A recent study estimated that a person needs approximately $390,000 (US) to retire in Thailand.

The cost was calculated over 14 years: retiring at 64, with a life expectancy of 78.7 years.

This works out at $2,321 per month, or 82,500 THB.

This is actually quite accurate. Most expats would agree that a single retiree could live fairly well on $1,500 per month (53,000 THB), but having an extra 30,000 THB to spend each month would afford more luxury.

The study covered most countries of the world, with the goal of estimating the cost of retiring in Thailand based on the equivalent quality of life you'd enjoy back home.

The research was based on the following lifestyle for 1 person:

- Renting a 1-bedroom apartment in a city centre, like Bangkok

- Two vacations a year

- Moderate drinking

- No smoking

- Eating out: 15% expensive restaurants, 75% inexpensive restaurants

- Eating Western food at home

- Two round trips on public transport per week

- Moderate coffee takeout

- Moderate buying of clothes

- No taxis/ride shares, but moderate car use

- Gym membership

But how does this estimation translate to the real world? Let's dig a little deeper.

The Cost of Retiring in Thailand

If we do a quick summary of expenses, the sum of $2,321 p/m is a reasonable assumption:

- Rent and bills: 20k per month

- Average daily expenditure: 1,000 THB per day

- Food shopping/eating out: 10,000 THB per month

- Medical Insurance: 10,000 THB per month

- Moped / car rent: 5,000 – 10,000 Baht per month

- Miscellaneous costs: 2,500 THB (visa renewal, or similar)

Total = 82,500 per month.

You can, of course live on a lot more, or less. Let's explore this.

Living Cost Variables

One of the main reasons Thailand is such an attractive destination for a retiree is because there are different standards of living available. You can live pretty cheaply, or quite expensively.

Therefore, people will no doubt comment that you can live on half the amount cited above.

It's true. However, I think 80,000 THB is a good monthly amount to aim for if you are considering retirement in Thailand. And if you don't spend that much, it's more to leave your kids :).

It's all down to lifestyle. Some retirees view retirement as a time to enjoy all the finer things in life: extravagant meals, wine bars, members clubs, etc., while others are happy to enjoy the simplicity of walks, coffee with friends and the odd round of golf.

When thinking about the cost of retirement in Thailand, consider the following:

- How often do you want to eat out and go drinking?

- Do you regularly pay-for-play?

- Do you have a partner to support, or are you seeking a partner?

- Will you rent a condominium or a house?

- Do you require a car?

- What level of health insurance do you need?

- Do you need to buy monthly medication?

- Do you need to fund life insurance policies?

- How often will you fly back home?

What Lifestyle do You Expect?

There are expats who dine in high-end restaurants, buy a German car at twice the price you'd get one for in Europe, rent a condo on Wireless Road in Bangkok for 80k+ a month, and always fly first class.

And then there's expats eating street food for 200 Baht a day, and staying in a 5,000 THB per month condo. I'm not judging either way. You have to cut according to your cloth, as the saying goes.

Some people will take taxis everywhere; others will rent a motorbike or buy a cheap one secondhand, and others won't settle for less than owning a car.

Some people will accept a studio apartment to keep their rent low, while others will cook at home to save money on food, and then put that saving into renting a more spacious home.

Some people have a few beers twice a week, and others drink a few beers every night. Others regularly pay-for-play while some would rather date, and some aren't interested at all.

In terms of expenses, there are many variables, including choosing to live in a rural location, which is much cheaper. Some expats live in the family home of their partner, or a home they have built, and therefore don't have to pay rent.

Regardless, for a single retiree living in Bangkok, Pattaya, Hua Hin, Samui, or Phuket, 50-60,000 THB per month can be enough.

Indeed, living expenses for some can be as low as 40-50,000 THB per month. I have spreadsheets from 10 years ago showing monthly expenses of 35,000 THB! Though the cost of living has risen since then.

Inflation & The Cost of Living

When calculating how much you will need to see you through retirement you will need to factor in inflation.

Savings aren't static, even though it might seem that way if the money is just sitting in an account. The cost of living rises (generally), so the value of your money (spending power) decreases over time, unless you are earning an interest rate in line with, or higher than, inflation.

As we have seen in recent times, the cost of living can shoot up unexpectedly. Just look at the price of flights compared with a few years ago. For this reason, i is prudent to factor in more than you think you will need. You should have a safety net.

One should also note that few people have $390,000 in savings. A more likely scenario is having the equivalent in pension pay-outs over the 14-year period. Most retirees have modest savings and a half decent pension. Some may have savings and a state pension.

Either way, the amount required to see you out, so to speak, is still the same.

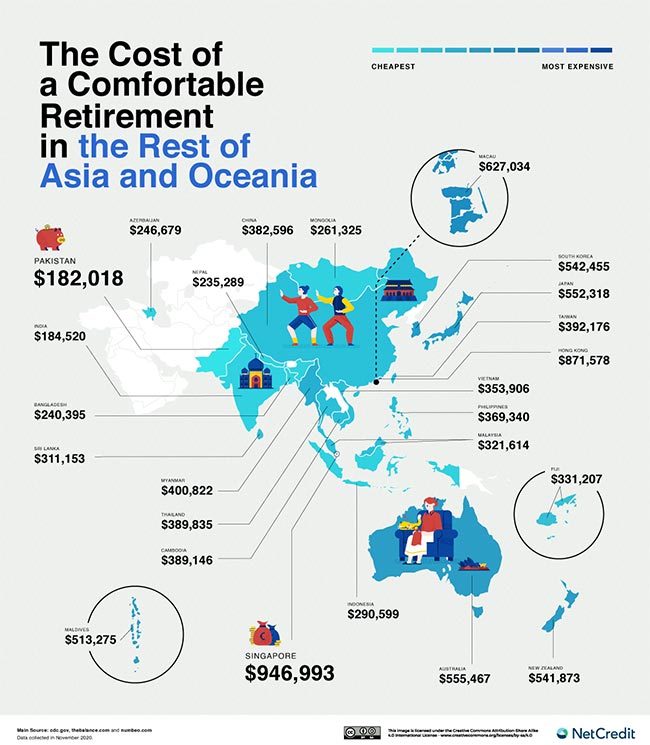

Sorry, you'll have to zoom in on the image to see the country names.

Thailand Retirement Cost Vs. Rest of the World

And so it begs the question: is Thailand value for money when it comes to retirement?

For the equivalent cost of living, a retiree would need $515,742 in the UK, and $601,489 in the USA (over the 14-year period).

Thailand is only $125,000 less than the UK, but then consider that the UK is cold, grey and rainy for 6 months of the year. Thailand has warmer weather and warmer people. It also has lovely beach getaways at unrivaled prices.

Here are some other countries of interest:

- Canada – $496,118

- Mexico- $257,078.

- Costa Rica- $470,432

- Spain – $453,191

- Italy – $427, 226

- Portugal – $429, 647

- Switzerland – $842,790

- Germany – $508,656

- Sweden – $569,809

The most expensive country in the world to retire in is Bermuda: $1,065,697.

The cheapest country to retire in is Pakistan: $182,018.

Thailand Vs the Rest of SE Asia

You're probably thinking that Portugal, Italy, and Mexico look like pretty good options, but you like Asia, right?

So let's look at how neighboring countries stack up to Thailand. The following countries all work out cheaper than Thailand for retirees:

- Philippines – $369,340

- Indonesia – $290,599

- Malaysia – $321,614

- Vietnam – $353,906

- Cambodia – $389,146

- China – $382,596

Singapore is expensive at $946,993, as is Hong Kong at $871,578.

Summary Thoughts

For sometime, there has been a general consensus that “Thailand isn't cheap anymore”.

This is certainly true for holidaymakers. Global economic shifts have devalued many Western currencies and made Thailand more expensive. The cost of living in Thailand has also risen, with inflation reaching 8% in 2022, up from the usual 1-3% average.

However, for retirees, while there are cheaper options, the people, culture, weather, optional living standards, and beach get-away options, make Thailand an attractive prospect.

There are downsides to Thailand, of course. Perhaps the biggest is health and safety. Thailand has a very high road traffic accident level and, depending on where you're living, pollution can also pose a hazard to your health.

Like many second world countries, regular reports of police corruption may worry some. But these problems always seem to exist where it's “cheap”, and are avoidable for those who stay on the right side of the law.

I think these downsides are more of a concern to those relocating as a family with children, since we worry about our children more than ourselves. In addition, those with kids also have schooling to consider. Good private schools are expensive here, and that's where the balance is likely to tip in favor of living “back home”.

Back to retirees, though: Is the average 65-year-old going to be worried about road traffic accidents or poor electrical wiring standards?

Most will take the view that the benefits outweigh the risks and, with a little extra caution, one can avoid something unfortunate happening. And those with a Thai partner will be at an advantage in navigating potential problems and risks. Other countries in SE Asia aren't immune to these problems either.

Thailand is a very colorful country in terms of travel, people, heritage, art, festivals, markets, socializing, and more. And let's be honest, the large majority of single men retiring in Thailand are either A) influenced in their decision by the availability of single women, or B) moving here to settle with a native they are already in a relationship with.

Lots of food for thought.

—

How accurate do you think this study is? Is retiring in Thailand still your preferred choice?

More Living In Thailand Tips

How Much is Health Insurance for Thailand?:

Find out with a quick quote here from Cigna. Takes 2 minutes.

Want More on the Cost of Retiring in Thailand?:

Find out how it stacks up against North America, Europe and Asia. Click here.

Improve Your Thai Skills:

Learning Thai makes life here easier and more fun. I use Thaipod101. It is free to get started & easy to use.

Last Updated on

Moose says

Your information extremely helpful.

Do I have to pay any taxes?

For example I have a IRA account in the USA also I do some stock market trading if I retired in Thailand do I have to pay taxes on any of this income?

Also, I am three years from being 62 to where I could receive my Social Security benefits based on the last calculation at 62 I should be getting 2500 to 2600 I was hoping to be able to live and this amount is that possible?

Thank you

Dec 11, 2023 at 12:12 am

JamesE says

The jury's still out, but, Thailand and the US have a Double Taxation Treaty which means that income earned and taxed in one jurisdiction - in your case the US - won't be subject to tax in another - AKA: Thailand. https://www.belaws.com/thailand/double-tax-agreements/ for reference. Also, historically, Thailand has left retirement income off the table and there has been no mention of that changing. What is not clear is what reporting will be required by expats who stay in the country long enough (>180 days) to qualify as tax residents regardless of whether they might not be required to files taxes in Thailand. So, deep breath and stay tuned.

Dec 11, 2023 at 1:42 am

Ken F says

As to the question of being able to live on $2500 a month in Thailand that is entirely up to you. I have already mentioned in the past on here that I lived in Phuket for less than half that amount 15 years ago. And the reason I was able to live so cheaply, despite having stupidly chosen to rent a big luxurious place that was WAY out of my price range at the time, is because my girlfriend cooked all our meals and we never went out drinking or doing other costly things.

This last time living in Phuket however it was a completely different story. For one thing I was single for most of that first year back and although I did not go with bar girls I did go out drinking a lot to stave off the boredom and to hopefully meet some interesting Westerners to talk to (wishful thinking). I also found that I was craving western food much, much more often than I ever had the previous times I lived in Thailand and so I ended up spending a lot more than I should have on food. Instead of averaging 100 baht or less per meal (very doable) I was averaging 3 times that amount. Basically, although I am normally very good at making and sticking to a budget, I just threw the budget out the window and bought whatever I wanted this time around. I also spent money going on dates while trying to find the right girl. And then after I eventually got a girlfriend she unfortunately lived very far away from Phuket. And since she was still in school, she could not move to Phuket. And since I did not think I could possibly stomach living in the boring small countryside town where she went to school I chose to stay in Phuket and just have her come down to stay with me during school breaks and I would travel up to see her other times. The point is all those travel expenses really added up. I also once again spent 70 percent of my income for an opulent apartment that was much bigger than I needed and was in a prime area, rather than sticking to the 30 percent rule. All in all, I would say that I spent about twice my social security income each month for the two years I was there, and this overspending depleted my savings by about $25,000. But of course, my social security is less than half of what you will be getting and if I had made the same as you my savings would still be at the same level as two years ago. In fact, they would likely be higher. The bottom line is that even if you choose to be as fiscally irresponsible as I was for those two years you will still have more than enough money to live a very comfortable lifestyle in Thailand.

As for me, now that I am back in California and am working again and sticking to a budget, I should be able to get my savings back up to where they were in 2021 in just a few years time.

Dec 11, 2023 at 3:45 am

JamesE says

Dec 11, 2023 at 4:48 am

Ernie says

Just curious on what location in Thailand expats over 60 y/o prefer in beach areas but also an arms length away from touristy areas. Also can you recommend a good health insurance company?

Mar 12, 2023 at 8:43 pm

TheThailandLife says

Mar 13, 2023 at 6:43 pm

Ernie says

Mar 14, 2023 at 12:04 am

fretta luigi says

Avendo ricevuto danaro da una ditta Italiana della quale ne ero socio.

Essendo stato liquidato ,e avendomi versato la liquidazione dei nuovi soci ,

in una banca Thailandese (liquidazione di un capital game )

La mia domanda e', Quale percentuale devo pagare di tasse in Tailandia ?

Cordialmente

Fretta Luigi

Jul 28, 2022 at 12:06 pm

JamesE says

Jul 28, 2022 at 10:59 pm