The majority of visitors to Thailand are tourists who require standard travel insurance. However, there are also thousands whose connections to Thailand are more complex, necessitating tailored travel and medical insurance solutions.

For instance, some individuals spend 3–6 months in Thailand, returning home periodically and traveling to other Asian countries in between. Others work offshore for months at a time and then return to Thailand to join their partners. Some professionals work globally, with Thailand serving as one of their periodic workplaces. Meanwhile, digital nomads operate remotely, moving to destinations as they please.

The good news is that SafetyWing offers insurance solutions that cater to all these diverse groups and others in between. I have personally used their insurance for three years, and it has been an excellent fit for my needs.

In this review, I will explore the specifics of SafetyWing’s Nomad Insurance, including their key policy features, available add-ons, and pricing.

Contents

SafetyWing Overview

SafetyWing is a travel-medical insurance company that provides flexible policies for travelers, nomads, and expats alike.

Cover is streamlined into two categories: The Essential plan covers the basics with options for adventure sports and electronics theft, while the Complete plan offers comprehensive health coverage with routine healthcare, mental health support, and maternity.

Most people, from anywhere in the world, can get SafetyWing insurance. The exceptions are:

If you are younger than 14 days or older than 70 years.

If your home country is sanctioned (North Korea, Syria, Cuba and Iran).

If you, as an individual, are sanctioned under any of the sanctioned regimes.

Nomad Essential Vs Complete Insurance Cover

Essential:

Essential cover is travel-medical insurance and can be used by tourists, long-stayers, and digital nomads. It's designed for individuals and families, and for persons up to 69 years of age.

Two children can be covered under the policy of one adult, free of charge.

The policy provides coverage for medical expenses, trip cancellations, and other unforeseen events that may occur while you are traveling. Essential also includes coverage for remote work-related activities, such as loss of income due to illness or injury.

The Nomad plan also covers you in your home country for short visits. See the policy details for specific information.

You can sign-up for cover before you travel or at any point in your journey. This provides great flexibility if you find yourself needing to extend your trip.

Adventure sports, US cover, and electronics theft are available add-ons that will increase the price of the policy.

Complete:

SafetyWing Complete is comprehensive travel-medical insurance designed for those working remotely and traveling abroad on a long-term basis. It covers persons up to 64 years of age.

The policy provides coverage for all the travel benefits of ‘Essential', and all medical expenses that may be incurred while you are abroad, including hospital stays, doctor visits, and prescription medications. The adventure sports add-on is included as standard in Nomad Insurance Complete. There is optional cover for Hong Kong, Singapore & US.

In terms of medical cover the policy is far more inclusive than the Essential Plan. You get coverage wherever you are working, including your home country, without limitation.

Who Is SafetyWing Insurance For?

Standard travel insurance is easy to come by but often has restrictions on the amount of time you can be traveling for, the countries you can claim in, and the amount of cover you are allowed in a specific country.

SafetyWing is travel-medical insurance for the modern traveler, taking into account the fact that many people now spend their lives between countries, remote working and traveling around. But it also provides cover for everyday tourists, who are visiting one country at a time.

Typical SafetyWing customer groups are:

- Everyday travelers taking a holiday pretty much anywhere in the world (175+) countries

- A digital nomad who travels in different countries while working from their laptop and wants comprehensive travel or travel+medical insurance.

- Part-time expats who would like one insurance plan to cover them whether they are at home or abroad.

- Part-time nomads or expats who prefer the efficiency of private health care when they are home

Essential Policy Coverage

The Essential Plan covers many aspects of travel and health. Below is a summary of the key policy items:

- Medical expenses: Coverage for medical treatment and hospitalization due to injury or illness while traveling. Max limit up to $250,000.

- Emergency evacuation: Coverage for transportation to a medical facility or to return home in the event of a medical emergency. Up to $100,000, or up to $25,000 for a pre-existing illness or condition.

- Emergency dental treatment: up to $1,000 for the onset of acute pain, as long as you seek treatment within 24 hours.

- Physical therapy or chiropractor: up to $50 per day.

- Unexpected quarantine due to Covid-19: Up to $3,000 per certificate, and $6000 lifetime limit.

- Trip interruption: Coverage for expenses related to interrupting or canceling a trip due to unforeseen circumstances, such as illness or a natural disaster. Up to $5,000.

- Trip delay: Coverage for expenses related to delays caused by unforeseen circumstances, such as missed connections or severe weather.

- Baggage loss: Coverage for the loss, damage, or theft of luggage and personal belongings while traveling.

- Accidental death and dismemberment: Coverage for accidental death up to $25,000 paid to a beneficiary.

- Personal liability: Up to $25,000 for third person injury or liability.

- Robbery and abduction: Lifetime up to $10,000 and $1,000 cover per personal belonging.

See the details here.

Add-Ons

While the insurance covers all the average person will need, there may be some specifics you want to add-on. You can choose between different add-ons and tailor your coverage plan to include 30+ adventure sports like cave diving, quad biking and scuba diving. You can also opt to cover specific electronics such as your laptop, phone, camera or other electronic device for up to $1,000 in the event of theft.

And…

- You can visit any public or private hospital in the world.

- Your emergency treatment pre-authorization (for procedures costing $500 or more) will happen in less than two hours.

- Standard claim reimbursements take just 2-3 days.

Complete Policy Coverage

The Complete Plan includes the travel benefits but is more comprehensive in terms of medical care. Here's a list of some of the key areas it covers:

- $1,500,000 maximum cover, per policy

- Private hospital room

- Adult companion accommodation

- Oncology: cancer tests, medication and treatment

- Surgeon and Anesthesiologist Fees

- Renal failure and dialysis

- Intensive care

- Reconstructive surgery after an Accident or Illness

- Diagnostic procedures like MRI PET, CT scans

- Newborn coverage and Maternity Complications

- Rehabilitation

- Emergency evacuation and repatriation

- Prescription Drugs

- Emergency dental coverage

- Nurse care at home

- Palliative Care

- Vision

Motorbike Accident Cover

I've purposefully put this information in a separate section because it is so important. Many insurance policies do not cover motorbike riding in Thailand and other countries, but travelers automatically think they are covered.

The bad news comes after an accident, when medical bills are stacking up and the injured person has no funds to pay.

Whether you are a tourist or a digital nomad or expat, the likelihood is that you will ride, or be a passenger on a moped/motorbike at some point.

Given the number of accidents we hear about involving foreign nationals, it goes without saying that you must have cover.

The good news is that SafetyWing Nomad Insurance does cover motorbike/moped accidents. Here is the exact wording:

In case of an accident, while riding a motorbike, moped, or scooter, you are covered for your own eligible medical expenses as long as you are properly licensed for the area where you are driving and you are wearing proper safety gear such as a helmet. Driving while intoxicated and racing are excluded. Personal liability is excluded for operating any vehicle.

The bottom line is that you must have a license to ride, and that license must be accepted in the country you are traveling in.

Nomad Essential – SafetyWing Pricing

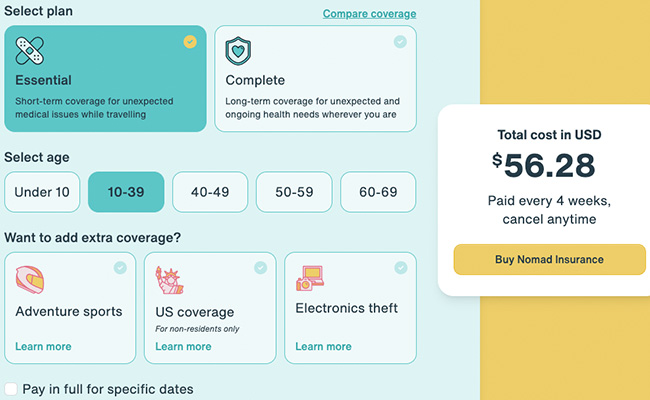

A base policy starts at $56.28 for 4 weeks. However, you can adjust the length of your stay to less than 4 weeks on the quote screen.

If you toggle the include US coverage button to on, the policy price will rise to $104.44 for 4 weeks.

You don't have to set an end date for your policy either. If you don't set an end date you will be billed monthly.

Two children under 10 per family (1 per adult) can be included on your insurance free of charge.

There is a $250 deductible (excess) as standard, and a $250 000 max claim limit.

SafetyWing will cover up to 69 years of age.

Here's a quote I got for a 3-month trip to Thailand.

Nomad Complete – SafetyWing Pricing

The base plan starts out at $150.50, which is the estimated monthly fee per member of age 18-39. Contracts are annual, even if you pay monthly.

Of course, this price will rise with age and any pre-existing conditions and add-ons.

if you want to add cover for Hong Kong, Singapore, and the USA as an extra, the price will rise to $263.50 per month.

Don't forget that is always a good idea to compare quotes. I recommend getting a quote from Cigna to see how SafetyWing compares – I pretty much guarantee SW is cheaper. It takes just 2 minutes…

to compare with…

Making a Claim with SafetyWing

So you fell over and broke your arm. Luckily you are insured, but will the company pay out, or will they find some exclusion you weren't aware of?

Let's face it, no matter how attractive the marketing and pricing of a travel insurance company, what really matters is how they perform when it comes to putting in a claim.

Thankfully, SafetyWing has a very good reputation when it comes to claims. You can start a claim in as little as 5 minutes and get reimbursed within 2.7 days.

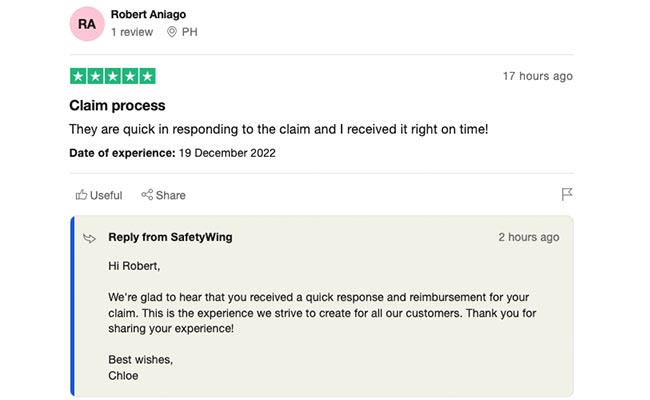

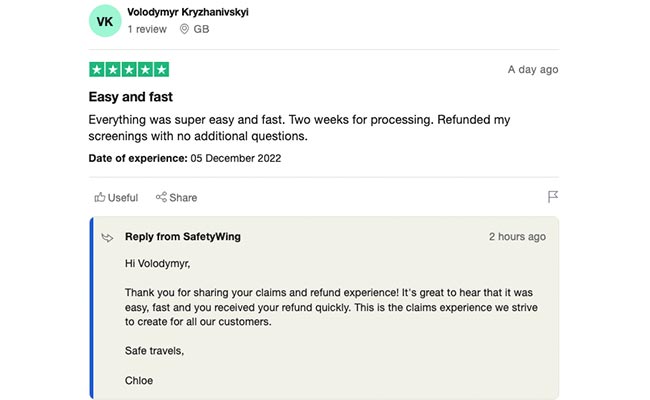

Here's a couple of recent review left by customers who made claims:

To process an insurance claim with SafetyWing, you will need to do the following:

- Login to your account and start a claim. If you are filing a medical claim, make sure to attach the following:

- (a) your medical report (a note from your doctor which include symptoms, diagnosis and treatment),

- (b) a detailed invoice outlining what you have paid for and (c) proof of payment or receipt.

- If approved, you will receive the reimbursement to your bank account by a wire transfer. If your claim is less than the USD $250 deductible and this is your first claim, your refund will be subtracted from your deductible and there will not be a reimbursement until your total claim amount for the certificate period (max 364 days) is more than $250.

- Your claim can take as little as 2.7 days to go through.

In Summary

SafetyWing is certainly an industry disruptor. It has brought travel insurance into the modern era by creating travel-medical insurance, and splitting this into two simple categories that serve distinct groups.

People who are location independent, full or part time, fall between the cracks of many travel and medical insurance policy offerings and, in this regard, SafetyWing is a much-needed addition to the market.

The cover takes into account the digital age we live in and the fact that people now combine travel and work in numerous ways. It also provides cover in multiple countries and for short trips back home, which many nomads take intermittently.

Moreover, policy cover is easily adjusted, and can be taken out when traveling, unlike old-fashioned policies that must be taken out in advance.

Its base policy still provides comprehensive cover for the average tourist traveler, making it a holiday option too.

Pricing is very competitive, though the Complete Plan, for older citizens of 50+, in particular when including the US, begins to lack competitiveness with the likes of Cigna and Bupa.

That being said, if you're planning on staying in Thailand as a retiree, or working here long term, you may not need any international cover (many people use government healthcare when traveling back home). If this is the case, you should compare prices of local medical insurance companies, as that may be a cheaper option for you.

+ Get a quote from SafetyWing here

Last Updated on

Michael Babcock says

Jan 26, 2023 at 5:21 pm

TheThailandLife says

Jan 26, 2023 at 5:51 pm

Raph says

Feb 15, 2021 at 9:24 pm

mowit72760 says

Aug 08, 2020 at 9:08 am

David says

Jul 06, 2020 at 3:10 am

David says

Having said this, I would book a flight right now if I didn't have to quarantine upon arrival at an Alternative State Quarantine facility. Can't see many people wanting to come to Thailand if this stays in place.

Jul 05, 2020 at 10:48 pm

TheThailandLife says

Jul 06, 2020 at 1:24 am