If you've been lucky enough to amass over 100 million Baht (approximately $3M), then your estate will be unlucky enough to be caught in Thailand's inheritance tax threshold.

Few of us have managed to squeeze that much out of our stay in Thailand, but there's a lot more to think about than that.

What if your wife dies before you? Do you benefit from her estate?

And what of single guys / girls who hold assets such as condos and cars in Thailand, who gets their greedy paws on those when you buy your farm in the sky?

And what if you die without a will (intestate)?

The fact is, few people know where they stand on such matters, thus the need for this article.

In this post, I'll explore the ins and outs of Thai inheritance tax law, including what happens to your assets if you die in Thailand, and what you stand to inherit if your wife/husband dies before you.

Who Pays Inheritance Tax in Thailand?

Unless you're sitting on $3m of money earned in Thailand, then your assets won't be subject to IHT.

If you are, your heirs will pay 5 or 10 percent – depending on their relationship to you – on anything over that amount

The law states:

The inheritance tax is 5 per cent for ascendants or descendants and 10 per cent for others. It is levied on assets worth above Bt100 million.

IHT is levied on heirs who are either individuals or Thai juristic persons. It is also applied to non-Thai nationals who are resident in Thailand according to the immigration law, and non-Thais inheriting assets located in Thailand.

This means that your Thai wife, or full or half Thai child, will pay IHT on your estate if it meets the threshold.

But really, who has this kind of wealth in Thailand? you might ask.

Many more than people tend to think, actually.

Wealthy Thais are far wealthier than we might perceive, and as such the government expects to collect 3 Billion Baht per year at the 5 percent rate.

Gift / Personal Income Exemptions

Like most countries, to counter possible avoidance of inheritance tax, a gift tax was also introduced by way of amending the types of tax-exempt income in the Thai Revenue Code.

The types of income exempt from personal income tax include income derived from maintenance, income derived under moral obligation, inheritance, or a gift received in a ceremony or on other occasions in accordance with established custom.

The law will only exempt the following types of income from personal income tax:

The portion of inheritance income not exceeding 100 million Baht under Section 12 of the Inheritance Tax Act.

Income derived from the transfer of ownership or possessory right in an immovable property without consideration by the parent to a legitimate, non-adopted child, only for the portion not exceeding 20 million Baht per tax year.

Income derived from maintenance or a gift from ascendants, descendants or a spouse, only for the portion not exceeding 20 million Baht per tax year.

Income derived from maintenance under moral purposes, or a gift received in a ceremony or on occasions in accordance with custom and tradition from persons who are not ascendants, descendants or a spouse, only for the portion not exceeding 10 million Baht per tax year.

Income from gifts received for use for religious, educational or public purposes according to the rules and conditions under a ministerial regulation (yet to be issued).

Yes, I'm sure you can see how a bunch of rich folks will find loopholes here and pay diddly squat. At which point the threshold will no doubt be lowered to scoop up those on moderate incomes.

Thanks to Benjamas Kullakattimas, Head of Tax at KPMG Thailand, for providing the English interpretations of the above list.

What Happens to My Assets When I Die in Thailand?

Single guys and unmarried guys in relationships might wonder what will become of their condo and Honda Click should they bite the bullet. The hard and fast truth is, if you have assets in Thailand, you need to make a will.

You should have a will for both your assets in Thailand and any that you hold in your home country.

When you die in Thailand, a government officer requests a copy of a will either from the family or the lawyer of the deceased.

In short, the will filed in your home country will not cover any property in Thailand.

Failing to have a will could result in lengthy, costly probate.

Without a will in Thailand, these assets are the property of your Thai estate and would be subject to Thai inheritance tax, if they total over the 100 million Baht mark.

For the married, your assets are distributed according to Thai law, and this means that family members are given priority (see the next section).

If you should die with no will, and there is no family or said heirs, then the state has the right to take all your property and sell it as it sees fit. Gasp!

If you have accumulated assets in Thailand that you don't want to end up in the state's purse, then you really should consider making a will in your home country that includes these assets, so that your relatives are aware of what you have and who is heir to them.

You should also file a will in Thailand too.

In order to register a will in Thailand and have an executor appointed, you must go to a provincial court. The executor will then get the court’s authority to dispose of the person’s assets in accord with their will. Of course a Thai lawyer can arrange this for you.

+ Read: How to Make a Will in Thailand

Will I Inherit My Wife's Fortune?

If she leaves it to you in her will, then yes. But please do read below about land and property.

If your wife doesn't leave a will, you better get in line, because, see that list below, that's you at #7, at the bottom of the queue:

In Thailand there are 6 classes of statutory heirs and they are entitled to inherit in the following order:

- Descendants

- Parents

- Brothers and sisters of full blood

- Brothers and sisters of half blood

- Grandparents

- Uncles and aunts

- The surviving spouse is a statutory heir, subject to the special provisions of Section 1635 Civil and Commercial Code.

You wife might choose to leave you money, gold, or perhaps her car. But if you expect to inherit these things, you'd do well to encourage her to make a will that stipulates exactly what she wants to leave you, and for her to instruct her family of her wishes, so there is no dispute.

Family disputes are common in this regard.

If family members seize assets after a death, the process for a foreigner getting them back, even with the presence of a will, is a very difficult one.

This is certainly something you should think about if you have a child together, because no doubt you'll want your child to inherit your wife's assets.

Can I Inherit My Wife's Land?

Believe it or not, you can inherit your wife's land.

If she doesn't make a will that says otherwise, it will be passed to you. But there is a catch, and a pretty huge one at that:

You cannot register ownership of the land because you will not be given permission.

You must dispose of the land within a reasonable period (up to 1 year) to a Thai national.

If you fail to dispose of the land, the Director-General of the Land Department is authorized to dispose of the land and retain a fee of 5% of the sale price before any deductions or taxes.

Yes, you're probably thinking what I'm thinking: No one is going to give you a decent price for that land once word gets out that your wife has died and you need to offload the land within a year.

Oh, and by the way, if you're living in your wife's house, consider that Thai law sees a house as “always having an interest in the land”, so I'd pack your bags within a year before your mother-in-law kicks you out, hehe!

What About Inheriting My Wife's Condo?

It's almost the same as the deal with land:

A foreigner who acquires a condominium unit by inheritance, either as statutory heir or inheritor under will, shall acquire ownership, however, unless the foreigner qualifies for ownership under Section 19 of the Condominium Act, it is required by law that the foreigner shall dispose of the unit within 1 year from the date of acquisition.

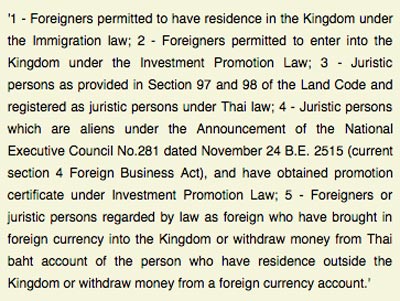

The reality is that most foreigners wouldn't qualify. Being retired in Thailand just isn't enough. See below for who qualifies:

Image Source: (Samui for Sale)

In Summary

The reality is, unless you're pretty wealthy, your estate probably won't meet the threshold for Thailand's inheritance tax.

There aren't that many foreigners naive enough to keep that much wealth in Thailand, anyway. But you may well have assets you want to make sure get passed to your wife or your kids, so making a will is a good idea.

The same goes for single people who've accumulated wealth in Thailand. You should make a will both back home and in Thailand to cover the event of your death.

Lastly, there's a number of foreigners living in Thailand who live in their wife's house, on their wife's land, drive their wife's car, and may even live off their wife's income.

If you fall into this category, then you should definitely speak to your wife about what will happen to her assets if she dies before you, because these will default to her family, in line with the statutory order of heirs outlined earlier in this post.

Getting Professional Advice

I am not an accountant, lawyer or financial advisor. This post simply represents my personal interpretation of the inheritance tax laws in Thailand.

Of course, I will make every effort to provide satisfactory responses to your inquiries in the comment section below, but it is important to note that handling IHT matters can be complex and require professional advice for a beneficial outcome.

If you find yourself uncertain about the best course of action for your tax affairs and investments, I strongly recommend consulting with a qualified professional. If you'd like, I can arrange for you to communicate with my IFA, who can offer expert guidance. If you want to get in touch, you can reach out to me via email or fill out this form.

PLEASE NOTE: If you're a UK National living in Thailand and want information about financial planning for UK inheritance tax, read this post here.

—————-

More Tips for Life Planning

Want to Start Leaning Thai?

Register a free account with Thaipod101. I use it and so do many of my readers.

Got Medical Insurance?

+ You should have. Get a quote on international cover here.

Need to send money to Thailand?

+ Go here to find out the cheapest way. Everyone is using this

Last Updated on

Bryan S says

Also looking for a reputable stock brokerage to help a Thai national set up an investment account.

Any suggestions are appreciated.

Jun 21, 2021 at 9:53 pm

kelvin bamfield says

Jun 23, 2021 at 9:10 am

Peter says

Mar 15, 2021 at 9:11 am

Marie says

Mar 15, 2021 at 3:47 pm

kelvin says

We speak English and have 5 stars on all Google reviews. I am an Australian in Thailand for 21 years. Like Peter said, they don't have much money, so it's up to him to make a decision based on the advice I have given him.

Thanks

Mar 15, 2021 at 6:00 pm

Bryan S says

Jun 21, 2021 at 11:44 pm

kelvin says

1st off was he legally married and was this registered at the local city hall?

If there was no Will then he died intestate and the laws of succession begin as posted under section 1629 of the Civil and Commercial Code of Thailand. There are 6 classes of statutory heirs and they are entitled to inherit in the following order:

descendants

parents

brothers and sisters of full blood

brothers and sisters of half blood

grandparents

uncles and aunts

The surviving spouse is a statutory heir, subject to the special provisions of Section 1635 Civil and Commercial Code.

As a decedent you therefore have a claim unless there is a Will

What area did your father live in and die in as this is the jurisdiction where the court challenge will take place?

Foreigners cannot buy house and land and so it is probably in the wife's name. The car and his bank account are another matter. But as your said neither your dad or have much money. However, he may have had a pension ?

Deciding what part of the assets you want is where you should start and then maybe a few letters from us can persuade the wife to negotiate or face legal costs in fighting it in court.

Give me a few more answers and then I will better understand.

Thanks. Regards Kelvin

Mar 15, 2021 at 4:15 pm

TheThailandLife says

Mar 15, 2021 at 4:41 pm

Peter says

Mar 15, 2021 at 6:10 pm

mervyn parsons says

Mar 22, 2021 at 8:25 pm

TheThailandLife says

Mar 23, 2021 at 3:07 am

mervyn parsons says

Mar 20, 2021 at 2:11 am

Bob says

How long the Thais will quarantine you is not certain. I would ignore all the blah blah blah until a definite regulation is in place.

Currently 15 days is necessary. That's what I would plan on

Mar 20, 2021 at 9:01 am

TheThailandLife says

Mar 21, 2021 at 4:42 am

mervyn parsons says

Mar 21, 2021 at 3:59 pm

kelvin bamfield says

Mar 22, 2021 at 9:35 am

mervyn parsons says

Mar 22, 2021 at 6:51 pm

kelvin bamfield says

Mar 22, 2021 at 10:08 am

mervyn parsons says

Mar 22, 2021 at 3:43 pm

kelvin bamfield says

Mar 22, 2021 at 6:59 pm

mervyn parsons says

Mar 23, 2021 at 2:57 am

k says

Mar 21, 2021 at 8:52 am

mervyn parsons says

Mar 21, 2021 at 8:14 pm

Helpless farang says

Tried to ask one lawyer she told me she had used before and she had known for many years, he tried to fool me into signing a paper where I would lose all legal rights.

Lucky I demanded a translate of the Thai document before signing. What kind of lawyer do this to husband of his so called good friend.

Talked to another lawyer who say I need to request to be legal executer, I just don't understand why it's not a good idea to try to find the lawyer with a will. Or maybe I just need to learn more about how things work in Thailand. Really appreciate any help you can give me.

Best regards

Apr 04, 2021 at 7:06 pm

kelvin bamfield says

Apr 05, 2021 at 9:14 am

Helpless farang says

All i got from new lawyer was just not enough evidence do you want to be legal executor. Unfortunately my wife lost alot of documents before i was able to get down here. and there was not enough time to retrieve them before she died. i tried what i could. but they got locked due to covid restictions then lost in the mail, then resend but never appeared. But family had no knowledge on most of it. so i am a bit lost.

But yes i am trying first to find out if anything has my name on it or how to track down lawyers. i have several papers with different lawyers but the lawyer i have contacted dont seem to happy to call around not sure why.

Thank you kelvin for your ideas, will try to investigate further

Apr 11, 2021 at 11:55 pm

Katja says

My parents are the next of kin and they're the legal inheritors. As he was not married is girlfriend is not allowed to close bank accounts or anything else. So my parents have handle the court stuff and get everything done. They are quite old and don't feel fit to fly to Thailand. Can they give me as their daughter the power of attorney to handle everything in Thailand? How long does the court procedure usually take? Thanks for your help!

Feb 09, 2021 at 11:39 pm

kelvin bamfield says

i believe your parents already contacted me and I have emailed them back the procedures -regards kelvin

Feb 10, 2021 at 12:14 pm

Slade says

I am wondering if someone would spend some time reading my story and giving so insight or advice on how these proceedings tend to end. My father-in-law didn't leave a will.

My wife's father recently passed away (He is Thai, she is as well). Her younger siblings are now blaming her of taking money from her parents over the years. She has been managing her parents businesses over the years and have helped them to make them pretty profitable (not 10s of millions) so much so that they now multiple vehicles and gigantic home, etc. Her younger brother has accused her of stealing money from her parents in a sort of indirect manner. He also has refused in the last decade to take care of his parents because he hated his father (not so sure about the mother), he rarely visited or assisted with anything regarding parents health and emotional issues (Abuse, both physical and psychological happened in this household). Now that his father has passed away he wants his share of the inheritance, but also he wants more because to him his sister (My wife, the oldest sibling) has gotten "more" than she is saying she got. He also accusing her of hading wealth (which she isn't). Me and my wife have also paid for her father's gambling debts he has made in the past which hasn't given back to us (Around about 800 000 baht). All the businesses and money went through my wife's accounts (It just made everything less complicated for her and parents to not have to constantly go in to sign documentation for transactions, etc.) So here we are, a son who has been absent for 20 years wanting more than what he deserves and basically ripping this whole family a new butthole in the process.

My questions after this story is: How do these cases typically resolve in Thailand? Additionally what are the laws that need to be followed?

Jan 28, 2021 at 9:13 am

kelvin bamfield says

Jan 29, 2021 at 10:05 am

kelvin bamfield says

Feb 10, 2021 at 12:15 pm

George says

My biological Mother Passed in aug.7,2017. She left land to her American husband and 4 American children. It’s my understanding that I had 1 year to claim the land. Do I have any rights to the lands anymore? Thanks

Oct 07, 2020 at 12:01 am

kelvin bamfield says

what country are you referring to as I am in Thailand

Did your mother leave a Will

Understand that foreigners cannot own land in Thailand and so there would be a period where the land would need to be sold off

Was your mother Thai

Did she have any other children or relatives

Why was American husband not with mother

Many questions to answer

thanks regards kelvin

Oct 07, 2020 at 2:10 pm

GEORGE CUSHING says

My mother lived in Khao Phra Ngam district Lopburi province. My mother did leave a will. She remarried an American, who still lives in the property. My mother had four children and listed 7 properties in her will. One property was willed to her American husband and her 4 American children, also each American child was willed a 1 acre property. As her death has been over a year past, are the rights to these properties lost? Thank you

Apr 14, 2021 at 3:40 am

kbamfield says

if she had a legal Will then there was an Executor. This person needed to take the matter to court to get a Grant as without that no property could be transferred or bank accounts accessed.

As foreigners you cannot own land - the courts would probably direct the properties be sold within one year

By law the Will should have been acted on and as it may not have been then the Executor is at fault - you need to talk with that person

However if no Probate Grant has been obtained then no one knows and so people can continue to live in the property. Also, the husband might have a caveat on the property - ie a mortgage so he cant be thrown out or some other agreement.

Apr 14, 2021 at 9:50 am

George says

Apr 15, 2021 at 8:54 pm

kelvin bamfield says

The Executor under the Will is legally obligated to settle the matter with you - they would need to apply to the courts for Probate and at that time you would make your claim known

Apr 16, 2021 at 9:24 am

Rebecca Hall says

His wife has already listed their home in Thailand for sale. The land and home are in her name although my father owned and ran the business he sold 6 months ago ( that paid for the home) They had no children together.

My brother and I also had to give authority to Thai hospital to release Dads body to her and she is also asking for us to complete paperwork so she has access to my Dads bank account (in thailand). Doesn't that mean we are considered Next of Kin?

What are my brother and i legally entitled to, under Thai law, if there is no Will and property is in Thai wife name?

Thanks

Apr 01, 2020 at 3:49 pm

Kelvin Bamfield says

as next of kin NOK you are the ones that give the ok for the Embassy to release the body by getting a release letter from them. It is now called a Consular letter

This is strange as if your dad was legally married to the Thai lady then she would be considered the NOK - better check this

This also means that the Thai wife cannot get the money released from the bank without a court order - maybe if its less that 100,000 baht the bank may release it to her if she is a Beneficiary.

Something odd here.

If no Will your dad died intestate and as next of kin you guys would get the money

True that the Thai lady would own the house and land as without a form of proxy agreement your dad would not control company or house and land

So it looks like theres some money in the bank she cant get out and thats where you come in as NOK

Get the Thai lady to update the bank accounts and send you a scan of the update to see if its worth the expense of getting it out

also where did your dad die and what was his name to find the Will

thanks regards kelvin

Apr 02, 2020 at 6:25 pm

Rita says

I’m trying to find out about getting a Power Of Attorney (?) to gather his assets to pass to my son as he is next of kin .

My son had to authorise instructions regarding his fathers body by the Embassy as he is next of kin.

I have a Thai lawyer asking my son to sign a Power Of Attorney form to allow him and several other named persons to be given this power.

Is this the usual procedure in these type of cases?

Thanks 🙏

Sep 10, 2020 at 11:53 pm

Kelvin Bamfield says

I do this work everyday.

The POA is for the cremation/funeral.

The matter has to go to court and then a grant of Probate is given.

Once you have the court order then the assets can be liquidated and sent to you, ie the bank account closed, cars sold, property sold -

Due to covid you need to sign a few docs as you cannot come here to Thailand, and you need a lawyer to take the matter to court.

What area is the court hearing?

Thanks,

regards kelvin

Sep 12, 2020 at 10:07 am

Rita says

We are now instructing lawyer to go ahead with getting my son’s share of the three properties. We have also discovered that the deceased wife’s mother has 50% rights as she is also Next of Kin along with my son who also has 50% as NOK.

My son does not want her to have to sell the properties and land and will settle for a smaller cash payment in exchange for rights of properties.

My question is, we are now giving the lawyer another large payment in advance. Are there any risks involved in this case? Or are we throwing more money at this , like the last time seeking (bank accounts , which member of the family emptied) only to find they can’t obtain access to assets? I feel we have to trust the lawyers on this and not sure if I should.

Thank you

Rita

Mar 15, 2021 at 7:06 pm

kelvin says

Mar 16, 2021 at 1:05 pm

Shelley says

Jul 19, 2021 at 6:55 am

TheThailandLife says

Jul 19, 2021 at 2:57 pm

Shelley says

Jul 21, 2021 at 4:45 am

JamesE says

Jul 22, 2021 at 6:19 am

kelvin bamfield says

Jul 23, 2021 at 10:02 am

JamesE says

Jul 23, 2021 at 10:36 pm

shelley says

Jul 25, 2021 at 5:38 am

kb says

Jul 25, 2021 at 2:57 pm

Shelley says

People do it. Thank you.

This also is not ttye main question which was inheritance and the civil commercial Act and the land departments opinion that the heir can own and needs to pay just the transfer and stamp duty. I have referred the original question to a lawyer. Anyways thank you for ur contribution.

Jul 26, 2021 at 9:10 am

kb says

you can go to court and argue that its an asset owned by the testator and so can be willed to the heir as many have done - and all have failed

If you want to pay my company for doing this then OK but we dont work this way

You are talking about the future and so we can leave it as we dont know if this will change - however its several departments you will be dealing with and ALL have different laws and powers - this is not America

Jul 27, 2021 at 11:37 am

Bob says

Buyer and seller meet there, the ownership is transferred and the buyer pays using a cashier's check from the bank.

Jul 25, 2021 at 8:17 am

Shelley says

Jul 26, 2021 at 9:12 am

kelvin bamfield says

Jul 26, 2021 at 9:48 am

Bob says

Yes, you also need the inward FX transfer document which the bank can supply as well as the cashier's check.

Jul 26, 2021 at 10:18 pm

kelvin says

Jul 28, 2021 at 9:56 am

Bob says

I am not sure where the "wrong at every turn" applied".

However, I met and still meet all the legal requirements of a visa extension. As indeed I have for the last decade. But this time the officer was insisting on a twelve month rental contract. That is not a fair demand.

Jul 28, 2021 at 6:07 pm

kb says

many buy in company names and theres nothing wrong with that and it works

Some buy using a proxy and then mortgage it back

some buy land without a proper title and this is a problem

Jul 25, 2021 at 3:51 pm

Bob says

Setting up the company costs money and has ongoing annual costs of around 10 to 20k.

Closing the company also has costs.

There is always the nagging doubt about the 51% Thai shareholding.

There is also the nagging doubt that it is not totally legal, as it is using a construct to avoid the land ownership laws.

But yes, there are a lot of guys using this method.

And there is a reason why condos in the foreign quota generally have a higher price and are more easily sellable than the company owned ones.

Jul 26, 2021 at 10:26 pm

kb says

Your post suggest costs of setting up a company but also realise that many houses, condos, land are already in a company structure and all thats needed is to change the Director and the share holders

There are annual accounting costs as with any business and these are apprx 12000 baht PA

Closing the Co - see above as you may be able to sell the whole package to the buyer as is normal practice

The 51% Thai shareholders has been done to death and people should realise that the Supreme Court on appeal ruled that share holders sign an open transfer document for convenience and so there is no issue with this any more

It is legal and so "nagging" is not an issue

Lots use this method as it is legal and normal if you know the law

In my experience the Thai quota and the foreign quota difference in costs is a myth - particularly now with covid

Jul 27, 2021 at 9:42 am

Shelley says

Jul 27, 2021 at 1:39 pm

TheThailandLife says

Jul 27, 2021 at 3:22 pm

Bob says

"the reason for getting a lawyer to do things is because they know"

and to complete the sentence ..."the right people to bribe".

LOL.

Taking over a company is also fraught. It is impossible to know if there are any outstanding company liabilities or contracts that the previous owner(s) have entered into. The company has these liabilities and the previous owner can sell the company and disappear abroad. I don't think it is possible to protect against that happening.

It costs maybe 20,000 to 30,000 baht to set up a new company and transfer the property into it. If anybody wants to go this route, then that seems to me to be the best way.

Jul 27, 2021 at 4:29 pm

Bob says

Yep, the general feeling from long-termers (like me) is that buying real-estate in Thailand is a terrible idea unless your wad so so thick that any "investment" can be written off without remorse.

And in this discussion no-one has yet mentioned the difficulty of selling a property, or lack of regulations over neighbors' behavior. They can have a pack of dogs barking all night and there is very little that can be done.

Rent is very cheap and you can be out in a day, and your money can remain in a financial center outside of Thailand that isn't a pain to deal with. Stay in Chiang Mai for six months, move to Bangkok for three, down to Phuket for a year. Once you own property you are no longer so flexible.

As to visas, for many years I did the annual extensions myself. But a couple of years ago I moved and the local immigration officers started making life difficult, indeed on the verge of impossible.

Then I discovered the world of "agents". WOW! These guys make life easy, no more sullen police in brown uniforms. Now its happy Thai smiles, about 13,000 Baht and 24 hours later a new extension in the passport. No financial, health insurance or other requirements. And as far as I can tell, it is totally legal. You pay the agent, he deals with immigration and the officer uses his "discretionary powers".

Jul 27, 2021 at 4:48 pm

kb says

The subject is about a property and as I have been here going on to 22 years and own businesses that work in the subjects we are discussing I can tell you there is a right way and a wrong way. On many occasions, people trying to save a few baht normally get burnt in the end as they did not do due diligence - ie homework. Cut corners and one day you pay the piper. All over the World, the same system exists.

There is nothing wrong with buying real estate here in Thailand and some are very successful at it - my companies do not do real estate however as we do probate then we do get properties that we need to sell. In 12 years we have 2 we have not sold as the location is outside of an area where people live, not sure why as Bang Saray is a beachside area and a village feel to it. It is being developed quickly and this will change the future sale of this property.

Everyone in the world has issues with neighbors at one point and noisy dogs well thats everywhere in the World as police reports will verify.

I have corrected Bob's assertion in his post as frankly, they are wrong as Shelley's enquiry is about inheritance tax and how to "avoid the problems of inheritance".

In all countries you must do conveyancing and Thailand is no different, however I would not let this deter anyone from buying property.

I hope this helps

Jul 28, 2021 at 9:21 am

kelvin says

Jul 28, 2021 at 9:59 am

kb says

and

this would be assumed on your part and also if there are air conditioners, fridges, machines, they may still have some manufacturers warranty left

You as the buyer have a responsibility to check all things within the parameter of the condo

What is outside is the responsibility of the Condo Committee

Due Diligence is required

K

Jul 22, 2021 at 12:40 pm

Shelley says

Jul 25, 2021 at 5:42 am

JamesE says

Jul 19, 2021 at 9:57 pm

Shelley says

2) However, I have read online that if yo0u are co-owner, each will have to bring in the the full amount of the purchase price in foreign currency and get separate FET for the full amount each. I have read tht ownership is 100% for each, even though co-owners.

3) On the other hand , on this website (https://daryllum.com/thailand-property-inheritance-laws-taxes-succession-and-wills/) I read that per the Civil and Commercial Code combined with opinions of the Department of Land, the foreign heir per condo owner's testament not only inherits but can own it also by registering it in their name as follows: publish a public notice in Thailand for 30 days, and present the proper documents 9 will, proof of relationship , etc -( no court order is needed if the Publication route is taken). If not contrary claim is made in that 30 days by some other person, the heir can then have it registered by paying the proper transfer and stamp fees. I am trying to contact lawyers in Thailand to determine the veracity of this.

Thanks

Jul 21, 2021 at 4:39 am

kelvin bamfield says

You can try cutting all the corners but eventually you will need to deal with the land office and they are a power unto themselves - even when i was armed with a Will, Court order and being the Executor the Land office had taken issue

Do it the right way as in the future things might change

Jul 23, 2021 at 10:05 am

kelvin says

being co owner she would need to show how she brought money into the country for buying the condo - this is called a TT3 - a Will is needed if she is to inherit the condo and as a foreigner and under section 19 of the condo act she would need to sell the property within 12 months

The Will states that it is for Thailand only and under Thai law for Probate - read between the lines - what is in Thailand stays in Thailand and is dealt with under Thai Law and jurisdiction - nothing to do with the USA

Jul 21, 2021 at 9:05 am

Bob says

I would guess that it is also possible to transfer the money in her name into Thailand, buy the condo from "Administrative limbo" and have it registered in her name, sending the money back out again afterwards.

Might even be able to find a "fixer" to get it done without providing the capital. This being Thailand, and where there's a Baht there's a way....

I am glad to have no interest in buying property in Thailand.

Jul 21, 2021 at 4:49 pm

kelvin bamfield says

Jul 23, 2021 at 10:06 am

kb says

but this thread is to educate the ones that might want to settle in paradise

Jul 25, 2021 at 3:52 pm

Shelley says

And yes, I noticed that properties don't move and some hve been on the market for over 4 years. But D being in her twenties, the selling bkms less of a concern as it can be her vacation home for years after I pass on and she can take years to sell it and not much of an urgent problem as it will have been a gift.

Peter and Bob said what I guessed already - buying is a bad idea. But my reason isnt for staying year round or taking profit - rather that i would like to stay the winters and spend time with friends as well - a few friends have bought condos in the same building hoping to spend some time there each year. Also the particular condo is larger than the tiny rabbit coups inside bkk as this is a little outside Bkk and it comes with lots of open air spaces unlike the tiny bkk condos.

I am almost afraid what you all will say about buying in D’s name as mentioned above !

Jul 27, 2021 at 8:57 pm

kelvin says

People buying from overseas will need a power of attorney here in Thailand to facilitate the contract and buy and sell, as the Land Office will require this

The FATCA and IRS laws of the USA are the issue - I am currently researching other ways the Land Office can accept money coming into the country as the crypto market would be ideal, however, the banks will miss out on their comms.

Jul 28, 2021 at 9:53 am

Bob says

You won't get an FFT with crypto

Jul 28, 2021 at 6:17 pm

JamesE says

Jul 21, 2021 at 10:18 pm

k says

Jul 22, 2021 at 12:46 pm

kelvin bamfield says

Also, it is the Executors duty to wind up the total estate within 12 months from the grant of probate

Also during these times, people are not flying in to give testimony in court - this is done via power of attorney

Today in my office we are doing a Probate video conference with the court as unfortunately we are locked down - however, we are essential services - I hope this helps

Jul 21, 2021 at 9:15 am

David says

Mar 03, 2020 at 10:07 pm

Kelvin Bamfield says

the UK Will lists who the Beneficiaries are and if she is not listed then she doesnt have a claim as the assets were your brothers to start with

the pre nup can be made to say what your brother brought into the marriage was his and remains his and the smae for her

when they get married the Sim Sot Ros Law comes into play where everything they gain together is 50/50 and so when they divorce this is the law

I hope this helps thai888

K

Mar 04, 2020 at 11:10 am

Dan says

He also has a Thai Child, younger than the UK children, with a Thai woman whom he did not marry - Will his estate automatically go to the mother? How can we in the UK be considered as the next of Kin, who do we speak to?

Feb 26, 2020 at 10:12 pm

kelvin says

Feb 27, 2020 at 9:34 am

Dan Dixon says

For Clarity - when you say here - do you mean I will have to apply to the courts in Thailand (where he died and his assets are) or Here in the UK where I am. (apologies, I do not know where "Here" is to you :) )

And when you say "We get a grant" do you mean you offer a service that I can use?

Mar 03, 2020 at 4:07 pm

kelvin says

The mod may give my email to you, as I do probate in Thailand

Mar 03, 2020 at 4:51 pm

TheThailandLife says

Mar 03, 2020 at 5:12 pm

Oliver says

I have a situation that I could use some guidance on.

My father passed in July. He was born in Thailand, but then migrated to the USA. He lived in the USA till about 65, and then moved back to Thailand to live permanently. He'd travel back and forth for his visa renewals.

well, after he passed, I come to learn that he was part of a property inheritance from my grandparents. with him now deceased, without any will to be found, the family is now looking to sell the property.

so heres the situation: 8 children (my dad and his siblings) are the owners of the property. only half of the siblings are now alive. I was just contacted by my cousin, asking me to get involved so I can legally assign authority to sell on behalf of my deceased father.

so i guess my question is, do I really need to be involved? doesnt the rights just go directly to the living siblings to deal with the property? or am I really a liability to them if I dont give my "okay" to sell?

Oct 15, 2019 at 3:08 am

James E says

Oct 15, 2019 at 9:20 am

Kelvin Bamfield says

surviving parent dies then

descendants

parents

brothers and sisters of full blood

brothers and sisters of half blood

grandparents

uncles and aunts

The surviving spouse is a statutory heir, subject to the special provisions of Section 1635 Civil and Commercial Code.

Oct 15, 2019 at 3:40 pm

Kelvin Bamfield says

if its small money and lots of in fighting then leave it alone as fees and time may eat up the estate

Oct 17, 2019 at 12:18 pm

Lizzie says

Sep 29, 2019 at 8:25 pm

Bob says

Your brother did not own the house, he owned (probably) 49% of the Thai company that owns the house.

If this ownership was not explicitly mentioned in a Will then it would fall into the intestate area, and his daughter has a solid legal claim on the full 49%.

The other 51% of the company is owned by Thai shareholders, who have a legal claim on percentage.

So, in my understanding, you and your brother have no legal claim whatsoever. It is not "our house" as you state.

Now, either you can accept this and transfer the property to the daughter, or you can try and be devious and access the money illegally. I would consider this to be immoral, but morality falls by the wayside where money is involved.

I am not going to offer any advice in that direction.

You could do the following.

1. Find the pre-signed share transfer contracts and transfer the Thai shareholders to the daughter's name (or trust).

2. Transfer the property to the daughter's name (or trust) which you can do as directors.

3. Close the company (if you don't it may eventually die by itself) to avoid the ongoing annual accounts which will cost around 10 to 20,000 Baht.

Hopefully she will then have enough money to get a great education and lead a successful life.

Another issue is who is the appointed guardian. This should be a responsible and reliable person who is not going to sell off the houses and use the proceeds for selfish purposes.

Sep 30, 2019 at 10:19 am

Bob says

If the company shares your father owned have not been mentioned in any Will, then according to Thai intestacy law the children inherit the shareholding. As there appear to be three children involved, then the shareholding will usually be divided equally between them.

Then there is the problem of the Thai shareholders, who have a claim on their shareholding, unless presigned share transfer contracts are available.

I suspect this process will take many months and be expensive.

Sorry again for my mistake.

Sep 30, 2019 at 6:15 pm

Kelvin Bamfield says

without seeing the Will all is speculation

most Wills incorporate the world all possessions at the time of death, again without seeing the Will we cannot speculate

Oct 02, 2019 at 11:54 am

Bob says

Must be quite busy too, as a lot of old codgers in Thailand don't seem to have done very much regarding Wills. Just don't care about what happens after they are dead, I suppose. Won't be their headache.

She did say specifically that the house was not in the Will. Which would mean it would be an asset that is covered by intestacy. Maybe they are hoping to sell it and then disappear with the proceeds, leaving the company in limbo. Probably the easiest and cheapest solution, if not legal.

But wth no plaintiff there are no lawyers.....

Glad I moved most of my assets to Singapore, with the most of the rest following in a few months. I'm fed up with the Thais and their "this is Thailand, not your country. That'll be another 20,000 Baht".

Oct 02, 2019 at 6:59 pm

TheThailandLife says

Oct 02, 2019 at 7:27 pm

Kelvin Bamfield says

Oct 03, 2019 at 4:30 pm

Kelvin Bamfield says

The house and company - lets see as the WIll could have been made before the house was purchased. House all wrapped up in Company with shareholders, share transfers, mortgages, lease? etc. Many questions here.

I did a presentation at the local expats club on Murphys Law Thai Law and International Law - what could go wrong?

I used 4 case studies and the members couldnt believe how if something was going to go wrong it would. This is Murphys Law.

Oct 03, 2019 at 4:25 pm

Kelvin Bamfield says

sorry to hear about your dad and the issues you face

Any Will needs to go to court and the Executors also need to give testamony. You cant do this without a Lawyer as the court issues you with a Grant of Probate to allow you to go to the DBD and the Bank to close down or sell assets.

As the house was in a company then foreigners can only own 49% and so who are the other shareholders. Under the company act as Directors you are also obligated to make things right in the company as it still hold the house asset. If a shareholder dies then these shares need to be allocated to another party. Also accounts need to be paid or there will be a fine.

Where the house is situated determines what court province will hear the case.

If you come as the Executors then this will cost you time and money to sort this out. You can apply to court then resign and let your nominee do the work instead of you flying in and out. Costs again.

I do this work all the time and if the mods allow you might be able to contact me

thanks regards Kelvin

Sep 30, 2019 at 11:45 am

TheThailandLife says

Sep 30, 2019 at 5:42 pm

Kelvin Bamfield says

Oct 17, 2019 at 12:16 pm