If you've been lucky enough to amass over 100 million Baht (approximately $3M), then your estate will be unlucky enough to be caught in Thailand's inheritance tax threshold.

Few of us have managed to squeeze that much out of our stay in Thailand, but there's a lot more to think about than that.

What if your wife dies before you? Do you benefit from her estate?

And what of single guys / girls who hold assets such as condos and cars in Thailand, who gets their greedy paws on those when you buy your farm in the sky?

And what if you die without a will (intestate)?

The fact is, few people know where they stand on such matters, thus the need for this article.

In this post, I'll explore the ins and outs of Thai inheritance tax law, including what happens to your assets if you die in Thailand, and what you stand to inherit if your wife/husband dies before you.

Who Pays Inheritance Tax in Thailand?

Unless you're sitting on $3m of money earned in Thailand, then your assets won't be subject to IHT.

If you are, your heirs will pay 5 or 10 percent – depending on their relationship to you – on anything over that amount

The law states:

The inheritance tax is 5 per cent for ascendants or descendants and 10 per cent for others. It is levied on assets worth above Bt100 million.

IHT is levied on heirs who are either individuals or Thai juristic persons. It is also applied to non-Thai nationals who are resident in Thailand according to the immigration law, and non-Thais inheriting assets located in Thailand.

This means that your Thai wife, or full or half Thai child, will pay IHT on your estate if it meets the threshold.

But really, who has this kind of wealth in Thailand? you might ask.

Many more than people tend to think, actually.

Wealthy Thais are far wealthier than we might perceive, and as such the government expects to collect 3 Billion Baht per year at the 5 percent rate.

Gift / Personal Income Exemptions

Like most countries, to counter possible avoidance of inheritance tax, a gift tax was also introduced by way of amending the types of tax-exempt income in the Thai Revenue Code.

The types of income exempt from personal income tax include income derived from maintenance, income derived under moral obligation, inheritance, or a gift received in a ceremony or on other occasions in accordance with established custom.

The law will only exempt the following types of income from personal income tax:

The portion of inheritance income not exceeding 100 million Baht under Section 12 of the Inheritance Tax Act.

Income derived from the transfer of ownership or possessory right in an immovable property without consideration by the parent to a legitimate, non-adopted child, only for the portion not exceeding 20 million Baht per tax year.

Income derived from maintenance or a gift from ascendants, descendants or a spouse, only for the portion not exceeding 20 million Baht per tax year.

Income derived from maintenance under moral purposes, or a gift received in a ceremony or on occasions in accordance with custom and tradition from persons who are not ascendants, descendants or a spouse, only for the portion not exceeding 10 million Baht per tax year.

Income from gifts received for use for religious, educational or public purposes according to the rules and conditions under a ministerial regulation (yet to be issued).

Yes, I'm sure you can see how a bunch of rich folks will find loopholes here and pay diddly squat. At which point the threshold will no doubt be lowered to scoop up those on moderate incomes.

Thanks to Benjamas Kullakattimas, Head of Tax at KPMG Thailand, for providing the English interpretations of the above list.

What Happens to My Assets When I Die in Thailand?

Single guys and unmarried guys in relationships might wonder what will become of their condo and Honda Click should they bite the bullet. The hard and fast truth is, if you have assets in Thailand, you need to make a will.

You should have a will for both your assets in Thailand and any that you hold in your home country.

When you die in Thailand, a government officer requests a copy of a will either from the family or the lawyer of the deceased.

In short, the will filed in your home country will not cover any property in Thailand.

Failing to have a will could result in lengthy, costly probate.

Without a will in Thailand, these assets are the property of your Thai estate and would be subject to Thai inheritance tax, if they total over the 100 million Baht mark.

For the married, your assets are distributed according to Thai law, and this means that family members are given priority (see the next section).

If you should die with no will, and there is no family or said heirs, then the state has the right to take all your property and sell it as it sees fit. Gasp!

If you have accumulated assets in Thailand that you don't want to end up in the state's purse, then you really should consider making a will in your home country that includes these assets, so that your relatives are aware of what you have and who is heir to them.

You should also file a will in Thailand too.

In order to register a will in Thailand and have an executor appointed, you must go to a provincial court. The executor will then get the court’s authority to dispose of the person’s assets in accord with their will. Of course a Thai lawyer can arrange this for you.

+ Read: How to Make a Will in Thailand

Will I Inherit My Wife's Fortune?

If she leaves it to you in her will, then yes. But please do read below about land and property.

If your wife doesn't leave a will, you better get in line, because, see that list below, that's you at #7, at the bottom of the queue:

In Thailand there are 6 classes of statutory heirs and they are entitled to inherit in the following order:

- Descendants

- Parents

- Brothers and sisters of full blood

- Brothers and sisters of half blood

- Grandparents

- Uncles and aunts

- The surviving spouse is a statutory heir, subject to the special provisions of Section 1635 Civil and Commercial Code.

You wife might choose to leave you money, gold, or perhaps her car. But if you expect to inherit these things, you'd do well to encourage her to make a will that stipulates exactly what she wants to leave you, and for her to instruct her family of her wishes, so there is no dispute.

Family disputes are common in this regard.

If family members seize assets after a death, the process for a foreigner getting them back, even with the presence of a will, is a very difficult one.

This is certainly something you should think about if you have a child together, because no doubt you'll want your child to inherit your wife's assets.

Can I Inherit My Wife's Land?

Believe it or not, you can inherit your wife's land.

If she doesn't make a will that says otherwise, it will be passed to you. But there is a catch, and a pretty huge one at that:

You cannot register ownership of the land because you will not be given permission.

You must dispose of the land within a reasonable period (up to 1 year) to a Thai national.

If you fail to dispose of the land, the Director-General of the Land Department is authorized to dispose of the land and retain a fee of 5% of the sale price before any deductions or taxes.

Yes, you're probably thinking what I'm thinking: No one is going to give you a decent price for that land once word gets out that your wife has died and you need to offload the land within a year.

Oh, and by the way, if you're living in your wife's house, consider that Thai law sees a house as “always having an interest in the land”, so I'd pack your bags within a year before your mother-in-law kicks you out, hehe!

What About Inheriting My Wife's Condo?

It's almost the same as the deal with land:

A foreigner who acquires a condominium unit by inheritance, either as statutory heir or inheritor under will, shall acquire ownership, however, unless the foreigner qualifies for ownership under Section 19 of the Condominium Act, it is required by law that the foreigner shall dispose of the unit within 1 year from the date of acquisition.

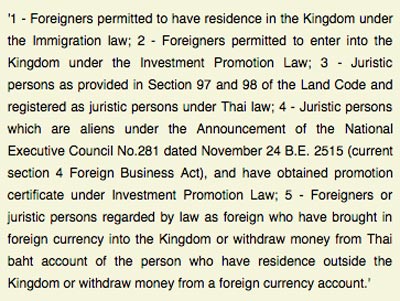

The reality is that most foreigners wouldn't qualify. Being retired in Thailand just isn't enough. See below for who qualifies:

Image Source: (Samui for Sale)

In Summary

The reality is, unless you're pretty wealthy, your estate probably won't meet the threshold for Thailand's inheritance tax.

There aren't that many foreigners naive enough to keep that much wealth in Thailand, anyway. But you may well have assets you want to make sure get passed to your wife or your kids, so making a will is a good idea.

The same goes for single people who've accumulated wealth in Thailand. You should make a will both back home and in Thailand to cover the event of your death.

Lastly, there's a number of foreigners living in Thailand who live in their wife's house, on their wife's land, drive their wife's car, and may even live off their wife's income.

If you fall into this category, then you should definitely speak to your wife about what will happen to her assets if she dies before you, because these will default to her family, in line with the statutory order of heirs outlined earlier in this post.

Getting Professional Advice

I am not an accountant, lawyer or financial advisor. This post simply represents my personal interpretation of the inheritance tax laws in Thailand.

Of course, I will make every effort to provide satisfactory responses to your inquiries in the comment section below, but it is important to note that handling IHT matters can be complex and require professional advice for a beneficial outcome.

If you find yourself uncertain about the best course of action for your tax affairs and investments, I strongly recommend consulting with a qualified professional. If you'd like, I can arrange for you to communicate with my IFA, who can offer expert guidance. If you want to get in touch, you can reach out to me via email or fill out this form.

PLEASE NOTE: If you're a UK National living in Thailand and want information about financial planning for UK inheritance tax, read this post here.

—————-

More Tips for Life Planning

Want to Start Leaning Thai?

Register a free account with Thaipod101. I use it and so do many of my readers.

Got Medical Insurance?

+ You should have. Get a quote on international cover here.

Need to send money to Thailand?

+ Go here to find out the cheapest way. Everyone is using this

Last Updated on

graham ewart johnson says

Jul 20, 2023 at 4:23 am

TheThailandLife says

Jul 20, 2023 at 5:26 pm

kelvin bamfield says

the land and house is hers

the child is not your biological daughter

you are domiciled abroad

should she die intestate or no Will then her family will get the assets

you can argue that it is your money and that you want 50% back however as the above is in her name this will not standup in court

getting co signatory on the account - you would need to be here and sign their form at the bank

This has trouble written all over it and should you want to protect your investment then act like a bank and make a mortgage to her - in that you are not giving money but loaning it to her and she has to pay it back . This will not happen as its a civil matter and will take years to judge if taken to court

I see your interests are for the child and so possibly put the money into a Foundation for her future - I hope this helps

Jul 21, 2023 at 10:18 am

Jerry says

Can anyone refer 1 or 2 good lawyers in BKK to deal with wills please.

Thanks in advance,

J

Apr 19, 2023 at 12:18 pm

TheThailandLife says

Apr 19, 2023 at 4:11 pm

kelvin bamfield says

You can contact Thai888 Law and they will email you a checklist - once all this info is made into your Will then this can be mailed back to you. The only thing that changes is that you need to give Thai888 Law the names, addresses, ID of 2 of your witnesses as they will be with you in Bangkok when you sign in front of them. A picture of you doing this also helps as later you may need to prove you were competent when you were signing the Will. If this is acceptable to you then contact Thai888 Law again

Apr 20, 2023 at 9:11 am

Jerry says

Not sure if the TheThailandlife allows you to put a laayer you had good experience wit in a post?

Thanks in advance

Jan 06, 2023 at 9:04 am

kelvin says

There are many barstool lawyers around who offer incredible free advice that they got from their mates. They mean well but are not factually accurate at all.

All I can say is that Thai888 Law has won the top awards for the last 2 years.

Why? Because we make it easier for people to look at what assets they have now, and what they may have in the future, and make it all into a booklet ready for the courts, should you pass away

When the Will goes to court the judge is a busy person and doesn't want to see gaping holes in the legal document. The last thing they want is someone coming out of the woodwork to contest a badly written will

Last week due to omissions in the Will the partner missed out on a few million baht, as the Will mentioned the partner gets the money in such and such a bank account and its corresponding account number. The rest of the estate goes to another beneficiary, and as luck would have it the bank account was dormant and so the beneficiary got nothing. Although the wishes of the person were there, the account had lapsed over the years and this couldn't be undone. However, the beneficiary did agree to give the partner 100k baht, about 5%

So its all in the wording and whether the assets are up to date. I have many good and bad stories and should write a book

I hope this helps, and if admin allows it you can contact me for a checklist on what is required.

Good luck.

Jan 06, 2023 at 5:29 pm

Jerry says

Two questions, in the US I can add a beneficiary to all bank accounts, upon my death the beneficiary is the legal owner. Using that method, there is no probate, and beneficiaries cannot be contested. It is a very efficient way to transfer assets. Does Thailand allow beneficiaries on bank accounts? If yes, which banks. Keep in mind the beneficiary has no legal ownership or access to the account while the owner is alive.

A note for expats, using this would not impact the funds needed for the retirement visa amounts is my understanding, since the beneficiary is not an owner while you are alive. Please correct me if I am wrong, maybe Thai laws are different.

Second question(s) is regarding condo ownership. Does Thailand have Transfer on Death deeds (TOD Deeds), works the same as a beneficiary on a bank account, only it is for real estate, such as a condo. Ownership transfers at death, and these normally need to be recorxed at the appropriate government office, which would be the land office I think. Second part of the real estate question, could I just add my gf or wife to the condo title at some point in the future and have the ownership pass onto her at my death? Or for that matter, just add any person to the title at some point and have the condo now belong to the other owner on title. How does Thai law address that issue?

Thanks in advance for any replies. Mostly likely others have the same questions.

Jerry

Apr 19, 2023 at 11:00 am

Kelvin says

in Thailand the banks require an and or signatory to the account ie its you and the GF either can sign as in and or either to sign - this is while you are alive - so you need the co signatory to go to the bank and sign on their POA

In some cases the banks will demand probate as has happened to me many times - if you have a Will that nominates the beneficiary then they can take the money out after you die however if they are not named it is a criminal offence - Wills and Probate are not expensive compared to other countries and so if you try to skim now it may cost more later on

Apr 22, 2023 at 11:24 am

Kelvin says

I probably go to court 2 times a week to sort out probate issues with foreigners and Thais and I can say that when i thought i had seen it all I have not.

The Will business is tricky and it is a civil matter - therefore the lower courts that hear probate issues are there to resolve disputes and there are many ways to contest the Will

If you look on the internet you should find Thai888 Law and i can guide you through the process

Good luck regards kelvin

Feb 05, 2023 at 1:04 pm

Kelvin says

If you make your Will properly there will be Beneficiaries and an Executor to manage you assets after you die. It is a very legal process where the Embassy Police Hospital next of kin, Police Land Office Banks etc are involved. You must as you own property and bank accounts MAKE A WILL

Feb 05, 2023 at 1:08 pm

kelvin bamfield says

Apr 20, 2023 at 9:15 am

Shelley says

Sorry to say that there will be a bunch of difficulties. I did a brief reasearch last summer as I was about to purchase a condo in Bangkok - needless to say, I decided against buying. True that under your will and Thai law, as well, your heirs will be your heirs - but when it comes to changing the name of your condo into their name , that's another story. As far as I could discern, they have the following choices (and, of course, seems like a probate has to be done , will or no will) : 1) sell the property within 12 -15 months ; 2) Should they fail to sell within that time frame, the govt. will sell it at whatever price they determine and keep 30% of the proceeds before giving your heirs their share of proceeds;or 3)Purchase the property from the estate by bringing in foreign currency - just like you did when you bought it . The value would be as determined by land department , of course. I wouldnt put my children through that. Thailand wants our money but they really dont want us settling down.

Feb 27, 2022 at 7:21 am

thai888 says

you are wrong in a number of areas, sorry to say. I do this work daily and have 2 companies to solve problems like this.

I am not drumming up business but I must intervene when the wrong advice is given.

For everyones benefit, I have 2 condos from a 5 year ago probate and they are still on record at the Land Office as they could not be sold. They are still not sold.

There are many ways to own the properties and the court system is fair.

Feb 28, 2022 at 9:49 am

Shelley says

As I said, I researched a lot and I am an attorney in the USA. I spoke to other lawyers in Bangkok , as well. However, I also added "from what I can DISCERN". You yourself responded to Jerry stating the condo has to be "sold in 12 months". Why not just tell us all the options clearly and transparently since you seem to be implying you are an expert? Clear the confusions without being vague.

Mar 01, 2022 at 3:19 am

Bob says

There are three "official" paths, as has already been pointed out.

1. Bring in forex and buy them from the estate.

2. Sell them to another buyer.

3. After a year they will be sold by the government, however this period can possibly be extended, depending on the official.

As this is Thailand, it might be possible to find a "fixer" to navigate around these issues for a fee. The issue being that there is never an absolute certainty when attemping to circumnavigate the law.

I've lived here for 22 years, and anything I buy I consider it simply an expense. Gone. But hope there will be something left.

I take this also to the 800k for the bank requirement to have a retirement pension. I now use an agent and he fixes it. My money remains firmly outside of the grasp of Thai officialdom and is invested in the stockmarket.

It don't believe this is even illegal, as the immigration officer who signs off the visa extension is using his "powers of discretion" to waive the requirement. I am not bribing him, all I do is pay an agent.

Mar 01, 2022 at 5:59 am

Shelley says

I completely agree with you - all of that is what my research found to be true, as well. Not all of us are brave enough to embark on some of the more questionable modes - for me just out of sheer respect of the law and getting caught doing something that I didnt realize (or chose not to realize) as being illegal or borderline illegal. That is perhaps because of my 35 years as an attorney and, hence,an officer of the court . But if you want to have property there or even keep wanting to extend your visa without having to go off to another country - you do what you have to do to make it easy for you in retirement - esp. if you love it there. I have chosen to rent when, and if, I go to visit my family when they happen to be staying in their homes there. I have found other better places to buy retirement homes in . Good Luck

Mar 02, 2022 at 5:32 am

thai888 says

Mar 01, 2022 at 8:34 am

Shelley says

As Bob and I mentioned - those are the 3 official ways that we know of . Including unofficial fixes which inculde "payiong" an agent to do the illegal, bribing, and equally on the shady border of things like creating holding companies etc. It's not your credentials - it's just you listing the options like some of us did. Simple request.

Mar 02, 2022 at 5:23 am

kelvin bamfield says

Mar 02, 2022 at 9:38 am

Shelley says

Your reference is what you say it is and doesnt help this forum unless you are seeking clients. All I am saying is that on this forum many of us have the same question about condo inheritence and possession by heirs after death of purchaser. Some of us have listed the legal ways that we found through research - as well as, the roundabout and complicated ( to me, at least) ways of forming shell companies, finding fixers, etc. You have responded by saying some of that info is wrong ( and contradicted yourself, too- if I may point that out with no offense intended). So could you kindly, at the risk of repeating myself, list the number of ways a condo can be dealt with by the heirs. That would easily clear up any confusions without you losing clients - as I am sure most in this condo situation are not lawyers and will not do anything without a lawyer. Your list would help utmost number of concerned folks on this forum. Thank you.

Mar 02, 2022 at 6:02 am

kelvin bamfield says

Mar 02, 2022 at 9:34 am

Kelvin says

Last week the Judge gave the UK property to the son and daughter, however the wizz bang UK 500 GBP per hour used old English and Latin in the UK Will and this confused the local court.

Example there are no trusts in Thailand and so no Trustees, however the English Will referred to the Trust as a holding Juristic Person of sorts and that the legatees would get the money in the bank. Problem was the money was in a Thai Bank and the Trustees were to administer this. Problem was that the Trustees names were not listed.

When I make a Will the actors are the person making the Will (Testator) , the Executor (Administrators) and the Beneficiaries (Legatees or Trustees) however the UK Will referred to these as the Trustees and so what is the Trust name? and the Beneficiaries as the heirs and the Trustees.

Thailand may refer to the under age children under the care of a Trustee however I refer to them as the controllers of property until the Beneficiaries reach legal age of 20 years and 1 day.

When in doubt check with me please. As we dont charge 500GBP per hour!!!!!!

Feb 07, 2023 at 4:06 pm

Jerry Douglas Jones says

Thank you for your insights.

Feb 25, 2022 at 10:45 am

Thai888 says

Feb 26, 2022 at 10:59 am

Joel says

Jan 25, 2022 at 10:44 am

kelvin bamfield says

ie - sorry to say, but what if you and you wife are killed in an accident and your daughter is the sole heir? she is underage and so a controller of property is needed

there are many issue with not having a Will - a Will covers those contingences - ie alternate Beneficiaries, alternate Executors (managers of the property)

what if you are in hospital on a respirator?

many things can happen and so having a Will is small insurance for the future - particularly now

Jan 26, 2022 at 9:50 am

Pep Goodwin says

Jan 11, 2022 at 5:48 am

TheThailandLife says

Jan 11, 2022 at 8:46 pm

kelvin bamfield says

once this is done you can go to step 2 - as there is no will he died intestate and the succession laws come into play ie family are the Beneficiaries

Step 3 is to decide if going to court is worth it based on step 1 ie assets, bank account etc.

The banks cannot freeze the bank account without a court order

I can be found at thai888.com

Jan 12, 2022 at 10:07 am

kelvin bamfield says

Thai888 Law

Jan 12, 2022 at 11:31 am

James Kyle says

I trust my Thai partner ( not wife) to manage this it not sure how to proceed. I have a current will in the UK where the beneficiaries are my 2 UK daughters but they have no need for this as they have comfortable lives . I am not talking about a lot of money but probably around 6m baht

Jan 30, 2022 at 5:14 pm

kelvin bamfield says

you can make a Last Will as you dont know how long you will live or what your assets will be in the future

In the Will you need to nominate a controller of property (COP) until your daughter reaches 20 years and 1 day

The Executor of the Will should be a bona fide person as trust is easily changed when 6 mill is on the table

The COP will pay from the estate the childs expenses and school

choose carefully

Jan 31, 2022 at 9:19 am