allowing you to travel freely without constraints. Many standard travel insurance policies require you to provide a return date when purchasing the policy. This helps insurers calculate the risk and premium based on the duration of your trip.

Coverage in Your Home Country (US Residents Only)

For US residents who need to make an unexpected trip back home, SafetyWing provides add-on coverage for incidental visits. Below is what a quote looks like for travel health insurance with US coverage for 4 weeks. Very reasonable!

Motorbike / Scooter Coverage

If you enjoy exploring on a motorbike or scooter, SafetyWing’s insurance includes coverage for accidents on two wheels. This is a rare and valuable insurance addition, especially for Thailand. No doubt you've heard the awful stories of travellers having motorbike accidents and then finding out that their insurance company does't cover riding a moped/motorbike. However, please do note that you are not covered for the following:

Injury that happened as a result of drunk driving of any type of motorized vehicle (for example car, moped, motorbike, watercraft, aircraft, electric scooter). The threshold of your allowed blood alcohol content is 0.8, or it is determined by local laws where you are—whichever is lower.

Pricing

Starting at $56, SafetyWing offers straightforward pricing based on your age and whether your travels include the US. There’s no need to navigate complex rate charts, ensuring you know exactly what you’re paying for.

SafetyWing Policy Coverage:

What Is Covered

Here are some of the key coverages included in SafetyWing's Nomad Insurance:

- Emergency medical treatment and hospital stays

- Ambulance and emergency transportation

- Medical evacuation to a better-equipped hospital

- Emergency dental treatment

- Prescription drugs

- Trip interruption due to an unexpected event in your home country

- Political evacuation

- Trip interruption due to the death of a family member

- Accidental death and dismemberment

- Arrangement for burial or repatriation of remains in the event of death

- Cash payout to your beneficiary in case of accidental death

- Accommodation coverage if a natural disaster forces evacuation

- Coverage for stolen passport or travel visa

- Lost checked luggage

- Unplanned overnight stay

- Option for a $0 deductible

What Isn't Covered

When you purchase SafetyWing's Nomad Insurance, it's important to understand that this is not primary health insurance but a travel insurance plan designed for unexpected medical emergencies and travel-related costs. As such, certain things won't be covered by this policy, including:

- Pre-existing conditions

- Routine check-ups and preventive care

- Cancer treatment

- Injuries from high-risk adventure sports (unless you buy the adventure sport add-on)

- Travel to Iran, North Korea, and Cuba

- Any treatment that is not medically necessary

- Mental health disorders

- Limited coverage for stolen or lost personal items (only if you buy the electronics theft add-on)

- A $250 deductible per claim, meaning you cover costs under $250 and the first $250 of larger claims

How to Make a SafetyWing Claim

While I haven't personally had to file a claim, which limits my ability to fully assess that aspect of their service, the process looks quick and straightforward, taking about 5 minutes. Once you've purchased insurance, just go to your member portal on the website and proceed as instructed. Have the following information ready, if available:

- Your medical report

- Medical invoices detailing your expenses

- Any relevant receipts

- Your bank account information

In Summary

SafetyWing Nomad Insurance offers an impressive policy tailored to modern travel needs. With a flexible pay-as-you-go subscription model, you can easily adapt your coverage to suit changing travel plans.

Their $0 deductible option means you won’t have to worry about out-of-pocket expenses in emergencies. Coverage includes emergency medical treatment, hospital stays, ambulance services, and medical evacuations, ensuring you’re protected no matter where you are. Plus, they cover trip interruptions, political evacuations, accidental death and even lost luggage.

The option for additional coverage for electronics theft and high-risk activities makes it ideal for adventure seekers. And the new streamlined claims process is a much welcome addition.

One downside is that coverage is not available for persons over the age of 70, which does exclude some of my readership. Additionally, in terms of insurance, I personally don't see the difference between losing a laptop in luggage and having one stolen, but for theft you need the add-on. Since many of us have an expensive laptops and cameras that are a target for thieves, this is worth having.

Whether you're a digital nomad, frequent traveler or planning an extended trip, SafetyWing Nomad Insurance provides peace of mind and comprehensive protection.

Last Updated on

Leave a Reply