If you've been lucky enough to amass over 100 million Baht (approximately $3M), then your estate will be unlucky enough to be caught in Thailand's inheritance tax threshold.

Few of us have managed to squeeze that much out of our stay in Thailand, but there's a lot more to think about than that.

What if your wife dies before you? Do you benefit from her estate?

And what of single guys / girls who hold assets such as condos and cars in Thailand, who gets their greedy paws on those when you buy your farm in the sky?

And what if you die without a will (intestate)?

The fact is, few people know where they stand on such matters, thus the need for this article.

In this post, I'll explore the ins and outs of Thai inheritance tax law, including what happens to your assets if you die in Thailand, and what you stand to inherit if your wife/husband dies before you.

Who Pays Inheritance Tax in Thailand?

Unless you're sitting on $3m of money earned in Thailand, then your assets won't be subject to IHT.

If you are, your heirs will pay 5 or 10 percent – depending on their relationship to you – on anything over that amount

The law states:

The inheritance tax is 5 per cent for ascendants or descendants and 10 per cent for others. It is levied on assets worth above Bt100 million.

IHT is levied on heirs who are either individuals or Thai juristic persons. It is also applied to non-Thai nationals who are resident in Thailand according to the immigration law, and non-Thais inheriting assets located in Thailand.

This means that your Thai wife, or full or half Thai child, will pay IHT on your estate if it meets the threshold.

But really, who has this kind of wealth in Thailand? you might ask.

Many more than people tend to think, actually.

Wealthy Thais are far wealthier than we might perceive, and as such the government expects to collect 3 Billion Baht per year at the 5 percent rate.

Gift / Personal Income Exemptions

Like most countries, to counter possible avoidance of inheritance tax, a gift tax was also introduced by way of amending the types of tax-exempt income in the Thai Revenue Code.

The types of income exempt from personal income tax include income derived from maintenance, income derived under moral obligation, inheritance, or a gift received in a ceremony or on other occasions in accordance with established custom.

The law will only exempt the following types of income from personal income tax:

The portion of inheritance income not exceeding 100 million Baht under Section 12 of the Inheritance Tax Act.

Income derived from the transfer of ownership or possessory right in an immovable property without consideration by the parent to a legitimate, non-adopted child, only for the portion not exceeding 20 million Baht per tax year.

Income derived from maintenance or a gift from ascendants, descendants or a spouse, only for the portion not exceeding 20 million Baht per tax year.

Income derived from maintenance under moral purposes, or a gift received in a ceremony or on occasions in accordance with custom and tradition from persons who are not ascendants, descendants or a spouse, only for the portion not exceeding 10 million Baht per tax year.

Income from gifts received for use for religious, educational or public purposes according to the rules and conditions under a ministerial regulation (yet to be issued).

Yes, I'm sure you can see how a bunch of rich folks will find loopholes here and pay diddly squat. At which point the threshold will no doubt be lowered to scoop up those on moderate incomes.

Thanks to Benjamas Kullakattimas, Head of Tax at KPMG Thailand, for providing the English interpretations of the above list.

What Happens to My Assets When I Die in Thailand?

Single guys and unmarried guys in relationships might wonder what will become of their condo and Honda Click should they bite the bullet. The hard and fast truth is, if you have assets in Thailand, you need to make a will.

You should have a will for both your assets in Thailand and any that you hold in your home country.

When you die in Thailand, a government officer requests a copy of a will either from the family or the lawyer of the deceased.

In short, the will filed in your home country will not cover any property in Thailand.

Failing to have a will could result in lengthy, costly probate.

Without a will in Thailand, these assets are the property of your Thai estate and would be subject to Thai inheritance tax, if they total over the 100 million Baht mark.

For the married, your assets are distributed according to Thai law, and this means that family members are given priority (see the next section).

If you should die with no will, and there is no family or said heirs, then the state has the right to take all your property and sell it as it sees fit. Gasp!

If you have accumulated assets in Thailand that you don't want to end up in the state's purse, then you really should consider making a will in your home country that includes these assets, so that your relatives are aware of what you have and who is heir to them.

You should also file a will in Thailand too.

In order to register a will in Thailand and have an executor appointed, you must go to a provincial court. The executor will then get the court’s authority to dispose of the person’s assets in accord with their will. Of course a Thai lawyer can arrange this for you.

+ Read: How to Make a Will in Thailand

Will I Inherit My Wife's Fortune?

If she leaves it to you in her will, then yes. But please do read below about land and property.

If your wife doesn't leave a will, you better get in line, because, see that list below, that's you at #7, at the bottom of the queue:

In Thailand there are 6 classes of statutory heirs and they are entitled to inherit in the following order:

- Descendants

- Parents

- Brothers and sisters of full blood

- Brothers and sisters of half blood

- Grandparents

- Uncles and aunts

- The surviving spouse is a statutory heir, subject to the special provisions of Section 1635 Civil and Commercial Code.

You wife might choose to leave you money, gold, or perhaps her car. But if you expect to inherit these things, you'd do well to encourage her to make a will that stipulates exactly what she wants to leave you, and for her to instruct her family of her wishes, so there is no dispute.

Family disputes are common in this regard.

If family members seize assets after a death, the process for a foreigner getting them back, even with the presence of a will, is a very difficult one.

This is certainly something you should think about if you have a child together, because no doubt you'll want your child to inherit your wife's assets.

Can I Inherit My Wife's Land?

Believe it or not, you can inherit your wife's land.

If she doesn't make a will that says otherwise, it will be passed to you. But there is a catch, and a pretty huge one at that:

You cannot register ownership of the land because you will not be given permission.

You must dispose of the land within a reasonable period (up to 1 year) to a Thai national.

If you fail to dispose of the land, the Director-General of the Land Department is authorized to dispose of the land and retain a fee of 5% of the sale price before any deductions or taxes.

Yes, you're probably thinking what I'm thinking: No one is going to give you a decent price for that land once word gets out that your wife has died and you need to offload the land within a year.

Oh, and by the way, if you're living in your wife's house, consider that Thai law sees a house as “always having an interest in the land”, so I'd pack your bags within a year before your mother-in-law kicks you out, hehe!

What About Inheriting My Wife's Condo?

It's almost the same as the deal with land:

A foreigner who acquires a condominium unit by inheritance, either as statutory heir or inheritor under will, shall acquire ownership, however, unless the foreigner qualifies for ownership under Section 19 of the Condominium Act, it is required by law that the foreigner shall dispose of the unit within 1 year from the date of acquisition.

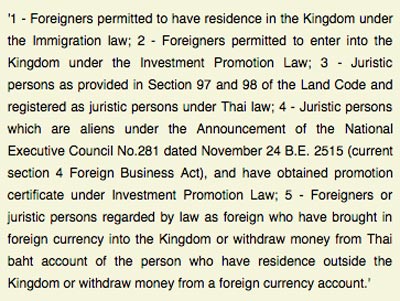

The reality is that most foreigners wouldn't qualify. Being retired in Thailand just isn't enough. See below for who qualifies:

Image Source: (Samui for Sale)

In Summary

The reality is, unless you're pretty wealthy, your estate probably won't meet the threshold for Thailand's inheritance tax.

There aren't that many foreigners naive enough to keep that much wealth in Thailand, anyway. But you may well have assets you want to make sure get passed to your wife or your kids, so making a will is a good idea.

The same goes for single people who've accumulated wealth in Thailand. You should make a will both back home and in Thailand to cover the event of your death.

Lastly, there's a number of foreigners living in Thailand who live in their wife's house, on their wife's land, drive their wife's car, and may even live off their wife's income.

If you fall into this category, then you should definitely speak to your wife about what will happen to her assets if she dies before you, because these will default to her family, in line with the statutory order of heirs outlined earlier in this post.

Getting Professional Advice

I am not an accountant, lawyer or financial advisor. This post simply represents my personal interpretation of the inheritance tax laws in Thailand.

Of course, I will make every effort to provide satisfactory responses to your inquiries in the comment section below, but it is important to note that handling IHT matters can be complex and require professional advice for a beneficial outcome.

If you find yourself uncertain about the best course of action for your tax affairs and investments, I strongly recommend consulting with a qualified professional. If you'd like, I can arrange for you to communicate with my IFA, who can offer expert guidance. If you want to get in touch, you can reach out to me via email or fill out this form.

PLEASE NOTE: If you're a UK National living in Thailand and want information about financial planning for UK inheritance tax, read this post here.

—————-

More Tips for Life Planning

Want to Start Leaning Thai?

Register a free account with Thaipod101. I use it and so do many of my readers.

Got Medical Insurance?

+ You should have. Get a quote on international cover here.

Need to send money to Thailand?

+ Go here to find out the cheapest way. Everyone is using this

Last Updated on

Sarah Petursson says

Many thanks

Sarah Petursson

Mar 14, 2019 at 12:25 pm

TheThailandLife says

Mar 14, 2019 at 6:14 pm

Diana says

Mar 12, 2019 at 12:09 pm

Bob says

Contact a few companies and find out a few recommendations from the various expat websites.

Yes, it takes that long in Thailand once the legal profession is involved. The Thais tend to just drain the bank accounts and job done.

Mar 12, 2019 at 7:28 pm

Kelvin Bamfield says

Under Thai Law you can submit to the court that you are old, sick, overseas, working and cannot come.

Also submit docs like your birth certificate, passport, pictures of you and the father, father mothers ID like their birth certificate, passport, etc. This is to prove your relationship with your father.

All these docs should be stamped by a Notary. Sometimes the court wants the docs legalised at the Embassy and Department of Foreign Affairs.

You also need to make a Power of Attorney (POA) to have a person in Thailand act on your behalf (Executor). This person goes to court to apply for a Grant of Probate.

You need a Lawyer as they make the submission to court and go to court with you or your proxy named in the POA. Also a translator is required.

I dont know of any lawyers on an hourly retainer.

Submission to get a court date runs approx 3 months, after court hearing and testimony by the Executor the Judge could take up to 30 days to give a court order to start work.

When the Executor has the court order and they are approved a period of 15 days is set aside for the Will, Executor to be challenged.

If no challenges ok. If challenges then back to court and more fees.

After the Executor is empowered by the court they then deal with challenges to the estate by creditors. During this time the Executor should advertise inviting anyone with a claim to come forward.

Normally 6 months from start to being able to liquidate the estate - clean out the bank accounts - sell properties, cars, give things away to charity.

Should Probate be straight forward it will cost around 2,000 to 2500 USD

This cannot be considered expensive and needs to be offset by costs you would incur should you fly to Thailand, rent hotel, taxi, translator, etc etc.

Maybe the Mods can give you my email?

Mar 13, 2019 at 9:37 am

TheThailandLife says

Mar 13, 2019 at 6:49 pm

Bob says

2. The translator is only required to translate the Will if no Thai version exists. This is not expensive.

3. I have only seen lawyers working on an hourly fee. If they don't, then on what basis are they charging for the work?

4. How much would a Thai family pay in the same circumstances? Among the hoi palloi there are very few who could afford that sort of expense to sort out transferring the farmland and pickup to the heirs. And mostly they do not seem to even write Wills, making the whole issue even more complicated.

5. To frame the expenses in terms of the cost of travelling does seem to put an unfair emphasis on "the Farang should pay more".

I have given my heir an ATM card and the PIN number and instructions to just drain the account.

Job done, and no 60,000 Baht fee plus six months messsing around.

Mar 13, 2019 at 8:42 pm

TheThailandLife says

Mar 13, 2019 at 9:03 pm

Bob says

I have been told it is a "common" Thai way.

There can only be an issue if somebody is around to complain and has a legal case.

If my rent is not paid then the landlord can simply chuck the stuff onto the street so he can rent out the property. I don't believe he has any responsibilty to look after it.

To charge 60,000 Baht and take six months to access a few hundred thousand Baht in a bank account is ludicrous.

My assets are mostly in Singapore.

The SG government issues clear guidelines in English how probate functions.

There is no dense fog of random "Thai Ways" to deal with....... And pay for.

Mar 13, 2019 at 9:42 pm

Kelvin Bamfield says

I have no time to debate points above.

All I can say is that I do this every day and it is up to the judge to accept the docs or ask for more docs. You will not know until you go to court. A recent case we had an old girlfriend make a claim in court to be an Executor based on her relationship of 10 years ago! So anything is possible.

I also deal with other countries and all have different requirements and taxes.

Thailand has 2 laws types - Civil and Criminal - there are variations in between and courts for hearings - ie Arbitration, Supreme, Appeal courts

Whatever you do, do it legally.

Make sure you have all the documents in place and make sure you have a good Executor and that they know where to find everything that you own, now and in the future.

Meaning a client died and the estate was wrapped up 2 years ago. His grandma died and left him a 25% share in a house.

Mar 14, 2019 at 9:16 am

Bob says

I realise that time is money and that you do not want to hand out free advice. However, I would very appreciate it if you could state on which basis a Thai lawyer charges.

Thanks.

Mar 14, 2019 at 7:32 pm

Kelvin Bamfield says

In many cases the family or Beneficiary for what ever reason may not want to come to Thailand to run the case and so what they save they may give to you as a bonus.

Lawyers here cant say so and so is charging x and we can do better than that and our price is Y.

In the early days we quoted a price but then realised we had to fly to the province and stay in hotels. This was explained to the clients as incidentals and not the lawyers fee. Everyone was OK with that.

I have had insurance co. call me and ask can we do a better price as the Travel Insurance is only X. Yes we can as this is perfect networking.

If you have a big case or a class action then of course you would go with the suits and they will charge you accordingly as they have overheads to cover.

Many of my clients are referrals as they say oh this guy is a foreigner and speaks English - After customer satisfaction they refer us on.

Most foreigners say why so cheap as they are used to paying 500 quid per hour or 500-1000 USD.

We own the buildings, cars, etc and so we can be very competitive as we only pay for utilities and staff, gas etc.

all the best

So far so good.

Mar 16, 2019 at 2:01 pm

leeanne rogers says

Dec 03, 2018 at 10:23 pm

Kelvin Bamfield says

Let me know

Dec 04, 2018 at 9:57 am

Henny says

Nov 29, 2018 at 7:48 am

Kelvin Bamfield says

Girl Friend - so not married and not under Sim Sot Lot laws of spouse - so she does not automatically get 50% - however as you are still married then you may have a claim.

Child - whos name is on the Birth Certificate? as this has some bearing.

Did your husband make a Last Will and Testament?

Many questions to ask -

Nov 30, 2018 at 9:08 am

Henny says

Dec 02, 2018 at 1:54 pm

Kelvin Bamfield says

In order to hold 100% you would have been in possession of a share transfer agreement whereby Thai's hold 51% by proxy. This is possibly how your husband sold one of the properties to the girlfriend

Legally you have a claim however you need to get some documents and bank accounts to prove you are the wife and share holder in the house and land.

If the only Will is the one from Scotland then you need to get this to see if its legal

After several years he may have made a Thai Will.

Thailand runs on documents and so if you want to pursue this you need to find these. The mods may give you my contact details and I can assist you in this

Dec 03, 2018 at 9:51 am

TheThailandLife says

Dec 03, 2018 at 6:47 pm

Henny says

Thank you so very much for the help.

Dec 04, 2018 at 10:19 am

TheThailandLife says

Dec 04, 2018 at 6:41 pm

Gemma says

Oct 25, 2018 at 4:17 pm

TheThailandLife says

Oct 25, 2018 at 5:01 pm

Kelvin Bamfield says

in any case try to convince him that he should make a Will as now its anyones guess as to what happens.

Oct 25, 2018 at 5:33 pm

Bob says

Indeed you have a moral obligation to help your brother carry out his wishes.

It is his money and he can do what he wants with it.

He plans on giving it to his wife, which sounds very reasonable. Why do you feel you have any entitlement to his estate?

Feb 17, 2019 at 12:00 pm

Becca56 says

Sep 04, 2018 at 5:30 am

TheThailandLife says

There are lawyers that will take this on for you and indeed ensure that you get your share of the house. However, I'm quite sure you will need to travel to Thailand, particularly if there is a court hearing.

Thai888 will hopefully confirm this if he reads this comment.

It is quite suspect that she cleared all the documents out of his house. That said, unless his wife had his ATM card and pin, or had a joint signatory account where both parties were able to withdraw money in branch, I can't see how she would have cleared out his bank account - so I wouldn't worry about that too much. And as the bank has rightly said you can't gain access without a court order.

Sep 04, 2018 at 4:16 pm

Kelvin Bamfield says

Sep 04, 2018 at 4:29 pm

Kelvin Bamfield says

Sep 04, 2018 at 4:24 pm

Art Colgain says

May 22, 2018 at 12:45 am

thai888 says

or at least Thai and English?

The POA is for a very specific event ie she maybe claiming insurance costs as most vehicles in Thailand have standard, 3rd part and comprehensive insurance.

If you sign the POA then make sure you know what it covers - it should not be open and if there is room there you should state that it is only for the insurance. Insurance normal top payout would be 200,000 to 300,000 baht.

You would need to supply a copy of your passport signed as well and on this passport copy you would sign and then write on it for brother "name" accident on "date" only

What are was the accident and where did it go to court?

I am based in Thailand for 20 years

May 23, 2018 at 2:59 pm

Jim says

I badly need help , my father died in Pattaya recently , I’m the only child my mum died years ago , I hired a lawyer over there as he left a will in Scotland with his lawyer , I am named as sole executor , this was thrown out of court as only one witness signature, found this out on arrival at the court , now I have to go back with

And give copies of grandparents and parents death certificates to obtain court order for funds in bank account, how will this prove I am the only child ?

May 01, 2018 at 7:23 pm

thai888 says

as the Will is void then you are not the Executor

As your dad died intestate then the assets or the estate goes to the siblings and that is you

There are ways to do this and proving who you are and your relationship to your father is a first step

In my experience it is possible to get your birth certificate, your mother and fathers BC and a possibly the grand parents to prove the family tree and where you are in it

These docs are not strong until you get them notarised and possibly legalised at the Thailand Embassy or Consulate in Scotland

Then of course the docs are in English and need to be translated for the courts here in Thailand

Maybe the mods can give you my email as there are some other questions like what is the size of the estate and bank accounts (not good on a public forum to disclose this)

Weigh up the estate and the costs to see if you want to go through with it

Look forward to your reply

May 02, 2018 at 4:31 pm

TheThailandLife says

May 02, 2018 at 5:03 pm

Marie says

May 03, 2018 at 10:13 am

Eric says

Mar 18, 2018 at 12:12 pm

Eric says

Mar 14, 2018 at 12:42 pm

TheThailandLife says

Mar 15, 2018 at 4:13 pm

thai888 says

Mar 19, 2018 at 10:04 am