Okay, so the title is a tad misleading, because it isn't really a scam in that someone is doing their utmost to rip you off, but I did get your attention, so now you're here, read on, as this may save you a tiny fortune…

The first time I came across this, I got caught out because I was quite simply unaware. After paying a bill in the hospital with my UK credit card, I looked down at my receipt and saw that I'd been charged in UK Pounds and not Baht.

On that receipt was also the exchange rate I'd been given, a whopping 4 Baht per GBP less than the going rate – I checked this against my bank's (UK) rate on other charges to my credit card that week.

Had I been charged in Baht, I'd have saved around 250 Baht. That's not a huge amount, but on larger purchases this would have a significant impact.

This was strange because I'd not been charged in GBP when paying for anything on my credit card before. And so I queried it…

The reception manager said the cashier should have asked me in which currency I wanted to pay before billing me. I guess she forgot on this occasion.

I put this down to a one off, but since that time the same issue has come up three more times and seems to be getting more popular.

For example, just recently I bought a new mouse from iBeat. On this occasion the lady did ask me whether I'd like to pay in GBP or Baht. I chuckled and said Baht. She chuckled too, indicating that she knew that I knew I'd pay less in Baht.

So what is this all about?

When you're in a queue and a cashier says “Baht or GBP”, the quick, natural thing is to say your own currency; it's a kind of auto-pilot thing to do. It's almost like your brain says, “Cool, I get to pay in my own currency in another country”.

But it's not cool. Because you lose out. Big-time.

When you look at your receipt, you are fooled into thinking that the exchange rate on your receipt is what you would have gotten whether you'd opted for Baht instead of your home country's currency anyway.

But that's not the case.

The exchange rate on your receipt is not what you would have gotten from your home bank once the amount was converted in your home country by your credit card provider. The amount on the receipt is the very low rate the Thai bank has given you on a conversion from Baht to your native currency.

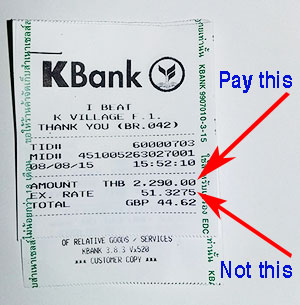

For example, look at the receipt below from iBeat. If I had accepted my home currency, I'd have been given an exchange rate of 51.32 Baht. As it was, being in the know, I chose Baht and my credit card company converted it at 54.56 Baht to the Pound at the other end. So I paid 41.97 GBP instead of 44.62 GBP, as it says I would have done on the receipt, had I chosen to pay in GBP.

But here's what I am having trouble working out. Who profits from this?

Surely the shop don't make anything because the bank just pays them the price in Baht. So is it the bank that makes a profit by pocketing the difference between the exchange rate they give you and the real exchange rate in Thailand at the time of purchase, which is much higher?

Perhaps someone can enlighten me on this in the comments section.

All I know is that it doesn't pay to NOT pay in Baht. I know it's not really a scam because 9 times out of 10 you will be asked first, so it is technically a personal choice, and the cashier isn't out to fiddle you (oo-er missus!) But I do think there is a lack of awareness about this and there ought to be more transparency.

So, when asked if you want to pay in Baht or your native currency, make sure you say Baht. And if you aren't asked, it would be worth making sure the transaction is about to processed in Baht before it goes through and can't be refunded.

**UPDATE: I was caught out again yesterday in Tesco. The reason I fell victim was because I'd been in there the day before and paid by credit card in Baht. But when I went back the next day, I paid, looked down at my receipt and the cashier had given me a rate of 53 Baht to GBP when the actual rate was 56! Below the conversion there was a 3% charge.

I immediately asked to see the manager. She apologised and said the cashier should have asked me first. But that's the point. I never have been asked in Tesco before, and therefore never had a reason to check my receipt.

So why is this suddenly happening everywhere? Are these innocent mistakes? Or does the weak Baht and falling tourist numbers have something to do with it?

Last Updated on

Martin1 says

TTL, you are right, people should always decline use of this service, because they always charge 3 %, whereas the foreign bank usually only does a 1,5 to 1,75 % damage.

But yeah, that damage you avoid because you have paid in e.g. GBP and not a foreign currency. In addition using that service gives you a worse exchange rate on top.

ATM also ask you about the currency you would like to be charged in. Same applies here!

But the ATM fees (both Thai ATM + ATM fee from your foreign bank) will be charged regardless off the currency you selected.

May 02, 2017 at 3:47 am

James says

Apr 08, 2017 at 2:38 am

Alex Root says

Either Visa and Mastercard exchange me, something in between -1,2~1,3% compared to XE.com EURO rates...

Don't have a clue why is that low (maybe because they are both prepaid cards? Mystery... ).

When I exchange cash, it's about -0,5~1,5% (starting from SuperRich down the bank with the worst ratio). Take a look to the link below to get a picture:

https://daytodaydata.net/

BUT when using the same credit cards and a Maestro/Cirrus debit card on ATM, they lower the actual rates to about A FREAKING -5%!!! No to mention the 200b Thai bank fee and 2euro fee from my bank...

Therefore, I use the ATMs only in case I have no choice at the very moment.

Try to avoid them at any cost. I use them just about 3-4 times in a year, so the loss is still mild (about 150euro total loss for 20,000b x 4 times exchange).

Then I just use credit cards like a madman and when I leave & back from my Country, I ALWAYS take with me 9,990euros in cash (max permitted cash is 10,000euros per time). Not to mention I refill the prepaid cards to their 5,000euro limit each. 20,000euro are a plenty of money in Thailand for about 1 year, intermitted stay.

Nov 02, 2016 at 2:35 pm

TheThailandLife says

Nov 02, 2016 at 4:38 pm

Alex Root says

I just had learnt from dad: put the liquid cash in places where thieves would never think about. Use their minds, instead yours.

Anyway, living in a Lumpini condo it's pretty safe:

1- to get in the establishment, strangers need to deposit their ID cards at the entrance (which looks like a frontier board);

2- then in order to get in to the building, they need a magnet pass...;

3- CCTV cameras are everywhere;

4- private guards are everywhere as well and know you;

5- people in the same condo get used to know each others (at least on the same floor or/and pool), so any suspicious stranger would be easily recognized.

Anyway, you're right. I'm gonna open soon a bank account with Bangkok bank, which gave me 2 options: deposit everything normally or use 80% of it as an investment with a 1,35% profit after 10 months... well... If i'm gonna invest 800,000b it would be a 11,000b profit... a tip... lol. but better than put the money in a "improper places". hahaha. :D

Nov 02, 2016 at 6:34 pm

Martin1 says

you are a bit unprecise here. You can travel with *any* cash amount inside and outside the EU!

The point is though that one has to go to customs and declare that amount. Customs will notice and send that information to your local IRS.

They might aks questions where has Alex that much money from?

But: Legal is to carry as much money with you as you can/have/want. :-)

May 02, 2017 at 3:53 am

Richard says

#2 As in the US, both savings and checking accounts were guaranteed by the FDIC in the amount of $100,000 USD and now it is $250,000. I am told there is an amount of guaranteed like this in Thai banks (DPA) but cannot find any reference to it on any banking site. What is the correct amount one is guaranteed in Thai banks?

Sep 04, 2016 at 10:04 am

TheThailandLife says

Sep 05, 2016 at 4:03 am

Martin says

But sure: 3 % is way too much! Almost all Thai banks try to rip off falangs: That, 180 THB ATM fee etc. and so on.

Jun 14, 2016 at 4:05 am

The Bose says

..which has caused me to wonder if the merchant does not stand to benefit (e.g. by receiving the foreign currency amount into their bank account at a more favorable exchange rate, etc.).

Mar 10, 2016 at 6:39 am

TheThailandLife says

Mar 10, 2016 at 10:52 am

The Bose says

The check-in girl stated "bill in US dollar, OK?"

I didn't think much of it, but upon doing a little research after the fact found that replying "Yes, OK." to this question cost me $200 USD (on a $2500 hotel bill) in the form of unfavorable exchange rates and bank fees.

Mar 14, 2016 at 8:59 am

TheThailandLife says

Mar 15, 2016 at 9:58 pm

David says

In other countries, especially ones where the banking system is only moderately developed, these fees can approach 3-7% of the transaction.

Dec 16, 2015 at 11:56 pm

Sai says

I should also probably say I used my normal bank card I use at home in England, not a Thai bank card.

P.s. I stumbled upon your website while searching for information about opening a bank account for when I visit next year. I will only have a 30 day visa because unfortunately, even though I was born in Thailand, I have been in England since I was 6 therefore I do not have Thai identification card or residency and my Thai passport is God knows where. ?

Dec 10, 2015 at 8:03 am

TheThailandLife says

Dec 10, 2015 at 3:03 pm

Sai says

Basically I would like to know if it is safe to use an extension cable from the UK in Thai hotel? Obviously I'll need to put the little thing with the 2 pins on the end of the plug but is it actually electrically do-able? I want to be able to use multiple sockets like charging my phone, camera ect and use hair curlers at the same time but I don't want to burn down the hotel room haha...

Dec 24, 2015 at 9:27 am

TheThailandLife says

Dec 25, 2015 at 1:46 am

Chris says

Sep 09, 2015 at 4:01 pm

TheThailandLife says

Sep 10, 2015 at 12:10 pm

payp says

Sep 11, 2015 at 9:46 pm

TheThailandLife says

Sep 12, 2015 at 1:26 pm

King Epic says

Aug 30, 2015 at 7:56 pm

TheThailandLife says

Aug 30, 2015 at 11:07 pm