If you're thinking of driving a car in Thailand then you'll need car insurance.

Sure, you may have heard that some locals don't take out a policy and get away with driving locally, but this is completely irresponsible and illegal.

If you're getting behind the wheel, you'll need a policy.

Thailand has a high volume of road traffic accidents and the risk of a crash is higher in certain areas than others (1).

One of the reasons the risk is high is because of sheer volume of traffic in some areas, particularly the number of motorcycles on the road that cut in and out of traffic. But it's also because of poor driving standards.

Test standards are better than they were some years ago, but there are still many people on the road who learned to drive in rural areas without formal instruction. This means lots of random lane cutting and poor signaling.

The high volume of cars in built up areas like Bangkok means that even when stationary there can be a high risk of being hit.

And so insurance is a must.

There's a ton of companies to choose from, many of which can be compared here on Mr Prakan, where you'll see the most competitive quotes.

In this post, I'll walk you through everything there is to know about car insurance in Thailand. I'll cover everything from types of insurance, must-know terms, the claims process and more.

Contents

Car Insurance Options

Thailand has two types of car insurance:

- Compulsory Third-Party Liability Insurance

- Private Insurance

Compulsory Third-Party Liability Insurance (CTPL)

Compulsory Third-Party Liability Insurance, known as Por Ror Bor, is required for all registered cars and motorcycles in Thailand under the Road Protection Act.

The policy costs approximately 650 Baht per year and provides basic coverage for death and injury resulting from a road accident.

CTPL insurance offers standard coverage of 80,000 Baht for injury and 300,000 Baht for death if the accident is not your fault. However, coverage decreases to 30,000 Baht for injury and 35,000 Baht for death if the accident is your fault.

To claim the maximum amount, a police report indicating that the accident was not your fault is required.

The insurance is renewed annually through the Department of Land Transport or a car insurance company, and most people renew it simultaneously with their annual car tax.

While this type of insurance is mandatory, those who can afford it often opt for private insurance for additional coverage on their vehicle and injury compensation.

Private Insurance

Private Insurance provides access to professional help and greater control over the repair of your car after an accident, which is particularly beneficial in Thailand where many accidents are minor collisions.

With private insurance, a representative from the company will come to the accident scene to consult with the other party, provide assistance on next steps, and issue relevant claims documents. This saves you from getting into a dispute with the other party.

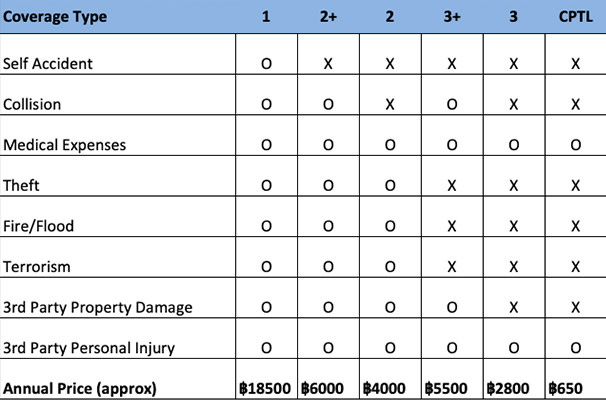

Private insurance coverage is categorized into five types: 1, 2+,2, 3+ and 3.

Type 1 is the most expensive and provides the best coverage, while Type 3 is the cheapest and provides the lowest level of coverage.

Insurance Coverage Types

Let's have a look at the different types of insurance cover in Thailand.

Type 1

This is the only insurance that covers you for all accidents, including those not involving a third party.

For example, if you swerve to avoid a dog and crash your car or accidentally reverse into a post while parking, these accidents will be covered. Depending on the policy, you may or may not have to pay an excess of 1,000 Baht or more.

Generally, this type of insurance is available for cars less than seven years old, but it is still possible to obtain it for an older car in good repair and without any major accident history.

Type 2+

Type 2+ is similar to Type 1 insurance but does not cover non third party accidents like Type 1.

Additionally, unlike Type 1 insurance, which typically sends your car for repairs at official garages, Type 2+ insurance usually sends cars to independent garages.

Type 2

Type 2 insurance is similar to Type 2+ but does not come with collision coverage. Type 2+ is widely preferred for this reason. Very few insurance companies offer Type 2 now.

Type 3+

Type 3+ insurance provides road accident protection, collision coverage, and third party property damage, but does not cover theft, fire, flood, and terrorism.

Type 3

Type 3 is a popular insurance for low value cars. It's very basic, covering only medical expenses and third-party liability.

For a newer car like this Honda, you will want to get Type 1 insurance.

Policy Coverage

Let's have a look at some of the specific aspects of a policy and which type of insurance covers each.

Collision

Type 1, 2+, and 3+ insurance usually offer collision coverage.

This covers the cost of repairing your car as long as the damage is caused by a collision with another car.

The key difference between policies is usually where the car is fixed. A more expensive plan will allow you to take a car to the official dealer, whereas a cheaper plan will mean going to an independent garage.

When a car is written off (deemed irreparable), you will usually be offered 70-100% of the insurance payout limit, depending on the finer details of your policy.

Medical Expenses

All the aforementioned insurance types cover medical expenses incurred by a road accident. The coverage is usually similar across all types, and usually lower if you cause the accident.

The insurance company will require a medical receipt, unless you attend a partner hospital, in which case they will liaise directly with the hospital.

You also have the option to use your car insurance, health insurance, or family insurance policy to cover your medical expenses after a car accident.

Theft

Types 1, 2+ and 2 all cover theft, but remember that personal responsibility is a factor when a claim is being processed. For example: if you forget to lock your car and get burgled, you may receive a lower payout.

Fire/Flood

Flood damage related to accidental, as in a flash flood that swamps your car. Don't expect to be compensated if you drive through floodwaters. You'll see a lot of people make this mistake during rainy season. Similarly, you can't torch your car and claim it was subject to a fire.

Like theft, Types 1, 2 and 2+ cover fire and flood damage.

3rd Party Property Damage

3rd Party Property Damage covers the opposing party in the accident. Type 3 insurance, for example, covers the third party but not you. So you pay for your own damage but not the other person's damage.

3rd Party Personal Injury

All the insurance types, including Compulsory Third-Party Liability Insurance, have 3rd Party Personal Injury coverage. So you can claim compensation if a car hits you when walking down the street.

You may already have this coverage on other policies such as your medical insurance policy.

Coverage Exclusions

Equally important to knowing what's covered is to know what's excluded.

These are standard exclusions you'll find with insurance companies back home, but you should be aware that these also apply in Thailand.

- Driver’s License: You will not be insured if you don't have a driver's license.

- Drunk Driving: If your blood alcohol concentration (BAC) is more than 50mg, you are considered drunk (according to Thai law). This will invalidate your insurance claim.

- Unauthorized Driver: Depending on your policy, you may be authorized to have other drivers on the insurance. However, if the person isn't listed or automatically covered, your insurance will be invalidated.

- Incorrect Purpose: a car is to be used for a specific purpose; that is transporting the allowed number of people in a safe manner. So don't carry more passengers than the vehicle should, install an NGV or LPG gas systems without giving notification, or do something silly like strap a fridge to the top of the car when you move home.

- Leaving the Scene of an Accident: This is considered a crime in Thailand, and you won't get your insurance payout either. Always stop in the event of an accident.

- War: If your car is damaged by an act of war, or even a street protest, it's likely that you won't be covered.

Policy Pricing

Of course policies differ considerably in price. The price is dependent on numerous factors such as whether the garage sends the car to a dealership or independent garage.

Some policies offer deductibles, too, and then there are no-claims bonuses, excesses, and driver specification choices.

Below is a table that provides a visual overview of what's included in each insurance type, and an estimate of what an average policy might cost.

Insurance Policy Terms You Should Know

Excess

An excess is a fixed amount that you agree to pay out of your own pocket when making a claim.

The excess is usually waived if the accident wasn't your fault but is enforced when no third party is involved.

In Thailand, excess usually starts at 1,000 Baht. In general, the higher the excess, the lower the insurance premium.

Deductible

A deductible is often confused with an excess, but it's a fixed amount that you agree to pay the insurer whenever you make a claim, and it's never waived. Unlike an excess, which may be waived if the accident wasn't your fault, a deductible always applies.

The good thing about a deductible is that it can considerably lower the cost of your insurance. For example, a 20,000 Baht policy might be reduced to 13,000 Baht if you have a deductible of 3,000 Baht.

A deductible usually applies to major accidents and not claims for minor damage such as scratches caused by a tree.

Note that the word for excess and deductible is the same in Thai and is therefore often confused by policyholders and insurance representatives.

As with all aspects of a policy, it's important to read the small print to make sure you understand your excess/deductible clause.

No-Claims Bonus

The no-claims bonus may be called a “bonus,” but it heavily favors the insurer.

It rewards you for not claiming by lowering your annual premium, but this in turn discourages people from making claims due to the fear of increasing the cost of their premium. Drivers end up paying to fix their own car so that they don't see a rise in their premium.

If you have a no-claims bonus in Thailand, you will receive a discounted premium. To be eligible for the bonus, you need to have driven for a minimum of one year without making any claims.

Dealership Vs. Independent Garage

If you have bought a new car in the last 5 years, you may want all repair work to be done at an official dealership. This will result in a more expensive premium. It may also mean a longer wait time to get your car fixed because dealerships are fewer in number, particularly in rural areas.

The key benefits of a dealership are:

- Fully qualified mechanics

- Genuine parts

- Warranty guaranteed work

Independent garages are hit and miss. Find a good one and keep it for life, but find a bad one and it could cost you. Stories of sub-quality parts being used, bad paint jobs, and temporary fixes are not hard to come by online.

I would argue that it is worth paying a little extra on your premium for the dealership option.

That said, the benefits of an independent garage are:

- Easier to find one in a remote area

- Faster turnaround times

- Cheaper labour, keeping your insurance premium lower

Driver Specification

This refers to specifying the names of the drivers on the policy.

If you have a maximum of two named people on the policy, you can save up to 20% (based on age and history), as opposed to a policy where anyone can drive the car who is legally fit to do so.

Pay Per Use

As the title suggests, this is a pay as you go car insurance option.

A company called Thaivivat introduced this concept. Vehicle usage is covered for a specific number of hours such as 144 hours for 30 days, or 600 hours for 108 day.

This is an option that suits those who only drive for a few hours each day. The pricing is lower than an average insurance policy but you can only use your car for a specified – usually 3 or 5 – number of hours per day.

This sounds like a good option but in reality it can be a hassle. You have to turn on an app before driving so that the company can monitor usage. You turn the app off when you finish.

If you are driving in a rural area and have no internet signal, you would have to call and notify the company of when you want to drive.

Add-Ons

As with all insurance polices, there are extras that you can add-on for coverage outside of the regular items. These may include the following:

- Compensation for stolen goods

- Coverage for a loan car

- Additional medical care

- Coverage for travel expenses incurred as a result of an accident

Probably Type 3 Insurance for this old boy.

Choosing Your Insurance Company

There are over 20 car insurance companies in Thailand, each advertising different benefits with their policies.

As with all types of insurance, it can be a minefield wading through websites to find out which is best suited to your situation,

In addition, if you look on the web for reviews you will always find contrasting experiences from company to company. The same is true for Internet providers and utility companies.

In reality, being in a foreign country like Thailand, it is wise to go for a company that you have real confidence in, even if it means paying a little bit more.

Here are a few things you should consider:

Reputation

In your home country you might be inclined to choose a small independent company that offers better rates due to smaller business overheads. In Thailand, however, it's probably a better idea to go with the brand name that you have heard of before and possibly seen commercially advertised.

If the company has been in business for 20 years as opposed to two or three, then it's probably a safer bet, even if a tad more expensive.

Customer Service

If you want to know the level of customer service that you can expect from a company in the event of a claim, then give them a call prior to taking out the policy and ask a few questions.

If the person on the other end of the phone is patient with you and goes the extra mile to help you out, that's a good indication of what you can expect going forward.

If your Thai isn't very good, then you will want to find a company that has English speaking customer support. The last thing you want in the event of a claim is to have to battle through a language barrier.

This is why I recommend Mr Prakan; because they have excellent English-speaking support.

Nearby Garage

If you live in a fairly remote area, then it may be worth looking at your options for garages before taking out a policy.

If you have a brand-new Toyota from a local dealership, then you will obviously be taking out insurance that would allow you to get your car fixed at that garage.

Conversely, if you have an old pickup truck, you may want to check which insurance companies your local independent company deals with.

Insurance Companies

The following are well-known, reputable insurance companies:

- Viriyah

- Bangkok Insurance

- Muang Thai

- Tokio Marine

- and Asia Insurance

In addition, a number of well-known banks offer car insurance, including Thanachart , SCB, Kasikorn, Krungsri, and TMB.

Smaller car insurances companies include:

- Dhipaya

- Deves

- Allianz

How to Make a Claim

If the worst happens and you have a road accident, the first thing you should do is call the insurance company and speak to a representative. The company will send out a representative to you at the scene.

Get out of your car and take photos from a number of angles, showing your license plate from both the front and rear of the vehicle.

Don't attempt to move the car, and stand well clear if there is oncoming traffic.

If it is a minor accident, then there is no need to call the police, who may not show up or even stop, unless you are blocking traffic, anyway.

However, if it is a more serious accident and there are casualties involved, the third party will likely call the police, or you can ask your insurance company representative to do that for you.

The insurance representative will come out and help determine which party is responsible for the accident.

This is one of the best reasons for having good car insurance in Thailand because it means that you don't need to engage with the third party and avoids the need for an argument over who is responsible.

It is possible to sort out a claim without a representative being present, in what's known as a knock-for-knock agreement.

In this situation, as long as both parties have Type 1 insurance coverage and there are no deaths, they can agree on liability and exchange a claim form with all the correct information filled in. This form can then be submitted to the insurance company.

One of the best ways to ensure that you are not wrongly accused of being at fault is to have a dashcam. These cameras are very popular in Thailand, and a good one is easily obtained for 5-10,000 Baht.

These Mercedes 190s are worth a lot of money in good condition.

Claiming Procedure

If a representative gives you a claim form at the scene of the accident, you can then submit this to a partner garage to begin repair of your car.

It may be the case that the insurance company has an online claim system, in which case you will go online, fill out your details and then be issued a claim number. You will submit this number to the garage where you intend to fix your car.

Double check the details of the claim before you proceed, making sure that it has clearly been identified that you are not at fault and the full cost of repair is approved.

If the garage fixing your car ask for a deposit, check back with your insurance company as to whether you should be handing this over, as this may be an indication that you are expected to pay for some of the repair.

Documents Required

To make a claim, the following documents are required. These are usually scanned and sent to the insurer.

- copy of car registration

- copy of the first page of a passport

- copy of driver license

- copy of insurance policy

It is always easier to have your car fixed at a partner garage of the insurance company. The process is straightforward because the insurance company and the garage will liaise back and forth without any need for you to be involved.

You can choose to repair the car with a garage that is not a partner of the insurance company, but this will require you to contact the insurer and obtain a budget for the repair. This may require you to send pictures of your car. This process could take a couple of weeks, depending on how efficient the insurer is.

If the repair budget the insurance company gives you is lower than the cost of the repair, then you will have to pay the remainder. Bear in mind that the garage might also charge a fee outside of the insurer's budget, such as a processing fee for having to liaise with your insurance company.

Applying for Your Insurance

The large majority of people in Thailand buy insurance through brokers.

The price is approximately the same as buying through an insurance company but brokers tend to offer different benefits due to the competitive nature of the industry.

For example, this may include additional help with the purchase process or with claims. And some will even offer a loan car while yours is under maintenance.

To have your car insured, you require the following documents;

- copy of the car’s registration

- copy of the first page of your passport

- copy of your driver’s license

- copy of your previous insurance policy (if you have one)

My Thai Car Insurance Recommendation

I recommend that any foreign national driving in Thailand take out Type 1 car insurance.

The chances of having an accident in Thailand are far higher than back home, no matter how good of a driver you are.

If you have an accident, it probably won't be your fault, and you will want the best possible coverage – especially if you are planning on buying a new car or a car that is under seven years old.

The good thing about Type 1 insurance is that a representative will come out to the scene of the accident.

If you don't speak the language proficiently, communicating with the third party isn't going to be a pleasant experience.

Consider this too: The representative is always going to try and argue the accident in your favor because they have a vested interest in winning the argument on your behalf.

The insurance representative can also help liaise with the police, call a tow truck, or arrange a loan car.

You can also avoid overcharging on repair costs. If the insurance company is liaising with the garage, then you do not have to negotiate the repair price, and don't have to worry that you will be charged 20, 30, or even 50,000 Baht over what you should be paying.

At the end of the day, you are paying for peace of mind. And if that means paying an extra 2,000 or 5,000 Baht a year, then I think it's worth it.

In Summary

I hope you found this information useful when deciding on your car insurance.

Insurance is a constantly evolving landscape, with changing regulations and policies. This means that the information presented here may contain one or two aspects that are out of date or no longer relevant. However, to the best of my knowledge it is up-to-date and useful as of the time of writing.

At the very least I hope you now have an understanding of the different types of insurance in Thailand and the claims process.

The best thing you can do now is to get yourself a range of quotes and decide which one best fits your expectations and budget.

My recommended broker in Thailand is Mr Prakan.

Last Updated on

Martin1 says

Police? (What is the ph. number?)

Towing service/garage? (How to find?)

Insurance? (What if not having a type 1 insurance?)

Mar 14, 2023 at 11:08 pm

Jose/Lerm da Silva says

Regards

Jose/Lerm da Silva

Jun 02, 2022 at 10:19 am

TheThailandLife says

Jun 02, 2022 at 3:46 pm