Sending money to Thailand from your home country, be it the US, Canada, Australia, or the UK, has been a pain point for just about every expat at one time or another.

But we all have to do it.

The scale of it is huge:

Each year, approximately 7 Billion USD is remitted to Thailand. Among the top sending countries are the USA, Germany, Australia, UK, and Sweden. (Source)

You can bet your bottom dollar a huge amount of that cashflow can be attributed to expats funding their Thai bank accounts, and of course sending money to Thai partners.

We all know banks are generally a rip-off when it comes to sending money, but hiding your money under a mattress isn't exactly a safe bet these days – not that it ever has been.

This sucks. They have us like a puppet on a string; free to slap on big fees and unfair exchange rates when we want to transfer money. When you sit back and think about it, it's the strangest thing: You are charged to withdraw your own money!

Okay, so you are abroad. You expect to pay a small fee, but not for the bank to make a big profit out of it – and believe me, they do.

There is a solution, though, and one myself and thousands of my readers have been using for the last 7 years. It's called Wise, and I'll review the service in a moment, and give you a code to get your first transfer free.

But first, let's look at how the way you're sending money to Thailand is hurting your pocket, how much it is costing you, and why this is happening.

Contents

4 Ways You Lose on Money Transfer to Thailand

1: The Bank Transfer Fee

The SWIFT (international transfer) fee can vary between £10-25 / $15-30, depending on your banking institution. If you engage in frequent transfers, let's say twice a month, this could accumulate to approximately £250 / $320 annually!

Even if you're a client of Bangkok Bank or Kasikorn Bank, both of which maintain overseas branches, including London and LA, evading the international transfer fee is impossible.

Take Bangkok Bank, for instance, which imposes a £20 fee for routing funds to your Thai bank account. Furthermore, you're subjected to an unfavorable exchange rate that means you lose even more money.

At this point, you're already experiencing significant financial losses, and the fees don't stop here. Keep reading.

2: The Receiving Fee

Following the payment of the international transfer fee, you'll encounter a corresponding charge from the receiving bank.

Most banks, such as Bangkok Bank, impose a maximum fee of 500 Baht to receive funds, although it typically amounts to the full 500 Baht, equating to an additional £10 / $16.

Now, you've already incurred two charges in the process of transferring your money, and this is before considering the currency conversion fee.

3: Currency Conversion Charge

Out of the three fees, this is the evil one.

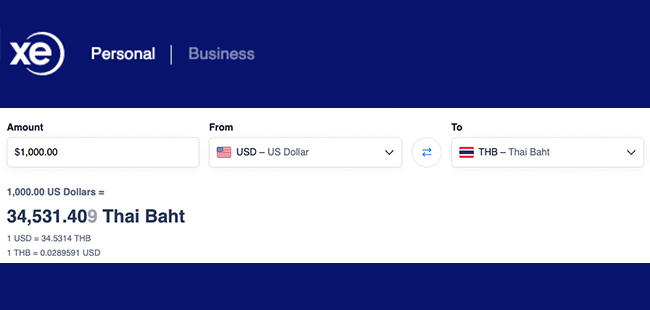

Many individuals assume they receive the mid-market transfer rate, the rate displayed on platforms like XE.com and similar websites. However, when you crunch the numbers, you quickly realize that you've been significantly shortchanged!

In the world's currency markets, traders define the rates at which they are willing to “buy” or “sell” a specific currency. The mid-market rate is simply the midpoint between demand and supply for a currency, and because of that, it changes all the time.

But that's as technical as you need to get. The most important thing to know is that the mid-market rate is considered the fairest exchange rate possible. The mid-market rate isn't a secret either. It's the rate you will find on independent sources such as Google, XE and Yahoo Finance.

Regrettably, you aren't provided with the authentic rate.

This tactic serves as a method to conceal the actual amount being levied. Most banks take the mid-market rate and impose an undisclosed margin, leaving you unaware of the extent of their overcharge.

By embedding the charge within the offered exchange rate, banks generate substantial profits at your cost, and you remain oblivious to the extent of the cost to your pocket.

See the image below for an example of how this works.

You can mitigate the loss to some extent by opting to send money in your home currency rather than Baht. However, a common mistake made by many sending money to Thailand is choosing to convert to Thai Baht at their source bank rather than at the Thai destination.

This results in an additional loss because your bank takes a substantial portion of cash at their own exchange rate, a rate they arbitrarily set, deviating from the “mid-market rate.”

While the Thai bank will still convert your currency to Thai Baht at an unfavorable rate, it's generally not as harsh on your pockets as the sending bank (your home bank).

4: Transfer Times

So, you've been hit on all fronts, and you're down at least $50-100.

You've borne the brunt of two transfer fees and a currency conversion charge.

Yet, even after multiple dips into your honeypot, the banks can't assure you that the money will be there within 24 or 48 hours.

It's a harsh reality.

In fact, sometimes it stretches to an agonizing 5-7 days!

This is 2024, not 1990. Given the digitized era we live in, the money should be transferred at lightning speed.

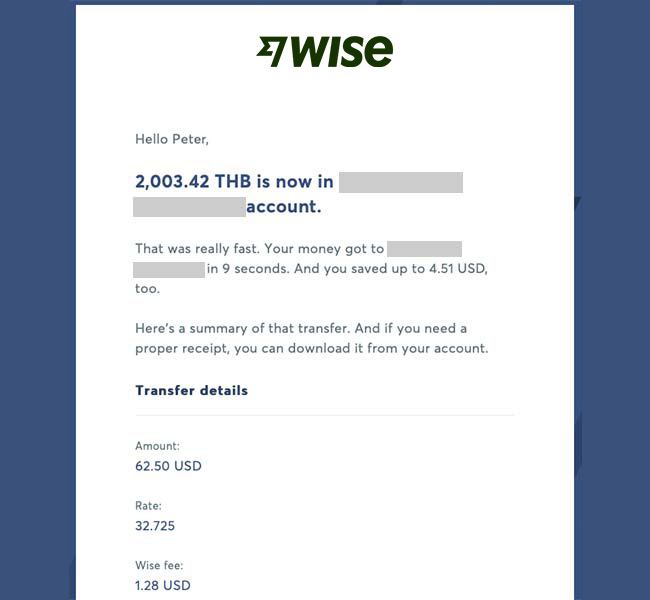

And it can be. The method I'm currently using not only sidesteps bank fees but ensures that a transfer can arrive in as little as 9 seconds!

Wise Review: Deep Dive

Sending money to Thailand is expensive, but what other option do you have except the bank?

You could carry money through customs, but then how often do you fly home to be able to do that?

To be honest, I hate carrying a ton of money around with me. It's just not safe.

Western Union is too expensive, but good if you need cash wired immediately.

PayPal steals 3.5% on a transfer and charges up to 4% currency conversion fees. Yes, I said up to 4%. It's 3% for the UK (where I'm from).

+ Enter Wise to Save You Money

Seriously, I waited years for this and, if you read the comments below, you'll see how chuffed others have been to find this service.

You can now transfer money to Thailand with ZERO bank charges, get the Mid-Market Rate currency conversion, and only pay a small fee, which is more than made up for on the overall cost savings.

Sending GBP to Thailand with Wise

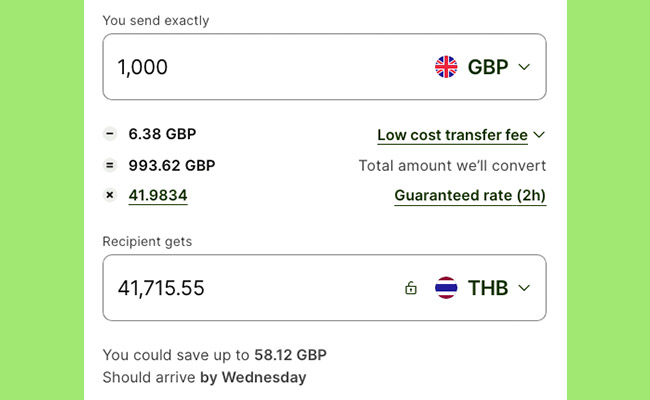

Have a look at this transaction where I saved over £58.

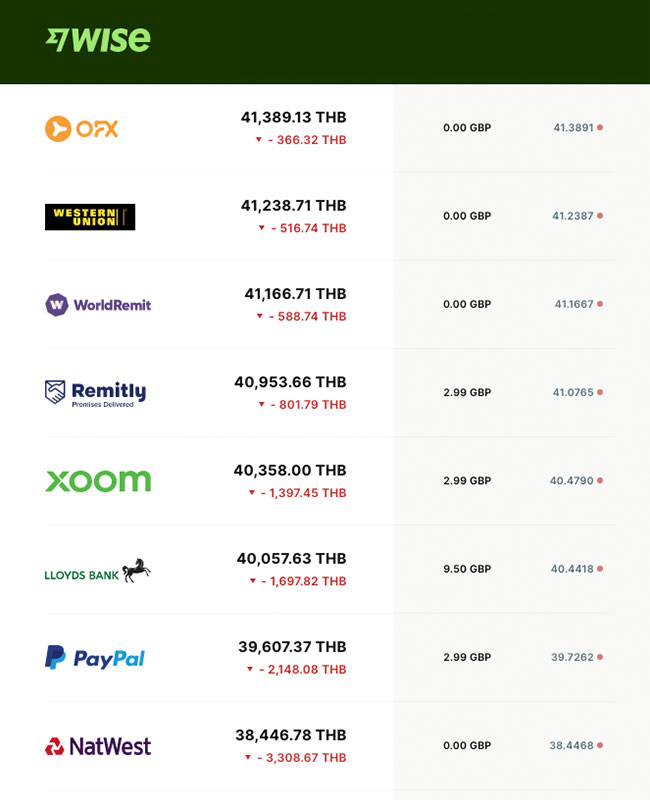

Here's a comparison of other money transfer services and banks at the exact same time. look at the bank transfer rates of four high-street banks. Wise beats them both, comfortably.

The exchange rate is lower and the fees higher than Wise.

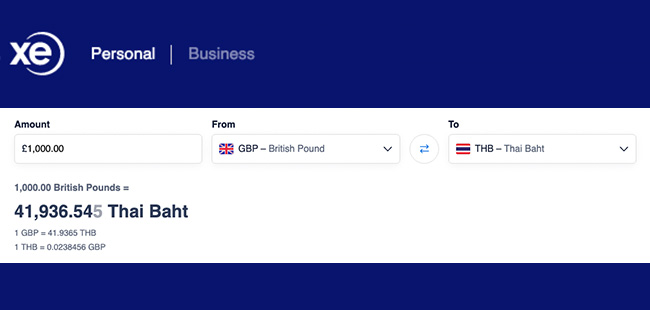

Now look at the market rate for the same time of day on XE.com.

Unbelievable, right? The overall Wise rate is actually slightly better!

So: not only did I get a better rate than my bank, I got a better rate than XE. com, which is the mid-market rate.

But that's not all: I only paid a £6.38 fee.

My bank (Nationwide) charges £20 for an international transfer. Plus I'd have to pay 500 Baht (£12 at the current exchange rate) to my receiving bank in Thailand.

So altogether, with the favorable exchange rate, I saved over £50 with Wise compared with a transfer from my home bank.

Sending USD to Thailand with Wise

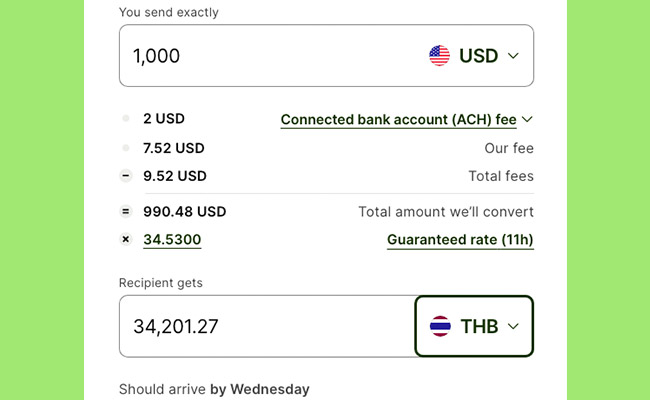

For my friends from the USA, here's how things size up in Dollars. I couldn't see competitor rates this time, probably because I was using my UK-based account.

This time the Wise rate is spot on with the Xe.com rate (below).

Usually the rate is the same or slightly better, but note that rates change by the second. The good news is that Wise locks in a rate for you for 2 hours. You can also check Reuters for comparison.

My Fastest Transfer: 9 Seconds to Receive My Money!

61% of Wise transfers are instant and completed in under 20 seconds.

This is really impressive. Just recently I sent some USD from Wise to an account in Thailand. The transaction time was 9 seconds.

That's insane!

Check out the screenshot below for proof.

Wise Sending Limits

With Wise you can send up to 2 million Thai Baht per transfer.

That's $55,000 ( USD), or £45,500 GBP at the exchange rate at the time of writing.

There is no limit on the number of transfers you can make.

However, unless you are sending to one of the following three banks, you’ll only be allowed to send up to 49,999 Thai Baht per transfer. Though again, there’s no limit on how many transfers you can make.

- Bangkok Bank Public Company

- Kasikorn Bank

- Siam Commercial Bank

For this reason, I always recommend opening a bank account with Bangkok Bank or Kasikorn Bank. These two banks in particular are “foreigner friendly”.

Get Your Free Wise Transfer

I was so over the moon with Wise that I popped off an email and asked if I could get more information on how they circumvent these fees so I could blog here about it (see below on how it works).

They wrote back and offered to give my readers a free transfer up to £1,000/$1,000.

Click that text link above to get the free transfer.

Remember: Banks could charge you up to 5% in hidden costs when sending money to any bank account abroad. Wise is up to 8x cheaper. It's only fair!

How Does Wise Make Sending Money to Thailand So Cheap?

Well, with investments from notable figures like Richard Branson, it seems like anything is possible.

Yet, the concept is quite ingenious.

Once you initiate the transfer, Wise actively searches for others conducting transfers to the same location, facilitating an effective currency swap.

Given the frequency of money transfers, there are usually several matches available, streamlining the process significantly.

My first ever transfer was completed within 24 hours, a notable 2-3 days faster than my bank. Subsequent transfers have been even speedier (as shown above).

In the comments section, there are readers who've received their money in Thailand within minutes, and some, like me, even within seconds. For larger amounts, the process may take a bit longer.

The mechanism operates by executing several individual conversions using market exchange rates that work to your advantage.

For a visual breakdown of how it works, check out this informative video

Quick Benefits Summary

Wise was established with a commitment to providing people with transparency, fairness, and better value in managing their money.

This principle resonates with the majority of us who have long awaited a service of this kind. For too long, banks have been able to overcharge for money transfers despite the digital nature of transactions—simply numbers changing in a system with no physical movement of cash.

Wise stands out as, on average, it is 7 times more cost-effective than traditional banks when sending, spending, or withdrawing money globally (though this can vary by country).

Here's a quick summary of the benefits:

- No home country bank fee.

- No receiving country bank fee.

- Access to the true Mid-Market rate for currency conversion, or even better!

- Capability to send up to 2 million Thai Baht per transaction.

- Rapid transfers, especially for amounts below 5k, taking approximately 24 hours.

- Once you become accustomed to the system, you can utilize the iOS or Android app for seamless transfers on the go.

+ Click here to get your first transfer free

Boy does it feel good to avoid those bank fees!

Frequently Asked Questions:

1. How do I send money with Wise?

Go to the website. Type in the amount you want to send. Then fill out your details to register.

Once registered, you just need your bank account details and the details of the bank you are sending to in Thailand. Then push the magic button!

2. What is the maximum amount I can send with Wise?

2 million THB in a single transaction.

However, due to regulatory changes in Thailand, from Jan 2022, transfers of 50,000 THB and above will only be available for Kasikorn Bank, Bangkok Bank, and Siam Commercial Bank recipients.

Transfers under 50,000 THB remain unaffected for all supported recipient banks.

3. How long will the transfer take?

Anywhere from 9 seconds to 24 hours. It's usually very fast. Generally speaking, larger transfers take longer. By large I mean over $5,000 (USD).

4. Do I need a Thai bank account?

Yes, because this where the money gets paid into. If you don't have a Thai bank account, perhaps your partner or close friend has and you can send the money to their account.

5. Is Wise like a bank account?

This is the money sending service side of Wise. But Wise does have a bank account facility that enables you to hold multiple currencies and spend that money internationally using a MasterCard. I have reviewed this service here.

6. Can I use this service to transfer my pension to Thailand?

Yes. Many expats are losing money by having their pension paid into their Thai bank account. They lose on the exchange rate and the receiving fee. You might be better off having your pension paid into your home bank account and then transferring it to your Thai bank account via Wise.

7. Will the transfer show up as an FTT, for visa extension purposes?

FTT is a code that indicates that the money transferred is a foreign money transfer. An FTT is what's required to fund a bank account that will be used for a retirement visa extension. For the funds to qualify the money must come from a foreign source and not a domestic one.

To achieve this, when asked in the Wise dashboard for the reason you are sending the funds, choose “Funds for long term stay in Thailand”.

8. How does Wise make money?

Wise charges a service fee for each transaction, but even when you factor this in you will still save a fair chunk of money.

9. Is Wise better than MoneyGram and other similar services?

Overall, yes. You can read through the reader comments below and see that at times people suggest other services but upon inspection they aren't cheaper than Wise, tend to be much slower on transfer, and collect more private data than is necessary.

10. Can I contact Wise with a question?

Yes, you can contact them by email or phone. The number is 020 3695 0999.

Last Updated on

Earl says

Nov 05, 2023 at 9:26 am

JamesE says

Nov 05, 2023 at 2:48 pm

Max says

Nov 05, 2023 at 3:15 pm

John says

I saw you mentioned you had a receiving fee of THB 500. I have 200 in Bangkok bank.

You also mentioned contacting Wise thru email. My experience is not that it is bad, it is non existent and likewise if you send a complaint. But for transfer it is the best.

Oct 28, 2023 at 8:12 pm

TheThailandLife says

Oct 28, 2023 at 10:54 pm

Max says

Oct 28, 2023 at 11:01 pm

Winston says

Hello WINSTON HECTOR,

Your transfer of 500 AUD to XXXXX was sent back to us.

There was a problem with the bank details we had for XXXXXXX. Because of that, your money was sent back to us.

To fix your transfer, you can either:

*Change your recipient’s bank details and send your money to them again. Before you do, please check that you’ve got their details right. If your money gets sent back to us a second time, we’ll need to give you a refund.

*Cancel your transfer and get a refund.

Oct 29, 2023 at 11:53 am

Max says

Oct 29, 2023 at 10:17 pm

Winston says

Oct 30, 2023 at 5:18 pm

Max says

Oct 30, 2023 at 5:49 pm

Bruce says

Jun 09, 2023 at 11:53 pm

Max says

Jun 12, 2023 at 9:49 am

Bruce Fielding says

Jun 12, 2023 at 11:34 pm

Max says

Jun 13, 2023 at 7:04 pm

Matt says

Jul 28, 2023 at 2:16 pm

JamesE says

May 07, 2023 at 10:35 pm

Rick Stenson says

Apr 29, 2023 at 3:08 am

jamesP says

Apr 30, 2023 at 8:10 pm

Rick says

May 02, 2023 at 1:10 am

Max says

May 02, 2023 at 4:34 pm

Rick says

May 03, 2023 at 12:57 am

Max says

May 03, 2023 at 7:42 am

Rick says

May 04, 2023 at 12:11 am

TheThailandLife says

May 04, 2023 at 5:55 pm

Max says

May 04, 2023 at 6:09 pm

TheThailandLife says

May 04, 2023 at 6:25 pm

Winston says

May 05, 2023 at 7:52 am

Max says

May 08, 2023 at 6:21 pm

TheThailandLife says

May 08, 2023 at 6:39 pm

Max says

Start with a 90 days Non-immigrant O visa and then extend the stay in Thailand annually at the local immigration office. No health insurance is needed in Thailand, just for the first 90 days.

May 04, 2023 at 6:17 pm

Richard H Stenson says

Jun 12, 2023 at 10:57 am

Max says

Jun 12, 2023 at 3:48 pm

Max says

Jun 12, 2023 at 4:19 pm

Joe Tanory says

Jul 27, 2023 at 5:24 am

Johnie Crocker says

I'm from the USA and here on a Visa oa in Samut Prakan

Any suggestions.

May 02, 2023 at 7:01 pm

Peter says

I am not American and never been to the USA but get asked by Thai banks repeatedly if I am.

I assume that the extra paperwork required by Thai banks for US citizens does make it worthwhile for them.

May 03, 2023 at 4:38 am

Max says

May 03, 2023 at 7:46 am

JamesE says

May 03, 2023 at 9:49 pm

Max says

May 03, 2023 at 10:44 pm

JamesE says

May 04, 2023 at 1:48 am

Johnie D Crocker SR says

Jun 12, 2023 at 5:03 pm

Max says

Jun 12, 2023 at 5:14 pm

Rick Stenson says

Jul 29, 2023 at 12:39 am

Max says

Jul 29, 2023 at 7:19 am

Max says

Thai immigration has nothing to do with decisions made by the US Embassy. From June 23 it doesn't issue the Affidavit of Residence,but that's not immigrations problem nor concern. Do you really think that they will change official requirements because of US citizens having problems with opening bank accounts? Blame the US government. Most banks in Thailand don't officially allow foreigners to open savings accounts,and that's their prerogative. Many Bangkok Bank branches in tourist areas still accepts the Residence Certificate from Immigration. You need a permanent address,(not a hotel) and it's a plus if you have a long term visa (permission of stay). You also need a Thai phone number and an email-address when applying for the account. I don't know where in Thailand you're going to stay,but there are many bank branches.

Jul 29, 2023 at 12:47 pm

JamesE says

Apr 30, 2023 at 10:00 pm

Rick says

May 02, 2023 at 1:06 am

Max says

May 03, 2023 at 10:51 am

JamesE says

May 03, 2023 at 9:57 pm

Max says

May 03, 2023 at 10:14 pm

JamesE says

May 03, 2023 at 10:27 pm

Max says

May 03, 2023 at 10:51 pm

Max says

https://pcec.club/Non-Immigrant-O-A

May 04, 2023 at 12:17 am

JamesE says

May 04, 2023 at 10:04 pm

Rick Stenson says

Jul 29, 2023 at 12:45 am

Johnie says

when you get to Thailand, you will need to get a certificate of residency from immigration. you will need your rent contract and landlord's information to get the certificate. if living free with friend, they have to bring their ownership papers or rental agreement and copies of their Thai citizen card and attest that you live with them. don't loose your airport declaration of import paper. also make sure that immigration officer at the airport puts the date stamp in your passport. Bangkok Bank is picky about those papers. other banks I don't know so much about. they wouldn't even talk to me, as I'm American and they have to guarantee my money is safe from what I understand. I just went with Bangkok Bank to resolve that issue.

Oct 30, 2023 at 6:23 am

Max says

Oct 30, 2023 at 6:03 pm

JamesE says

Oct 30, 2023 at 10:24 pm

Winston says

Feb 27, 2023 at 7:14 am

TheThailandLife says

Feb 27, 2023 at 4:43 pm

Winston says

Feb 28, 2023 at 10:10 pm

Max says

Feb 28, 2023 at 10:44 pm

Winston says

Feb 28, 2023 at 10:56 pm

Max says

Feb 27, 2023 at 4:54 pm

Winston says

Feb 28, 2023 at 10:15 pm

Max says

It's much easier because your bank won't be involved in the transfer. You just transfer money to Wise's local account in Canada. Your money will show up in your Balance account. When you transfer money,you just chose the Balance option. I'm 100% sure you won't have any delays because your money is like half way to Thailand. The total fee should also go down a bit. If domestic transfers are free in Canada then the only fee you'll pay is the fee to Wise.

Mar 01, 2023 at 6:21 pm

Max says

You have to apply at home for the O-A and have the required amount of money in a bank-account back home.

When going for an extension based on retirement (not a visa) at the local immigration office, you should start with applying for the 90 days Non-immigrant O visa at home. Then you have 30 days in Thailand to open a bank account and transfer the money. The easiest way to open a savings account at Bangkok Bank is to apply for a Residence Certificate at the local immigration office,but you must have an address other than a hotel OR get the equivalent to the Residence Certificate from your embassy in BKK. And, showing a proper address.

Apr 30, 2023 at 2:34 pm

sidney leonard says

We have decided that the best option for us for sending funds from our Bangkok Bank joint savings account to our checking account at Bank of America in the U.S. (until it will be possible to do so via WISE) is to wire same directly via SWIFT; I was pleased to read on Bangkok Bank's website that using this option there is “No need to apply for the service in advance or submit any supporting documents. You can make a transfer by yourself online.” - Do you find this to be the case?

Regarding the financial requirement for obtaining, annually, my visa extension: My wife and I have been transferring funds, via Wise, into our Bangkok Bank joint account (opened in 2017) over the last 3 years and now have a balance in that account of >฿M.

I have been assured by several expats that the least complicated option is the ฿400K in a personal bank account for a minimum of 2 months before applying for a visa extension, and that I can open such an account and transfer the required funds into it from our existing Bangkok Bank joint savings account without any requirement as to where the funds came from. Do you concur?

An aside: Does Bangkok Bank offer a fee-free credit card which can be used to purchase (in baht) and pay the balance each month via debiting our savings account?

I thank all respondents for your time and generous sharing of your experience and knowledge.

Feb 15, 2023 at 3:44 am

JamesE says

Bangkok Bank has a credit card or several, but as a foreigner they are very difficult to come by. Your wife may have better luck. However, you can do everything you need with mobile banking in most stores (from the tiniest to the largest) using a direct payment with your phone. Unless you can get a points/cashback card of some type, that's the way to go.

Good luck with your relocation!

Feb 15, 2023 at 6:59 am

Max says

You can do international transfers using Bangkok Banks Mobile banking app. Bangkok Bank has the rights to ask for supporting documents.

2)

A joint account in Thailand is not accepted at immigration. The two of you must have an account each. So,฿400k each, 2 months prior to the day you apply for the 1 year extension if you're going for the "based on marriage" method. Saying that this option is the easiest is not true,but you need less money in the bank. Officially, immigration requires the transfers to your Thai bank account to be foreign.

3)

You will get a debit card connected to your account, not a credit card. It's not free,the annual fee is about ฿250-300. Every purchase and ATM withdrawal is deducted from your account in real time.

Feb 15, 2023 at 10:10 am

Max says

When married to a Thai in Thailand it's a walk in the park to get the required marriage certificate for immigration. But, you are both foreigners and that makes it much more complicated. You need your marriage certificate from back home to be certified at the US embassy in BKK, translated and then certified by authorities in Bkk. This is non-negotiable at immigration and it can be a hassle. It might take a couple of days.

Feb 15, 2023 at 10:39 am

sidney leonard says

I believe you are saying that we can use our Bangkok Bank debit card when making purchases and that payment will automatically be debited to our account. Here in the U.S. the use of a debit card for purchases is much less secure than using a credit card for same, as credit card companies replace losses resulting from fraudulent use with much less complication than banks for fraudulent use of a debit card. Also, I have been told that it will be easier for my wife, a Thai national, to obtain a credit card than for me; do you agree?

Again, thanks for your generous attention to my inquiries.

Feb 16, 2023 at 6:07 am

TheThailandLife says

Feb 16, 2023 at 5:31 pm

Max says

Feb 16, 2023 at 6:25 pm

TheThailandLife says

Feb 16, 2023 at 6:29 pm

JamesE says

Feb 16, 2023 at 8:01 pm

sidney leonard says

Feb 19, 2023 at 1:45 am

JamesE says

The other system is mBanking which is what the banks got together and set up. It does require a bank account and you get it as soon as you set up your account for mobile - different than online - access. This gets you your QR code and links your account number and phone to the system. This is what I use 99% of the time. It allows you to send/pay for things by scanning someone’s QR code (most common when face to face) or entering their phone or account numbers when you don’t have access to their QR code.

As far as the 3rd party apps go, the only one I use is Line. Others exist, True Money, Rabbit, eg., but just don’t make sense when mBanking is so easy. The reason I use Line is the BTS. You can link your Rabbit card (ironic, isn’t it) to your Line wallet and earn Rabbit Rewards which gives you free BTS rides. The others have some kind of rewards, too, but nothing that I use. You can also use them to pay for stuff but not as universally as mBanking.

Feb 19, 2023 at 6:13 am

Max says

Feb 19, 2023 at 10:12 am

PeteBKK says

Mar 22, 2023 at 9:46 pm

Max Fredriksson says

I strongly doubt that. If you buy foreign currency (bank notes) at a bank in Thailand, you'll have to pay the banks Selling-rate which isn't that good,compared to the TT Buy-rate you'll get from an ATM abroad.

Mar 22, 2023 at 10:27 pm

PeteBKK says

Mar 23, 2023 at 10:13 pm

Winston says

Mar 24, 2023 at 11:46 am

sidney leonard says

First, I apologize if I have posted this concern on the wrong site. I was unable to find a more suitable one; in fact, I don't think I have ever seen this matter discussed previously anywhere on TheThailandLife.

As my wife and I prepare for our move to Thailand, I believe we have our financial “ducks in order” vis-a-vis bank accounts in both US and Bangkok (using WISE for transferring funds), financial requirements for visa extension, etc. However, as recipients of US Social Security, with our benefits being directly deposited into our US account, we will be required to inform Social Security, yearly, of our continued eligibility to continue to receive benefits (i.e., still alive) by returning to them the FOREIGN ENFORCEMENT QUESTIONNAIRE (SSA-7162) which will be mailed to us yearly.

As I have seen on other Thailand forums that many US expats have experienced great frustration in fulfilling this S.S. requirement, especially in the matter of returning said questionnaire to S.S. (e.g., long delay in receiving questionnaire, lost in mail, poor assistance from S.S. FBU in Manila and US, etc. - there doesn't seem to be a problem with the Thailand mail system), I would greatly appreciate any experience regarding this matter from those US expats who are receiving S.S. Benefits, particularly what others have found to be their solution to getting the questionnaire received without delay at the designated processing center in the US. indicated on the return envelope provided by S.S.

My thanks to all who respond.

Dec 10, 2022 at 6:02 am

JamesE says

First, are you giving up your address and US phone number? Assuming you're keeping both and monitoring same then you really don't need to fill out the questionnaire as you have valid US contact information. Second, if you are giving up same (maybe to save on the Part B Medicare Premium?) it's possible to return the form by DHL/FedEx to wherever you want and you'll have a delivery receipt. It might be pricier than Thai Post but you'll know it got there.

Dec 12, 2022 at 4:01 am

sidney leonard says

Dec 12, 2022 at 7:11 am

JamesP says

You mentioned; “…since our Medicare cannot be used in Thailand we will cancel same.” Are you referring to only Medicare Part B, or both A&B? Since part A costs you nothing, may as well keep it, just in case. Look at the “panic” in the retirement community in Indonesia. You never know what’s coming down the line. Best to hang onto the options you have, especially when they cost you nothing.

You also mention; “…as recipients of US Social Security, with our benefits being directly deposited into our US account…”

You probably already know, but since you mention “…we will not be returning the US…”. You can have your SS payments direct-deposited into your Thailand bank account and cut out the need to do the ‘Wise’ transfers.

Dec 12, 2022 at 7:46 pm

Max says

Dec 13, 2022 at 7:19 pm

JamesP says

Another option is having SS direct deposited to a U.S. bank, and then just doing an over-the-counter withdrawal at your Thai bank. Some U.S. banks have no-international-fee debit cards, so you can just do a “cash advance” at the current MasterCard or Visa rate over the counter and avoid the Wise fees. Depending on the Thai bank there may or may not be a fee of around 200 Baht. As an example, I just looked at the MC exchange rate and it was 34.8578. Wise was 34.6200 plus fees.

Another option is to use a Charles Schwab account and just do ATM withdrawals with your Schwab ATM card. Schwab reimburses all ATM fees.

Personally, I prefer to avoid going into my bank, so I mostly use Wise and my Charles Schwab ATM card.

These are all just options. Always good to have options. :-)

Dec 13, 2022 at 8:44 pm

Max says

Dec 13, 2022 at 10:23 pm

JamesP says

Dec 13, 2022 at 10:38 pm

JamesE says

Dec 13, 2022 at 11:25 pm

Simon says

I have a question the other way around: if one decides to leave Thailand and return home (say, to the UK) for good, how easy is it to transfer the THB800,000 (the current figure, I believe) held in a Thai Bank as part of one's retirement visa requirement back to a UK bank?

Thank you in advance for any help on this.

Dec 04, 2022 at 6:23 pm

JamesE says

Dec 05, 2022 at 3:07 am

TheThailandLife says

Dec 05, 2022 at 4:48 am

Simon says

Thanks very much.

Dec 05, 2022 at 4:40 pm

Tim says

Nov 29, 2022 at 6:13 pm