Sending money to Thailand from your home country, be it the US, Canada, Australia, or the UK, has been a pain point for just about every expat at one time or another.

But we all have to do it.

The scale of it is huge:

Each year, approximately 7 Billion USD is remitted to Thailand. Among the top sending countries are the USA, Germany, Australia, UK, and Sweden. (Source)

You can bet your bottom dollar a huge amount of that cashflow can be attributed to expats funding their Thai bank accounts, and of course sending money to Thai partners.

We all know banks are generally a rip-off when it comes to sending money, but hiding your money under a mattress isn't exactly a safe bet these days – not that it ever has been.

This sucks. They have us like a puppet on a string; free to slap on big fees and unfair exchange rates when we want to transfer money. When you sit back and think about it, it's the strangest thing: You are charged to withdraw your own money!

Okay, so you are abroad. You expect to pay a small fee, but not for the bank to make a big profit out of it – and believe me, they do.

There is a solution, though, and one myself and thousands of my readers have been using for the last 7 years. It's called Wise, and I'll review the service in a moment, and give you a code to get your first transfer free.

But first, let's look at how the way you're sending money to Thailand is hurting your pocket, how much it is costing you, and why this is happening.

Contents

4 Ways You Lose on Money Transfer to Thailand

1: The Bank Transfer Fee

The SWIFT (international transfer) fee can vary between £10-25 / $15-30, depending on your banking institution. If you engage in frequent transfers, let's say twice a month, this could accumulate to approximately £250 / $320 annually!

Even if you're a client of Bangkok Bank or Kasikorn Bank, both of which maintain overseas branches, including London and LA, evading the international transfer fee is impossible.

Take Bangkok Bank, for instance, which imposes a £20 fee for routing funds to your Thai bank account. Furthermore, you're subjected to an unfavorable exchange rate that means you lose even more money.

At this point, you're already experiencing significant financial losses, and the fees don't stop here. Keep reading.

2: The Receiving Fee

Following the payment of the international transfer fee, you'll encounter a corresponding charge from the receiving bank.

Most banks, such as Bangkok Bank, impose a maximum fee of 500 Baht to receive funds, although it typically amounts to the full 500 Baht, equating to an additional £10 / $16.

Now, you've already incurred two charges in the process of transferring your money, and this is before considering the currency conversion fee.

3: Currency Conversion Charge

Out of the three fees, this is the evil one.

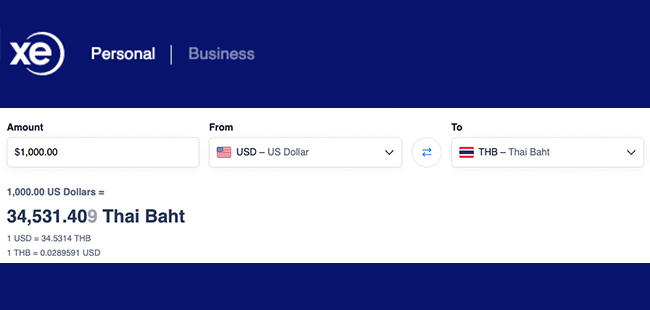

Many individuals assume they receive the mid-market transfer rate, the rate displayed on platforms like XE.com and similar websites. However, when you crunch the numbers, you quickly realize that you've been significantly shortchanged!

In the world's currency markets, traders define the rates at which they are willing to “buy” or “sell” a specific currency. The mid-market rate is simply the midpoint between demand and supply for a currency, and because of that, it changes all the time.

But that's as technical as you need to get. The most important thing to know is that the mid-market rate is considered the fairest exchange rate possible. The mid-market rate isn't a secret either. It's the rate you will find on independent sources such as Google, XE and Yahoo Finance.

Regrettably, you aren't provided with the authentic rate.

This tactic serves as a method to conceal the actual amount being levied. Most banks take the mid-market rate and impose an undisclosed margin, leaving you unaware of the extent of their overcharge.

By embedding the charge within the offered exchange rate, banks generate substantial profits at your cost, and you remain oblivious to the extent of the cost to your pocket.

See the image below for an example of how this works.

You can mitigate the loss to some extent by opting to send money in your home currency rather than Baht. However, a common mistake made by many sending money to Thailand is choosing to convert to Thai Baht at their source bank rather than at the Thai destination.

This results in an additional loss because your bank takes a substantial portion of cash at their own exchange rate, a rate they arbitrarily set, deviating from the “mid-market rate.”

While the Thai bank will still convert your currency to Thai Baht at an unfavorable rate, it's generally not as harsh on your pockets as the sending bank (your home bank).

4: Transfer Times

So, you've been hit on all fronts, and you're down at least $50-100.

You've borne the brunt of two transfer fees and a currency conversion charge.

Yet, even after multiple dips into your honeypot, the banks can't assure you that the money will be there within 24 or 48 hours.

It's a harsh reality.

In fact, sometimes it stretches to an agonizing 5-7 days!

This is 2024, not 1990. Given the digitized era we live in, the money should be transferred at lightning speed.

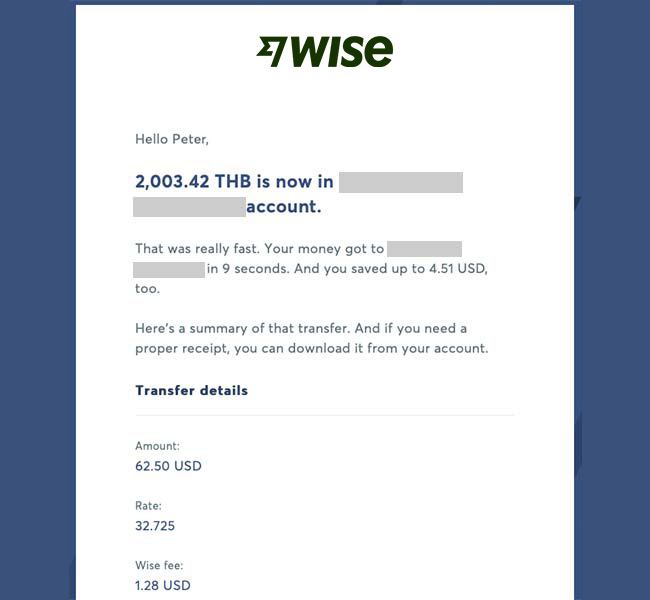

And it can be. The method I'm currently using not only sidesteps bank fees but ensures that a transfer can arrive in as little as 9 seconds!

Wise Review: Deep Dive

Sending money to Thailand is expensive, but what other option do you have except the bank?

You could carry money through customs, but then how often do you fly home to be able to do that?

To be honest, I hate carrying a ton of money around with me. It's just not safe.

Western Union is too expensive, but good if you need cash wired immediately.

PayPal steals 3.5% on a transfer and charges up to 4% currency conversion fees. Yes, I said up to 4%. It's 3% for the UK (where I'm from).

+ Enter Wise to Save You Money

Seriously, I waited years for this and, if you read the comments below, you'll see how chuffed others have been to find this service.

You can now transfer money to Thailand with ZERO bank charges, get the Mid-Market Rate currency conversion, and only pay a small fee, which is more than made up for on the overall cost savings.

Sending GBP to Thailand with Wise

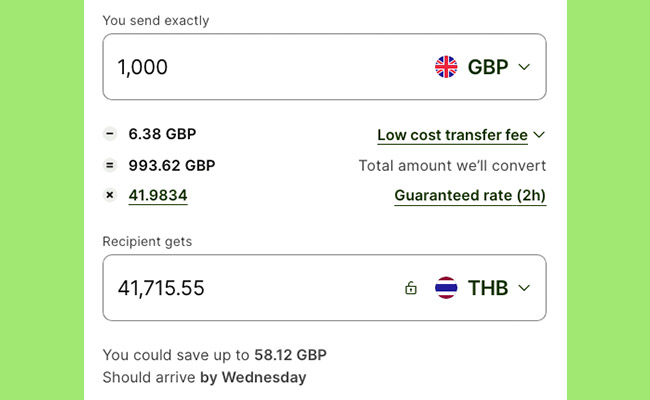

Have a look at this transaction where I saved over £58.

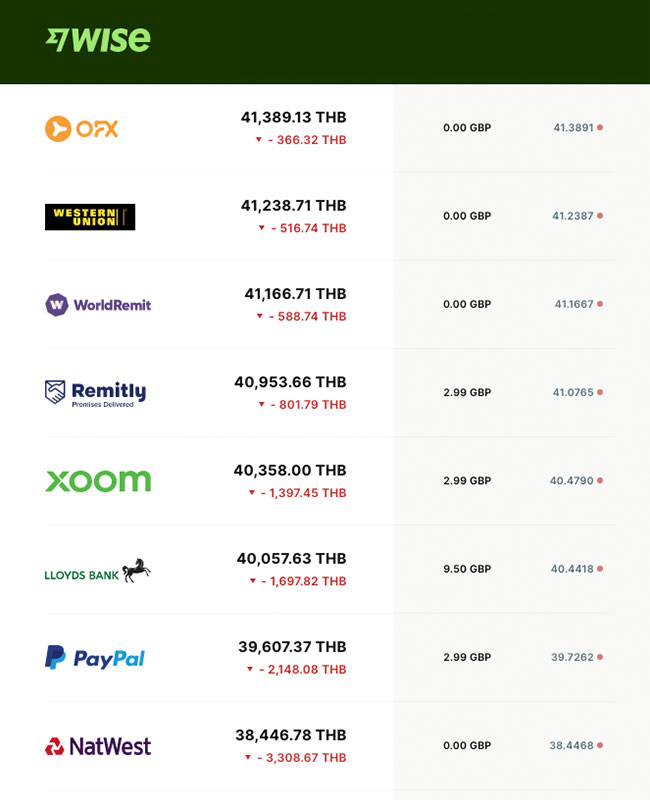

Here's a comparison of other money transfer services and banks at the exact same time. look at the bank transfer rates of four high-street banks. Wise beats them both, comfortably.

The exchange rate is lower and the fees higher than Wise.

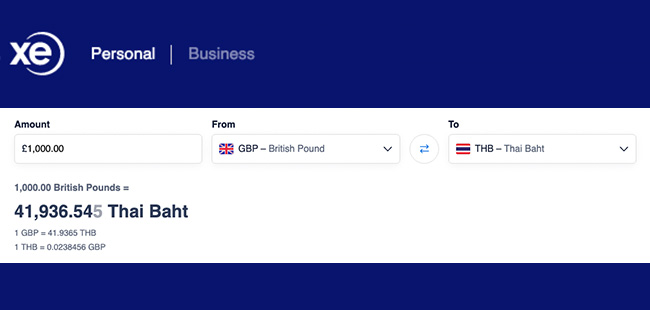

Now look at the market rate for the same time of day on XE.com.

Unbelievable, right? The overall Wise rate is actually slightly better!

So: not only did I get a better rate than my bank, I got a better rate than XE. com, which is the mid-market rate.

But that's not all: I only paid a £6.38 fee.

My bank (Nationwide) charges £20 for an international transfer. Plus I'd have to pay 500 Baht (£12 at the current exchange rate) to my receiving bank in Thailand.

So altogether, with the favorable exchange rate, I saved over £50 with Wise compared with a transfer from my home bank.

Sending USD to Thailand with Wise

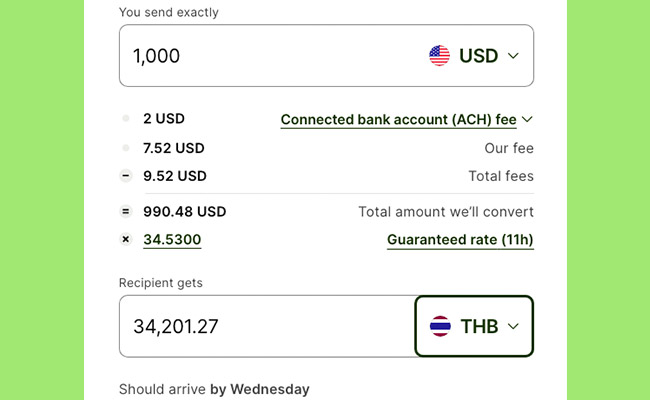

For my friends from the USA, here's how things size up in Dollars. I couldn't see competitor rates this time, probably because I was using my UK-based account.

This time the Wise rate is spot on with the Xe.com rate (below).

Usually the rate is the same or slightly better, but note that rates change by the second. The good news is that Wise locks in a rate for you for 2 hours. You can also check Reuters for comparison.

My Fastest Transfer: 9 Seconds to Receive My Money!

61% of Wise transfers are instant and completed in under 20 seconds.

This is really impressive. Just recently I sent some USD from Wise to an account in Thailand. The transaction time was 9 seconds.

That's insane!

Check out the screenshot below for proof.

Wise Sending Limits

With Wise you can send up to 2 million Thai Baht per transfer.

That's $55,000 ( USD), or £45,500 GBP at the exchange rate at the time of writing.

There is no limit on the number of transfers you can make.

However, unless you are sending to one of the following three banks, you’ll only be allowed to send up to 49,999 Thai Baht per transfer. Though again, there’s no limit on how many transfers you can make.

- Bangkok Bank Public Company

- Kasikorn Bank

- Siam Commercial Bank

For this reason, I always recommend opening a bank account with Bangkok Bank or Kasikorn Bank. These two banks in particular are “foreigner friendly”.

Get Your Free Wise Transfer

I was so over the moon with Wise that I popped off an email and asked if I could get more information on how they circumvent these fees so I could blog here about it (see below on how it works).

They wrote back and offered to give my readers a free transfer up to £1,000/$1,000.

Click that text link above to get the free transfer.

Remember: Banks could charge you up to 5% in hidden costs when sending money to any bank account abroad. Wise is up to 8x cheaper. It's only fair!

How Does Wise Make Sending Money to Thailand So Cheap?

Well, with investments from notable figures like Richard Branson, it seems like anything is possible.

Yet, the concept is quite ingenious.

Once you initiate the transfer, Wise actively searches for others conducting transfers to the same location, facilitating an effective currency swap.

Given the frequency of money transfers, there are usually several matches available, streamlining the process significantly.

My first ever transfer was completed within 24 hours, a notable 2-3 days faster than my bank. Subsequent transfers have been even speedier (as shown above).

In the comments section, there are readers who've received their money in Thailand within minutes, and some, like me, even within seconds. For larger amounts, the process may take a bit longer.

The mechanism operates by executing several individual conversions using market exchange rates that work to your advantage.

For a visual breakdown of how it works, check out this informative video

Quick Benefits Summary

Wise was established with a commitment to providing people with transparency, fairness, and better value in managing their money.

This principle resonates with the majority of us who have long awaited a service of this kind. For too long, banks have been able to overcharge for money transfers despite the digital nature of transactions—simply numbers changing in a system with no physical movement of cash.

Wise stands out as, on average, it is 7 times more cost-effective than traditional banks when sending, spending, or withdrawing money globally (though this can vary by country).

Here's a quick summary of the benefits:

- No home country bank fee.

- No receiving country bank fee.

- Access to the true Mid-Market rate for currency conversion, or even better!

- Capability to send up to 2 million Thai Baht per transaction.

- Rapid transfers, especially for amounts below 5k, taking approximately 24 hours.

- Once you become accustomed to the system, you can utilize the iOS or Android app for seamless transfers on the go.

+ Click here to get your first transfer free

Boy does it feel good to avoid those bank fees!

Frequently Asked Questions:

1. How do I send money with Wise?

Go to the website. Type in the amount you want to send. Then fill out your details to register.

Once registered, you just need your bank account details and the details of the bank you are sending to in Thailand. Then push the magic button!

2. What is the maximum amount I can send with Wise?

2 million THB in a single transaction.

However, due to regulatory changes in Thailand, from Jan 2022, transfers of 50,000 THB and above will only be available for Kasikorn Bank, Bangkok Bank, and Siam Commercial Bank recipients.

Transfers under 50,000 THB remain unaffected for all supported recipient banks.

3. How long will the transfer take?

Anywhere from 9 seconds to 24 hours. It's usually very fast. Generally speaking, larger transfers take longer. By large I mean over $5,000 (USD).

4. Do I need a Thai bank account?

Yes, because this where the money gets paid into. If you don't have a Thai bank account, perhaps your partner or close friend has and you can send the money to their account.

5. Is Wise like a bank account?

This is the money sending service side of Wise. But Wise does have a bank account facility that enables you to hold multiple currencies and spend that money internationally using a MasterCard. I have reviewed this service here.

6. Can I use this service to transfer my pension to Thailand?

Yes. Many expats are losing money by having their pension paid into their Thai bank account. They lose on the exchange rate and the receiving fee. You might be better off having your pension paid into your home bank account and then transferring it to your Thai bank account via Wise.

7. Will the transfer show up as an FTT, for visa extension purposes?

FTT is a code that indicates that the money transferred is a foreign money transfer. An FTT is what's required to fund a bank account that will be used for a retirement visa extension. For the funds to qualify the money must come from a foreign source and not a domestic one.

To achieve this, when asked in the Wise dashboard for the reason you are sending the funds, choose “Funds for long term stay in Thailand”.

8. How does Wise make money?

Wise charges a service fee for each transaction, but even when you factor this in you will still save a fair chunk of money.

9. Is Wise better than MoneyGram and other similar services?

Overall, yes. You can read through the reader comments below and see that at times people suggest other services but upon inspection they aren't cheaper than Wise, tend to be much slower on transfer, and collect more private data than is necessary.

10. Can I contact Wise with a question?

Yes, you can contact them by email or phone. The number is 020 3695 0999.

Last Updated on

peter lewis says

Jan 06, 2019 at 7:57 pm

James E says

Jan 08, 2019 at 12:45 am

MaxPower says

Apr 18, 2019 at 7:10 pm

James E says

Apr 18, 2019 at 10:28 pm

James E says

Apr 23, 2019 at 4:50 am

Max Power says

Sadly, it looks like TransferWise is either deceiving you, or they don't know what they're talking about. The MCC 4829 is flagged as "Money Orders - Wire Transfer." It's considered a "cash equivalent transaction" by most banks. The answer that TransferWise is "an electronic money company and" they "do not deal with cash at all" is a bit disingenuous. Just because it's not paper currency doesn't mean it's not money.

Of course, each bank is different. I've read a lot about this and it seems that some people manage to slip wire transfers, etc., under the radar and get them considered "purchases" for the purposes of fees/APR. But those seem to be the exception.

For more info, check this article out. It explains a bit better than I have: https://www.creditcardinsider.com/blog/can-you-buy-a-money-order-with-a-credit-card/

May 17, 2019 at 11:23 pm

James E says

May 18, 2019 at 1:56 am

Max Power says

The key here isn't whether there's actual physical currency changing hands in the purchase, it's whether or not what you're buying is a cash *equivalent.* For example, let's assume you're right and MCC 4829 "purchases" are handled by your credit card company as run-of-the-mill purchases. That means you'd be able to max out your credit card on things that are easily convertible back into cash and then pop that cash into your bank account. Weeks later, you'd spend that cash to pay your credit card bill (if you pay in full, no interest), and voila. You just got an interest free loan. If you're smart, you put the money in a nice interest-bearing account and you also racked up a ton of rewards points/miles. You only had to pay the money order fee or wire transfer fee.

You should read a few articles/blogs on "churning." It's basically people regularly applying for credit cards with sign-up rewards (e.g., get $500 if you spend $3,000 in the first 90 days), paying them off, and repeating the process. I'm hardly a pro (I dabbled a bit, but I only used the cards for purchases I'd otherwise have made anyway), but some people are really intense about it and have to find ways to artificially spend money (and then recover it). They've had to resort to things like buying gold coins, etc., in order to find the closest substitute for a cash-convertible purchase. That's because the overwhelming majority of credit card companies (it's on them, not the merchant) are going to code cash-equivalent transactions to prevent this kind of abuse. (Also, many merchants selling things like money orders aren't going to accept credit cards given the swipe fees they're stuck paying, which reduce or exceed whatever fee/spread they're charging the customer.)

The bottom line is that if cash-equivalent transactions are being considered purchases, I could quit my job right now and live off cycling through my ~$90,000 in available credit (and starting to open new accounts and churn) just like I've outlined above. Sadly, it just doesn't work that way.

May 22, 2019 at 12:52 pm

Max Power says

May 22, 2019 at 12:54 pm

James E says

May 22, 2019 at 11:11 pm

Lo Chan says

Sep 17, 2019 at 8:00 pm

Max says

You choose from Easy transfer or Low cost transfer. That's the only cost you pay. You don't normally pay anything to your bank back home because it will be domestic transfer,and there's no receiving cost in Thailand.

Sep 18, 2019 at 12:12 am

JPB says

Now TransferWise has started also a 'cash' debit card (visa) that you can load with the currency you want. I tried it last time I went to Thailand, loaded about 10,000 baht: exchange rate and fees are identical to the transfer ones, and then you can use the card in Thailand, in baht: no other fees etc... as long as you still have cash on it. It takes a few hours to load more baht on it if you want/need. The only trick you need to be careful is that as the card is from the country you are (UK for me), some outlets where you pay with your card, will automatically charge you in your national currency (GBP for me)... so careful and make sure that they charge in bahts.

Dec 01, 2018 at 11:58 pm

David Bonesteel says

TW beats them ALL.

Dec 02, 2018 at 7:09 pm

TheThailandLife says

Dec 03, 2018 at 1:38 am

JR says

Nov 29, 2018 at 9:58 pm

James E says

Anyway, until Transferwise gets its ducks lined up, this may be a cost-effective way of getting money out of Thailand.

Nov 25, 2018 at 11:46 pm

tom says

Nov 16, 2018 at 12:20 pm

TheThailandLife says

Nov 16, 2018 at 7:10 pm

Mary-Ann says

I have no UK a/c.

Nov 12, 2018 at 6:25 pm

JP says

Cashing in a cheque in foreign currency, anywhere in the world is a costly exercise.

Unless your bank has facility to open a foreign currency account, and you have a regular arrival of these cheques in foreign currency, you're bound to pay hefty charges.

HSBC in the UK is charging anything between 10 to 20£ for each transaction. The 'trick' is that, usually, it is per transaction, not per number of cheques. So if you receive a few cheques, wait to have enough before you send them to your bank.

Mar 19, 2019 at 12:50 am

Tony Evans says

The problem for me is that the transfer in my Thai bank book does not indicate it is an International transfer as is comes from Bangkok.

It is marked as a smart credit and I am not sure Immigration police will accept it as an International transfer. If not I may not be able to use this service.

Any others have this problem and is there a solution

Oct 24, 2018 at 12:45 pm

TheThailandLife says

Oct 24, 2018 at 4:32 pm

James E says

Oct 24, 2018 at 10:46 pm

TheThailandLife says

Oct 24, 2018 at 11:09 pm

Roman says

Oct 18, 2018 at 10:09 am

TheThailandLife says

Oct 18, 2018 at 5:44 pm

Paul says

Secondly if you have a flex plus Nationwide account you can transfer 150,000 Baht a day and the only charge is 200 baht charged by Thai bank with nothing charged by Nationwide. On top of this the average mid range price is only reduced by a maximum of 0.4 average.

Sep 19, 2018 at 4:15 pm

TheThailandLife says

Sep 19, 2018 at 6:06 pm

jerry says

pretty easy, i will continue to do so.

500 gbp to thai baht at the xe rate for a 4.90 gbp fee. next day arrival.

impressed.

Aug 27, 2018 at 12:03 pm

TheThailandLife says

Aug 28, 2018 at 1:45 am