Sending money to Thailand from your home country, be it the US, Canada, Australia, or the UK, has been a pain point for just about every expat at one time or another.

But we all have to do it.

The scale of it is huge:

Each year, approximately 7 Billion USD is remitted to Thailand. Among the top sending countries are the USA, Germany, Australia, UK, and Sweden. (Source)

You can bet your bottom dollar a huge amount of that cashflow can be attributed to expats funding their Thai bank accounts, and of course sending money to Thai partners.

We all know banks are generally a rip-off when it comes to sending money, but hiding your money under a mattress isn't exactly a safe bet these days – not that it ever has been.

This sucks. They have us like a puppet on a string; free to slap on big fees and unfair exchange rates when we want to transfer money. When you sit back and think about it, it's the strangest thing: You are charged to withdraw your own money!

Okay, so you are abroad. You expect to pay a small fee, but not for the bank to make a big profit out of it – and believe me, they do.

There is a solution, though, and one myself and thousands of my readers have been using for the last 7 years. It's called Wise, and I'll review the service in a moment, and give you a code to get your first transfer free.

But first, let's look at how the way you're sending money to Thailand is hurting your pocket, how much it is costing you, and why this is happening.

Contents

4 Ways You Lose on Money Transfer to Thailand

1: The Bank Transfer Fee

The SWIFT (international transfer) fee can vary between £10-25 / $15-30, depending on your banking institution. If you engage in frequent transfers, let's say twice a month, this could accumulate to approximately £250 / $320 annually!

Even if you're a client of Bangkok Bank or Kasikorn Bank, both of which maintain overseas branches, including London and LA, evading the international transfer fee is impossible.

Take Bangkok Bank, for instance, which imposes a £20 fee for routing funds to your Thai bank account. Furthermore, you're subjected to an unfavorable exchange rate that means you lose even more money.

At this point, you're already experiencing significant financial losses, and the fees don't stop here. Keep reading.

2: The Receiving Fee

Following the payment of the international transfer fee, you'll encounter a corresponding charge from the receiving bank.

Most banks, such as Bangkok Bank, impose a maximum fee of 500 Baht to receive funds, although it typically amounts to the full 500 Baht, equating to an additional £10 / $16.

Now, you've already incurred two charges in the process of transferring your money, and this is before considering the currency conversion fee.

3: Currency Conversion Charge

Out of the three fees, this is the evil one.

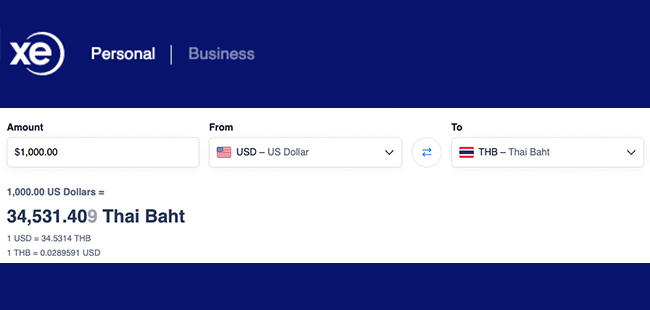

Many individuals assume they receive the mid-market transfer rate, the rate displayed on platforms like XE.com and similar websites. However, when you crunch the numbers, you quickly realize that you've been significantly shortchanged!

In the world's currency markets, traders define the rates at which they are willing to “buy” or “sell” a specific currency. The mid-market rate is simply the midpoint between demand and supply for a currency, and because of that, it changes all the time.

But that's as technical as you need to get. The most important thing to know is that the mid-market rate is considered the fairest exchange rate possible. The mid-market rate isn't a secret either. It's the rate you will find on independent sources such as Google, XE and Yahoo Finance.

Regrettably, you aren't provided with the authentic rate.

This tactic serves as a method to conceal the actual amount being levied. Most banks take the mid-market rate and impose an undisclosed margin, leaving you unaware of the extent of their overcharge.

By embedding the charge within the offered exchange rate, banks generate substantial profits at your cost, and you remain oblivious to the extent of the cost to your pocket.

See the image below for an example of how this works.

You can mitigate the loss to some extent by opting to send money in your home currency rather than Baht. However, a common mistake made by many sending money to Thailand is choosing to convert to Thai Baht at their source bank rather than at the Thai destination.

This results in an additional loss because your bank takes a substantial portion of cash at their own exchange rate, a rate they arbitrarily set, deviating from the “mid-market rate.”

While the Thai bank will still convert your currency to Thai Baht at an unfavorable rate, it's generally not as harsh on your pockets as the sending bank (your home bank).

4: Transfer Times

So, you've been hit on all fronts, and you're down at least $50-100.

You've borne the brunt of two transfer fees and a currency conversion charge.

Yet, even after multiple dips into your honeypot, the banks can't assure you that the money will be there within 24 or 48 hours.

It's a harsh reality.

In fact, sometimes it stretches to an agonizing 5-7 days!

This is 2024, not 1990. Given the digitized era we live in, the money should be transferred at lightning speed.

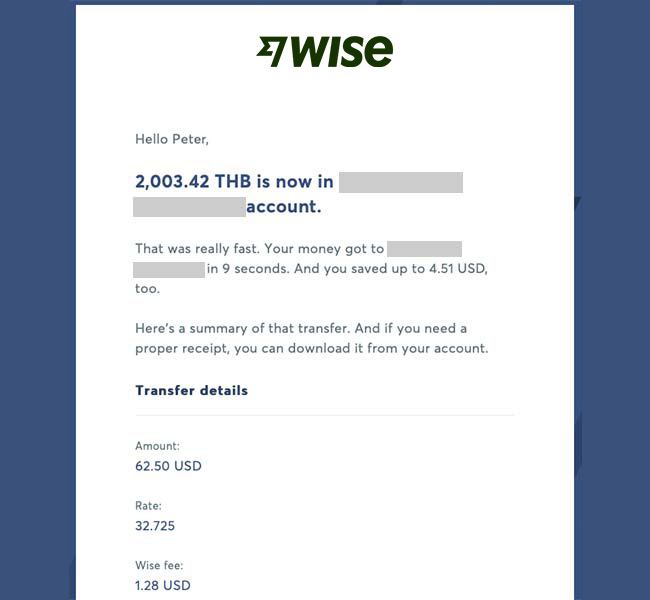

And it can be. The method I'm currently using not only sidesteps bank fees but ensures that a transfer can arrive in as little as 9 seconds!

Wise Review: Deep Dive

Sending money to Thailand is expensive, but what other option do you have except the bank?

You could carry money through customs, but then how often do you fly home to be able to do that?

To be honest, I hate carrying a ton of money around with me. It's just not safe.

Western Union is too expensive, but good if you need cash wired immediately.

PayPal steals 3.5% on a transfer and charges up to 4% currency conversion fees. Yes, I said up to 4%. It's 3% for the UK (where I'm from).

+ Enter Wise to Save You Money

Seriously, I waited years for this and, if you read the comments below, you'll see how chuffed others have been to find this service.

You can now transfer money to Thailand with ZERO bank charges, get the Mid-Market Rate currency conversion, and only pay a small fee, which is more than made up for on the overall cost savings.

Sending GBP to Thailand with Wise

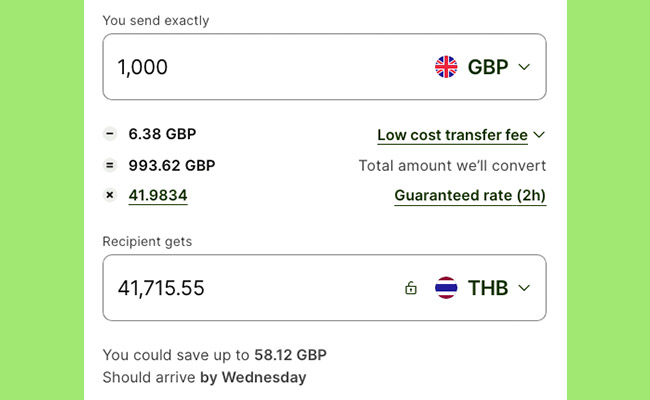

Have a look at this transaction where I saved over £58.

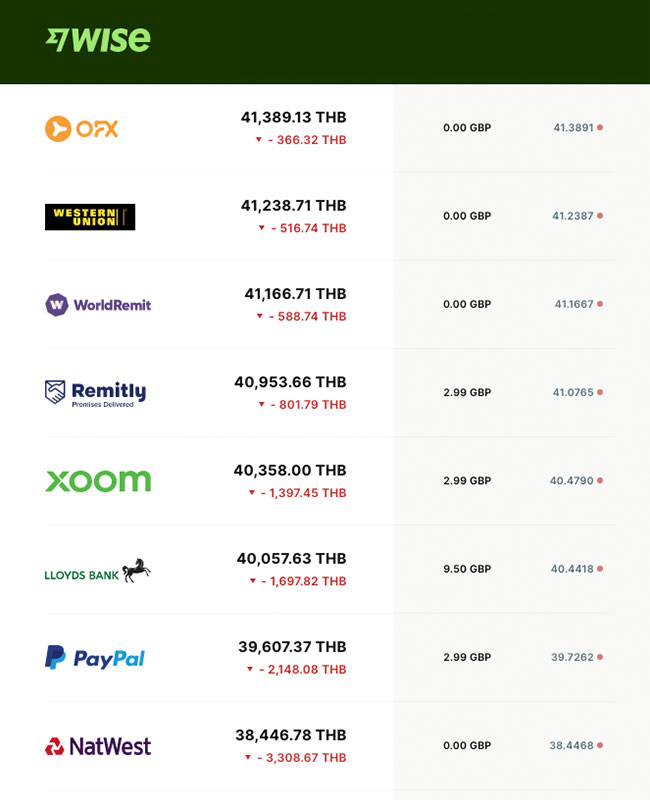

Here's a comparison of other money transfer services and banks at the exact same time. look at the bank transfer rates of four high-street banks. Wise beats them both, comfortably.

The exchange rate is lower and the fees higher than Wise.

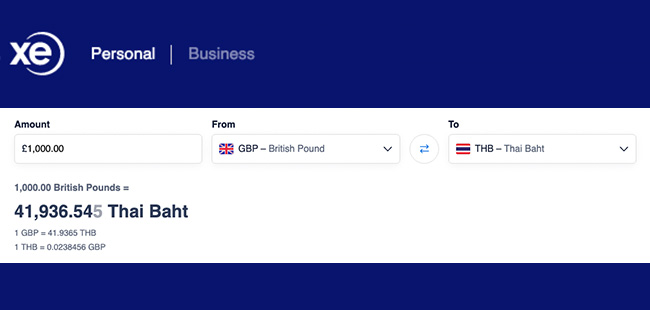

Now look at the market rate for the same time of day on XE.com.

Unbelievable, right? The overall Wise rate is actually slightly better!

So: not only did I get a better rate than my bank, I got a better rate than XE. com, which is the mid-market rate.

But that's not all: I only paid a £6.38 fee.

My bank (Nationwide) charges £20 for an international transfer. Plus I'd have to pay 500 Baht (£12 at the current exchange rate) to my receiving bank in Thailand.

So altogether, with the favorable exchange rate, I saved over £50 with Wise compared with a transfer from my home bank.

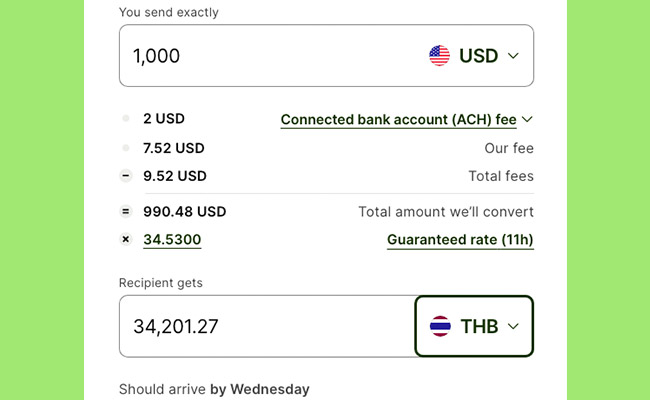

Sending USD to Thailand with Wise

For my friends from the USA, here's how things size up in Dollars. I couldn't see competitor rates this time, probably because I was using my UK-based account.

This time the Wise rate is spot on with the Xe.com rate (below).

Usually the rate is the same or slightly better, but note that rates change by the second. The good news is that Wise locks in a rate for you for 2 hours. You can also check Reuters for comparison.

My Fastest Transfer: 9 Seconds to Receive My Money!

61% of Wise transfers are instant and completed in under 20 seconds.

This is really impressive. Just recently I sent some USD from Wise to an account in Thailand. The transaction time was 9 seconds.

That's insane!

Check out the screenshot below for proof.

Wise Sending Limits

With Wise you can send up to 2 million Thai Baht per transfer.

That's $55,000 ( USD), or £45,500 GBP at the exchange rate at the time of writing.

There is no limit on the number of transfers you can make.

However, unless you are sending to one of the following three banks, you’ll only be allowed to send up to 49,999 Thai Baht per transfer. Though again, there’s no limit on how many transfers you can make.

- Bangkok Bank Public Company

- Kasikorn Bank

- Siam Commercial Bank

For this reason, I always recommend opening a bank account with Bangkok Bank or Kasikorn Bank. These two banks in particular are “foreigner friendly”.

Get Your Free Wise Transfer

I was so over the moon with Wise that I popped off an email and asked if I could get more information on how they circumvent these fees so I could blog here about it (see below on how it works).

They wrote back and offered to give my readers a free transfer up to £1,000/$1,000.

Click that text link above to get the free transfer.

Remember: Banks could charge you up to 5% in hidden costs when sending money to any bank account abroad. Wise is up to 8x cheaper. It's only fair!

How Does Wise Make Sending Money to Thailand So Cheap?

Well, with investments from notable figures like Richard Branson, it seems like anything is possible.

Yet, the concept is quite ingenious.

Once you initiate the transfer, Wise actively searches for others conducting transfers to the same location, facilitating an effective currency swap.

Given the frequency of money transfers, there are usually several matches available, streamlining the process significantly.

My first ever transfer was completed within 24 hours, a notable 2-3 days faster than my bank. Subsequent transfers have been even speedier (as shown above).

In the comments section, there are readers who've received their money in Thailand within minutes, and some, like me, even within seconds. For larger amounts, the process may take a bit longer.

The mechanism operates by executing several individual conversions using market exchange rates that work to your advantage.

For a visual breakdown of how it works, check out this informative video

Quick Benefits Summary

Wise was established with a commitment to providing people with transparency, fairness, and better value in managing their money.

This principle resonates with the majority of us who have long awaited a service of this kind. For too long, banks have been able to overcharge for money transfers despite the digital nature of transactions—simply numbers changing in a system with no physical movement of cash.

Wise stands out as, on average, it is 7 times more cost-effective than traditional banks when sending, spending, or withdrawing money globally (though this can vary by country).

Here's a quick summary of the benefits:

- No home country bank fee.

- No receiving country bank fee.

- Access to the true Mid-Market rate for currency conversion, or even better!

- Capability to send up to 2 million Thai Baht per transaction.

- Rapid transfers, especially for amounts below 5k, taking approximately 24 hours.

- Once you become accustomed to the system, you can utilize the iOS or Android app for seamless transfers on the go.

+ Click here to get your first transfer free

Boy does it feel good to avoid those bank fees!

Frequently Asked Questions:

1. How do I send money with Wise?

Go to the website. Type in the amount you want to send. Then fill out your details to register.

Once registered, you just need your bank account details and the details of the bank you are sending to in Thailand. Then push the magic button!

2. What is the maximum amount I can send with Wise?

2 million THB in a single transaction.

However, due to regulatory changes in Thailand, from Jan 2022, transfers of 50,000 THB and above will only be available for Kasikorn Bank, Bangkok Bank, and Siam Commercial Bank recipients.

Transfers under 50,000 THB remain unaffected for all supported recipient banks.

3. How long will the transfer take?

Anywhere from 9 seconds to 24 hours. It's usually very fast. Generally speaking, larger transfers take longer. By large I mean over $5,000 (USD).

4. Do I need a Thai bank account?

Yes, because this where the money gets paid into. If you don't have a Thai bank account, perhaps your partner or close friend has and you can send the money to their account.

5. Is Wise like a bank account?

This is the money sending service side of Wise. But Wise does have a bank account facility that enables you to hold multiple currencies and spend that money internationally using a MasterCard. I have reviewed this service here.

6. Can I use this service to transfer my pension to Thailand?

Yes. Many expats are losing money by having their pension paid into their Thai bank account. They lose on the exchange rate and the receiving fee. You might be better off having your pension paid into your home bank account and then transferring it to your Thai bank account via Wise.

7. Will the transfer show up as an FTT, for visa extension purposes?

FTT is a code that indicates that the money transferred is a foreign money transfer. An FTT is what's required to fund a bank account that will be used for a retirement visa extension. For the funds to qualify the money must come from a foreign source and not a domestic one.

To achieve this, when asked in the Wise dashboard for the reason you are sending the funds, choose “Funds for long term stay in Thailand”.

8. How does Wise make money?

Wise charges a service fee for each transaction, but even when you factor this in you will still save a fair chunk of money.

9. Is Wise better than MoneyGram and other similar services?

Overall, yes. You can read through the reader comments below and see that at times people suggest other services but upon inspection they aren't cheaper than Wise, tend to be much slower on transfer, and collect more private data than is necessary.

10. Can I contact Wise with a question?

Yes, you can contact them by email or phone. The number is 020 3695 0999.

Last Updated on

ed says

Jan 12, 2022 at 6:51 pm

TheThailandLife says

Jan 12, 2022 at 7:04 pm

ed says

Jan 12, 2022 at 7:10 pm

Max says

Jan 13, 2022 at 8:52 am

TheThailandLife says

Jan 13, 2022 at 7:11 pm

Biagio W Sciacca says

Dec 31, 2021 at 10:25 am

Max says

Dec 31, 2021 at 8:27 pm

Biagio W Sciacca says

Jan 01, 2022 at 1:21 am

Max says

Jan 03, 2022 at 8:41 am

JamesE says

But you really don't want to do this. You get skewered on the Buy/Sell spread because the Thai bank is doing the exchange. It would be much better to open a Wise multi-currency account with US$ and TH฿ balances. You'll get a US routing number and account number so you can have the SSA route your monthly payments straight into Wise. This gives you two benefits - you can control when to move the money into ฿ to take advantage of exchange rate fluctuations and, if you needed to, you can use the Wise account to pay any bills/taxes/etc. you might have in the US. It works really well and is easy to set up.

Dec 31, 2021 at 11:17 pm

Biagio W Sciacca says

Jan 01, 2022 at 1:21 am

JamesP says

Here is info on SS signup for IDD to Thailand; https://www.ssa.gov/forms/ssa-1199-op107.pdf

Jan 01, 2022 at 5:28 am

JamesE says

Jan 03, 2022 at 7:06 am

Max says

Jan 03, 2022 at 7:24 pm

Max says

Jan 03, 2022 at 8:36 am

M says

Jan 03, 2022 at 9:11 am

Max says

Jan 03, 2022 at 7:10 pm

JamesE says

Dec 21, 2021 at 8:32 am

TheThailandLife says

Dec 21, 2021 at 4:31 pm

JamesE says

There was another example of a disturbing trend I've seen more and more of lately: the sharing of one's login email with Facebook. There has been a "Login with Facebook" option available on a lot of sites for years now but this purchasing of your email address is a new trick that I had not seen before.

Short review, stay with Wise. It's faster, stabler, and doesn't share your data with Facebook.

Dec 21, 2021 at 11:42 pm

Max says

Dec 22, 2021 at 12:03 am

TheThailandLife says

Dec 22, 2021 at 12:05 am

M says

Dec 20, 2021 at 11:38 am

Max says

Dec 20, 2021 at 9:44 pm

M says

It doesnt state where to add bank account, can you direct me ? It only says where to add debit/credit card ??? Am I missing something ? Thanks Max and happy New Year !

Jan 03, 2022 at 9:16 am

Max says

Jan 03, 2022 at 6:56 pm

Paul Hastilow says

Having said that, is it possible for Normal SA citizens to transfer their money using this system.

Dec 18, 2021 at 12:47 pm

Bubba says

Dec 19, 2021 at 7:44 am

Max says

"Open a Wise account (or log in if you already have one). Click on “Balances” and then “Get started”. Complete your profile and upload your documents to verify your account for security. Activate South African rands and any of our other 45+ currencies in your account."

Dec 19, 2021 at 8:03 am

JamesE says

Dec 20, 2021 at 12:21 am

Max says

Dec 20, 2021 at 8:31 am

JamesE says

Dec 21, 2021 at 12:27 am

Max says

Dec 21, 2021 at 11:26 am

JamesE says

South Africa, takes this to new heights. You need some sort of pre-approval to move money. From posts I've seen on other fora, this limits one to bank-to-bank transfers because Wise doesn't qualify. (I've got no personal experience trying this).

But, yes, you're correct: you can carry a ZA Rand balance with Wise and transfer those Rand out. There's just no way to fund it from a Rand account. When you say "then send some money", what currency are you considering to be "money"? Wise doesn't list the Rand as available for a sending source. This is exactly like the issue with outbound Baht transfers. They're not allowed to happen in Wise.

Dec 21, 2021 at 11:54 pm

Max says

Dec 22, 2021 at 12:15 am

TheThailandLife says

Dec 22, 2021 at 12:17 am

Bubba says

Dec 01, 2021 at 8:45 pm

Max says

Dec 01, 2021 at 10:29 pm

Steve says

Nov 24, 2021 at 4:20 pm

TheThailandLife says

Nov 24, 2021 at 5:03 pm

Steve says

Nov 24, 2021 at 5:20 pm

TheThailandLife says

Nov 24, 2021 at 5:25 pm

JamesE says

Nov 25, 2021 at 1:41 am

John Peters says

Nov 09, 2021 at 9:12 am

Max says

Nov 09, 2021 at 6:00 pm

John Peters says

Nov 09, 2021 at 8:44 pm

Max says

I don't believe the answer you got from Wise. Wise themselves came up with the reason "Funds for long term stay in Thailand" in July 2019,so why shouldn't they honor that reason. There's one more reason I think also should make a transfer show up as foreign, the Buying a condo-reason. I don't remember exactly what it's called. I don't buy condos that often. 😎

I have no reason to transfer any money at the moment, otherwise I would have tried. But people started to complain about this "problem" way before my transfers in September and October and those transfers showed up as international = FTT.

Nov 09, 2021 at 9:41 pm

JamesE says

Nov 09, 2021 at 7:37 pm

Max says

And there's no problem what so ever getting credit advices to show immigration if something goes wrong. The receiving bank knows exactly where the money comes from. This is old news if you've been living in Thailand for years and used Wise.

Nov 09, 2021 at 8:44 pm

Charlie says

Nov 07, 2021 at 1:21 am

James says

So if you set up your account using a Thailand address, you won’t be able to get a card.

I originally signed up in the U.S., but I used my U.S. address in Hawaii to sign up, and unfortunately, Wise has more restrictions on residents of Hawaii (& Nevada). I can’t obtain a card and I’m limited to a U.S.$10,000 on transfers.

I think the card has limited use anyway for accessing local currency. For example: “If your card was issued in the US: You can take out money for free twice a month — as long as the total amount is under 100 USD. But after that, we’ll charge you 1.50 USD per transaction. This is a fixed fee. If you take out over 100 USD in one month, we’ll charge you 2% on top of that.” Cards issued in other regions of the world have similar restrictions.

For smaller transactions in Thailand, an ATM card from your home country with no, or low, international fees may be a better option. Just go into the bank and do an over-the-counter withdraw of cash. Us the Wise website or phone app to transfer larger amounts of funds to your Thai bank account.

Nov 07, 2021 at 4:13 am

James says

Nov 07, 2021 at 5:20 am

Max says

Nov 07, 2021 at 7:33 am

JamesE says

Nov 07, 2021 at 7:40 am

Charlie says

Not to mind, at least I still have the option of transfermg funds from my new Wise US account number to my Thai bank account.

Thanks.

Nov 08, 2021 at 10:33 am

JamesE says

Nov 08, 2021 at 5:43 pm

Max says

Nov 08, 2021 at 6:23 pm

JamesE says

Nov 08, 2021 at 6:59 pm

Max says

Nov 08, 2021 at 10:33 pm

James says

Nov 10, 2021 at 2:48 am

Raman says

Oct 29, 2021 at 1:36 am

Max says

Oct 29, 2021 at 7:18 am

JamesE says

Oct 29, 2021 at 10:54 am

Max says

Oct 29, 2021 at 4:19 pm